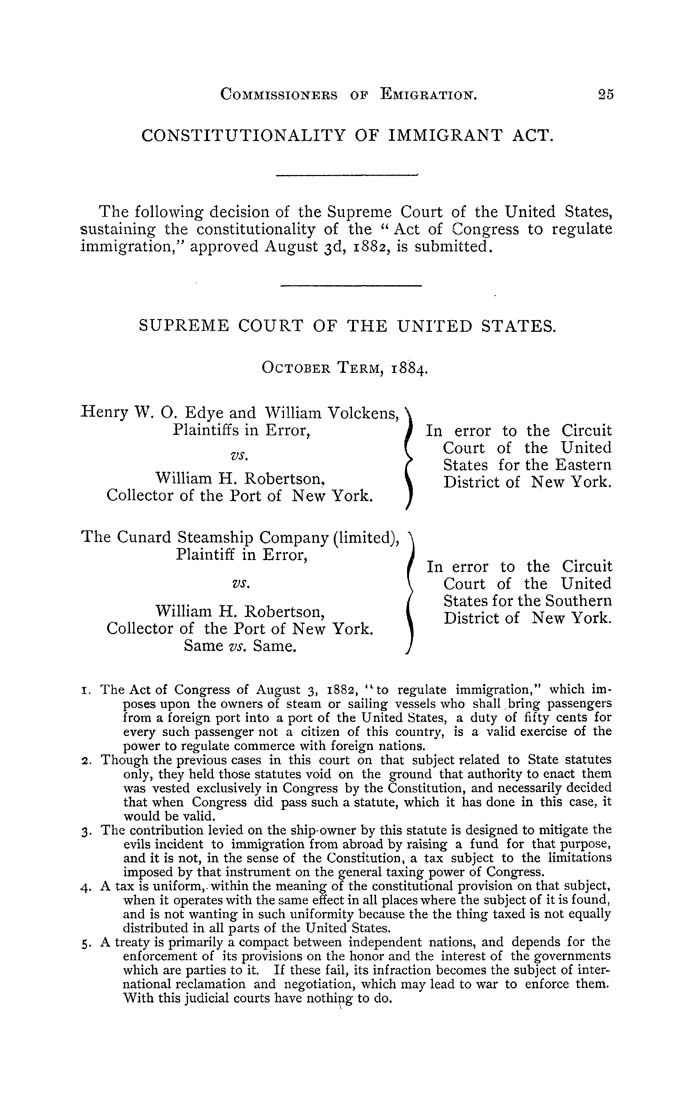

Commissioners op Emigration.

CONSTITUTIONALITY OF IMMIGRANT ACT.

25

The following decision of the Supreme Court of the United States,

sustaining the constitutionality of the " Act of Congress to regulate

immigration/' approved August 3d, 1882, is submitted.

SUPREME COURT OF THE UNITED STATES.

October Term, 1884.

Henry W. O. Edye and William Volckens,

Plaintiffs in Error,

vs.

William H. Robertson,

Collector of the Port of New York.

In error to the Circuit

Court of the United

States for the Eastern

District of New York.

The Cunard Steamship Company (limited).

Plaintiff in Error,

vs.

William H. Robertson,

Collector of the Port of New York.

Same vs. Same.

In error to the Circuit

Court of the United

States for the Southern

District of New York.

1. The Act of Congress of August 3, 1882, "to regulate immigration," which im¬

poses upon the owners of steam or sailing vessels who shall bring passengers

from a foreign port into a port of the United States, a duty of fifty cents for

every such passenger not a citizen of this country, is a valid exercise of the

power to regulate commerce with foreign nations.

2. Though the previous cases in this court on that subject related to State statutes

only, they held those statutes void on the ground that authority to enact theni

was vested exclusively in Congress by the Constitution, and necessarily decided

that when Congress did pass such a statute, which it has done in this case, it

would be valid.

3. The contribution levied on the ship-owner by this statute is designed to mitigate the

evils incident to immigration from abroad by raising a fund for that purpose,

and it is not, in the sense of the Constitution, a tax subject to the limitations

imposed by that instrument on the general taxing power of Congress.

4. A tax is uniform,-within the meaning of the constitutional provision on that subject,

when it operates with the same effect in all places where the subject of it is found,

and is not wanting in such uniformity because the the thing taxed is not equally

distributed in all parts of the United States.

5. A treaty is primarily a compact between independent nations, and depends for the

enforcement of its provisions on the honor and the interest of the governments

which are parties to it. If these fail, its infraction becomes the subject of inter¬

national reclamation and negotiation, which may lead to war to enforce them.

With this judicial courts have nothing to do.

|