iLECTRIC COMPANY

ILIATED COMPANIES

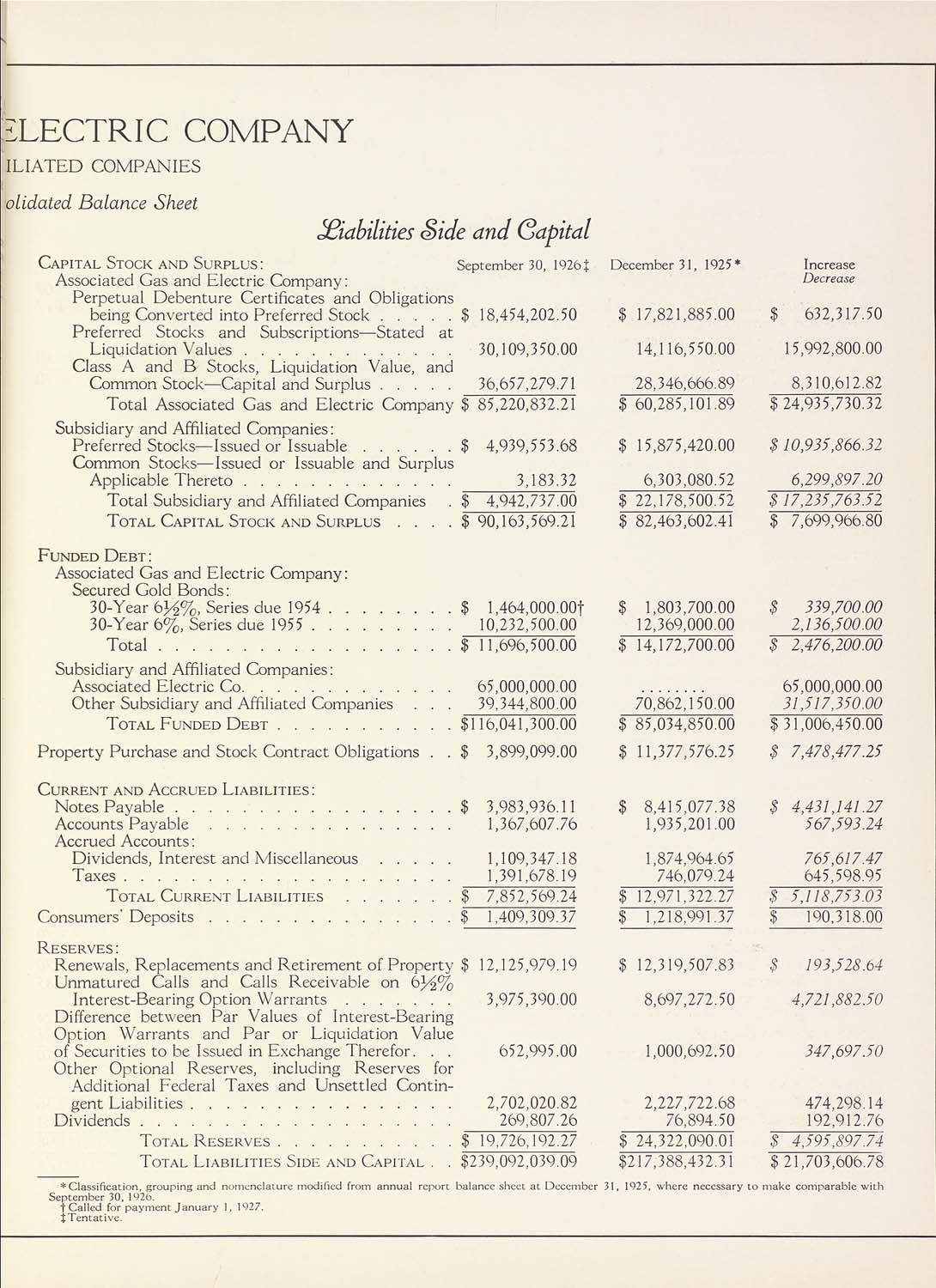

olidated Balance Sheet

liabilities Side and Capital

Capital Stock and Surplus: September 30, 1926J

Associated Gas and Electric Company:

F Perpetual Debenture Certificates and Obligations

being Converted into Preferred Stock.....$ 18,454,202.50

Preferred Stocks and Subscriptions—Stated at

Liquidation Values............. 30,109,350.00

Class A and B Stocks, Liquidation Value, and

, Common Stock—Capital and Surplus..... 36,657,279.71

Total Associated Gas and Electric Company $ 85,220,832.21

Subsidiary and Affiliated Companies:

Preferred Stocks—Issued or Issuable......$ 4,939,553.68

Common Stocks—Issued or Issuable and Surplus

Applicable Thereto............. 3,183.32

Total Subsidiary and Affiliated Companies

Total Capital Stock and Surplus . .

December 31. 1925*

$ 17,821,885.00

14,116,550.00

28,346,666.89

Increase

Decrease

632,317,50

15.992,800,00

8,310,612,82

$ 4,942,737,00

$ 90,163,569.21

$60,285,101,89 $24,935,730,32

$ 15,875,420,00 $10,935,866.32

6,303,080,52 6.299.^97.20

$ 22,178,500,52 $ 17,235.763.52

$ 82,463,602,41 $ 7,699,966,80

Funded Debt :

Associated Gas and Electric Company:

Secured Gold Bonds:

30-Year6J^%, Series due 1954........

30-Year6%, Series due 1955.........

$ 1,464,000.001

10,232,500.00

$ 11,696,500.00

65,000,000.00

39.344,800.00

$ 16 041 300 00

$ 1,803,700,00

12,369,000.00

$ 14,172,700,00

70,862.150,00

$ 85.034 850 00

$ 339,700.00

2.136.500.00

$ 2.476,200.00

65,000.000,00

31.517,350.00

$31,006,450 00

Total..................

Subsidiary and Affiliated Companies:

Associated Electric Co.............

■ Other Subsidiary and Affiliated Companies . . .

Property Purchase and Stock Contract Obligations . .

$

3,899,099.00

$ 11,377,576.25

$ 7.478.477.25

Current and Accrued Liabilities:

Notes Payable.................

$

$

$

3,983,936.11

1,367,607,76

1,109,347.18

1,391,678.19

7,852,569,24

1 409 309 37

$ 8,415,077.38

1,935,201.00

1,874.964,65

746,079,24

$ 12,971.322.27

$ 1 218991 37

$ 4.431.141.27

567.593.24

765.617.47

645.59895

$ 5,118.75303

$ 190 318 00

Accrued Accounts:

Dividends, Interest and Miscellaneous.....

Taxes....................

Total Current Liabilities .......

Reserves :

Renewals, Replacements and Retirement of Property

Unmatured Calls and Calls Receivable on 6J^%

Interest-Bearing Option Warrants.......

Difference between Par Values of Interest-Bearing

Option Warrants and Par or Liquidation Value

of Securities to be Issued in Exchange Therefor. . .

Other Optional Reserves, including Reserves for

Additional Federal Taxes and Unsettled Contin-

$ 12,125,979.19

3,975,390.00

652,995.00

2,702,020.82

269,807.26

$ 19.726,192.27

$239,092,039.09

$ 12,319,507,83

8,697,272,50

1,000.692.50

2,227,722.68

76,894,50

$ 24,322,09001

$217,388,432.31

$ 193.528.64

4.721.882.50

347.697.50

474,298.14

192,912.76

$ 4.595.897.74

$21,703,606,78

Dividends...................

Total Reser\ es...........

Total Liabilities Side and Capital . .

* Classification, grouping and nomenclature modified from annual report

September 30. 1926.

rCalled for payment January 1, 1927.

t Tentative.

bal

ncc siieeL at December

31. 1925. where necessary r

o make comparable with

|