KING'S VIEWS OF THE NEW YORK STOCK EXCHANGE

mainstay and the source of its importance. If it were a body merely for gambling

in stocks, its history would have been brief instead of extending back to the

year 1792.

This leads to another consideration about Wall Street—as the market for

securities. The great improvements of a public character, like the railroads,

steamships, gas and electric companies and industrial enterprises of the present

age, require capital and involve risks far beyond the means or power of individuals.

Corporations furnish the only solution, and their stocks distribute the ownership

of vast undertakings and are the favorite medium for investments. The rail¬

roads and other great corporations are large borrowers of capital through bonds

secured by mortgage, and, in addition, almost all our governmental institutions,

national. State, county or municipal, are large borrowers on their bonds. The

natural place to come for purchasers of this immense mass of securities is Wall

Street. A majority of the railroads of the United States have their financial

headquarters in or near Wall Street. Their dividends and the interest on their

bonds are payable in New York, and the same is the case with borrowing, based

on the public credit. The investor, that is, the owner of accumulations, who de¬

sires a return on it, and thus furnishes the capital for corporations and the buying

of public securities, goes to Wall Street as to a well-stocked mart. Moreover,

the banks and institutions of Wall Street are always ready to lend money upon

stocks and bonds having a recognized value and an immediate market, and thus

the " Street" fairly monopolizes this important branch of the public economy.

In this the Stock Exchange is a central factor. It furnishes facilities for the

purchase and sale of securities under legitimate conditions,

with certainty as to the completion of transactions, and of

both parties getting the market price. The Exchange has

always been under the guidance of men of high character,

and punishes irregularities on the part of any of its 1,100

members. The seats or memberships in the Exchange are

now selling at $22,000. They have sold for as much as

$32,000, and it is probable that in the near future they will

attain a much higher value. An applicant for membership,

too, must satisfy a committee as to character and financial

responsibility before he is admitted. The securities "listed"

on the Exchange, consisting of stocks and bonds of rail¬

road and other companies, foot about $6,000,000,000 in par

value, and the transactions on the floor of the Exchange

in i8g6 (a very poor year) represented 54,000,000 shares

of stocks, and bonds of the par value of $385,000,000. In

1892 they amounted to 86,000,000 shares and $501,000,000

in bonds. It is probable that in 1897 these figures will be

very much exceeded.

The officers of the New York Stock Exchange for the

year 1897-98 are : President, Francis L. Fames ; Vice-

President, Ransom H. Thomas; Treasurer, F. W. Gilley;

Secretary, George W. Ely. The Governing Committee,

which manages the affairs of the institution and maintains

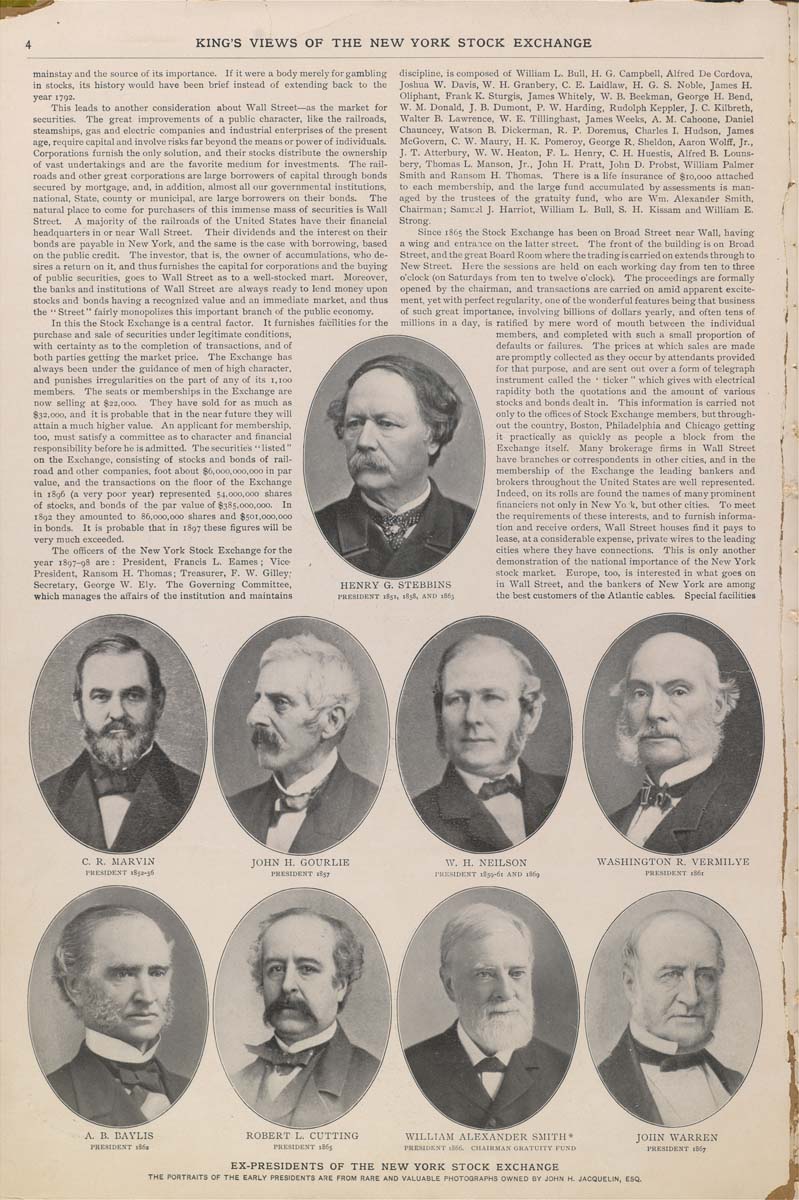

HENRY G,

PRESIDENT

discipline, is composed of William L. Bull, H. G. Campbell, Alfred De Cordova,

Joshua W. Davis, W. H. Granbery, C. E. Laidlaw, H. G. S. Noble, James H.

Oliphant, Frank K. Sturgis, James Whitely, W. B. Beekman, George H. Bend,

W. M. Donald, J. B. Dumont, P. W. Harding, Rudolph Keppler, J. C. Kilbreth,

Walter B. Lawrence, W. E. Tillinghast, James Weeks, A. M. Cahoone, Daniel

Chauncey, Watson B. Dickerman, R. P. Doremus, Charles I. Hudson, James

McGovern, C. W. Maury, H. K. Pomeroy, George R. Sheldon, Aaron Wolff, Jr.,

J. T. Atterbury, W. W. Heaton, F. L. Henry, C. H. Huestis, Alfred B. Louns-

bery, Thomas L. Manson, Jr., John H. Pratt, John D. Probst, William Palmer

Smith and Ransom H. Thomas. There is a life insurance of $10,000 attached

to each membership, and the large fund accumulated by assessments is man¬

aged by the trustees of the gratuity fund, who are Wm. Alexander Smith,

Chairman; Samual J. Harriot, William L. Bull, S. H. Kissam and William E.

Strong.

Since 1865 the Stock Exchange has been on Broad Street near Wall, having

a wing and entrance on the latter street. The front of the building is on Broad

Street, and the great Board Room where the trading is carried on extends through to

New Street. Here the sessions are held on each working day from ten to three

o'clock (on Saturdays from ten to twelve o'clock). The proceedings are formally

opened by the chairman, and transactions are carried on amid apparent excite¬

ment, yet with perfect regularity, one of the wonderful features being that business

of such great importance, involving billions of dollars yearly, and often tens of

millions in a day, is ratified by mere word of mouth between the individual

members, and completed with such a small proportion of

defaults or failures. The prices at which sales are made

are promptly collected as they occur by attendants provided

for that purpose, and are sent out over a form of telegraph

instrument called the '■ ticker " which gives with electrical

rapidity both the quotations and the amount of various

stocks and bonds dealt in. This information is carried not

only to the offices of Stock Exchange members, but through¬

out the country, Boston, Philadelphia and Chicago getting

it practically as quickly as people a block from the

Exchange itself. Many brokerage firms in Wall Street

have branches or correspondents in other cities, and in the

membership of the Exchange the leading bankers and

brokers throughout the United States are well represented.

Indeed, on its rolls are found the names of many prominent

financiers not only in New Yo.k, but other cities. To meet

the requirements of these interests, and to furnish informa¬

tion and receive orders. Wall Street houses find it pays to

lease, at a considerable expense, private wires to the leading

cities where they have connections. This is only another

demonstration of the national importance of the New York

stock market. Europe, too, is interested in what goes on

in Wall Street, and the bankers of New York are among

the best customers of the Atlantic cables. Special facilities

C. R. MARVIN

I'RESIDENT 1852-56

JOHN H. GOURLIE

PRESIDENT 1857

W. H. NEILSON

I'RESIDENT 1859-61 AND

WASHINGTON R. VERMILYE

PRESIDENT 1861

A. B. BAYLIS

PRESIDENT 1862

CHAIRMAN GRATUITY FUND

JOHN WARREN

PRESIDENT 1867

EX-PRESIDENTS OF THE NEW YORK STOCK EXCHANGE

THE PORTRAITS OF THE EARLY PRESIDENTS ARE FROM RARE AND VALUABLE PHOTOGRAPHS OWNED BY JOHN H. JAGQUELIN, ESQ.

J

|