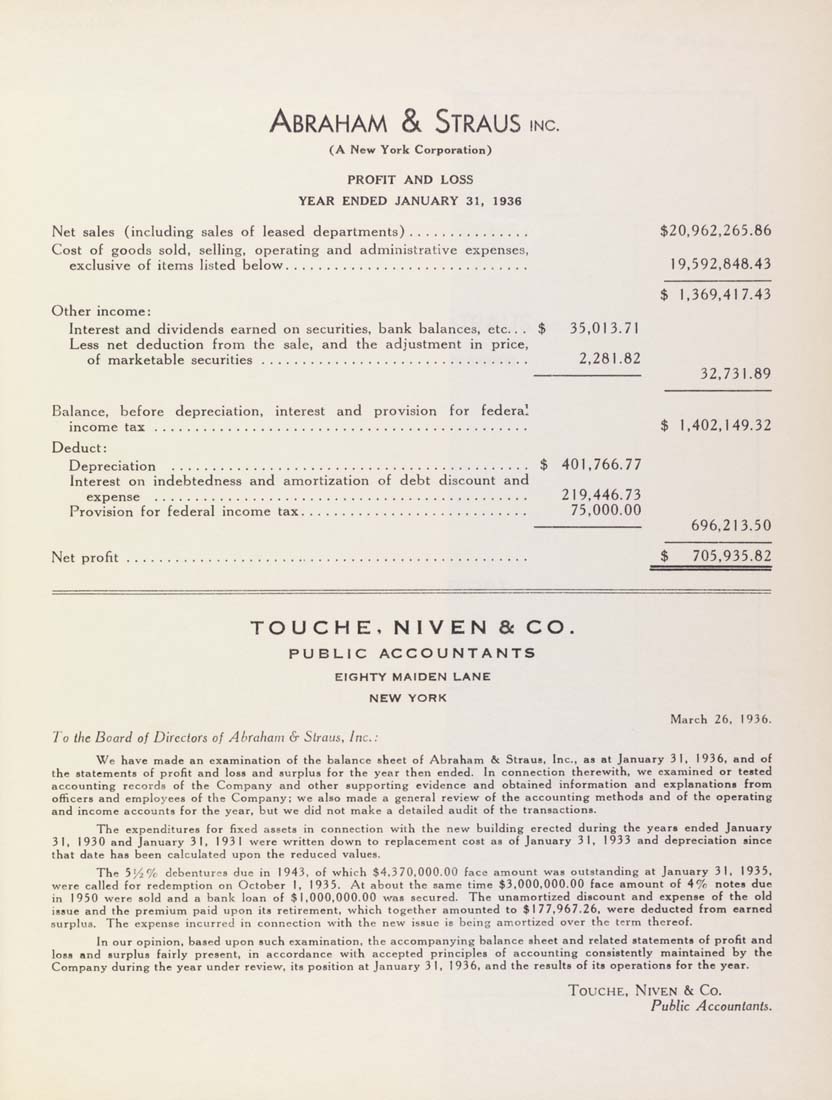

Abraham & Straus inc.

(A New York Corporation)

PROFIT AND LOSS

YEAR ENDED JANUARY 31, 1936

Net sales (including sales of leased departments)............... $20,962,265.86

Cost of goods sold, selling, operating and administrative expenses,

exclusive of items listed below.............................. 19,592,848.43

$ 1,369,417.43

Other income:

Interest and dividends earned on securities, bank balances, etc.. . $ 35,013.71

Less net deduction from the sale, and the adjustment in price,

of marketable securities................................. 2,281.82

-----------------------32,731.89

Balance, before depreciation, interest and provision for federal

income tax.............................................. $ 1,402,149.32

Deduct:

Depreciation ............................................ $ 401,766.77

interest on indebtedness and amortization of debt discount and

expense .............................................. 219,446.73

Provision for federal income tax............................ 75,000.00

------------------------ 696,213.50

Net profit.................................................. $ 705,935.82

TOUCHE, NIVEN & CO,

PUBLIC ACCOUNTANTS

EIGHTY MAIDEN LANE

NEW YORK

March 26, 1936.

I a the Board of Directors of Ahrahaui & Stnnis, Inc.:

We have made an examination of the balance sheet of Abraham & Straus, Inc.. as at January 31, 1936, and of

the statements of profit and loss and surplus for the year then ended. In connection therewith, we examined or tested

accounting record.? of the Company and other supporting evidence and obtained information and explanations from

officers and employees of the Company; we also made a general review of the accounting methods and of the operating

and income accounts for the year, but we did not make a detailed audit of the transactions.

The expenditures for fixed assets in connection with the new building erected during the years ended January

31, 1 930 and January 31. I 93 1 were written down to replacement cost as of January 31, 1 933 and depreciation since

that date has been calculated upon the reduced values.

The bYj'A debentures due in 1943, of which $4,3 70,000.00 f.ice amount was outstanding at January 3i. 1935,

were called for redemption on October 1. 1935, At about the same time $3,000,000.00 face amount of A^/c notes due

in 1950 were sold and a bank loan of $1,000,000,00 was secured. The unamortized discount and expense of the old

issue and the premium paid upon its retirement, which together amounted to $177,967.26, were deducted from earned

surplus. The expense incurred m connection with the new issue is being amortized over the trrm thereof.

in our opinion, based upon such examination, the accompanying balance sheet and related statements of profit and

loss and surplus fairly present, in accordance with accepted principles of accounting consistently maintained by the

Company during the year under review, its position at January 31, 1936, and the results of its operations for the year.

Touche, Niven & Co.

Public Accountants.

|