Statement

([New York] : The Bank for Savings in the City of New York )

|

||

|

|

|

|

| 1929: Page [1] |

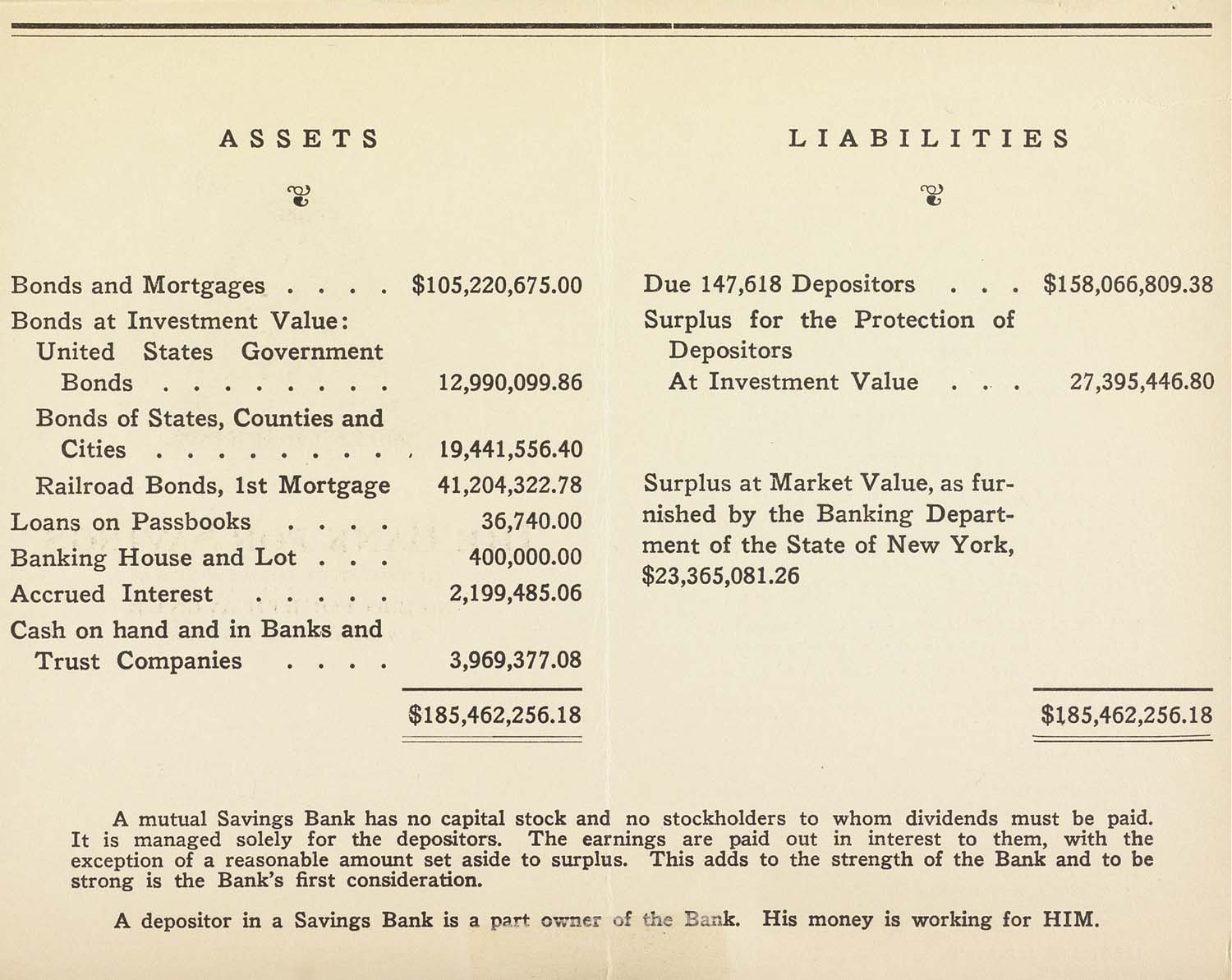

ASSETS LIABILITIES Bonds and Mortgages .... $105,220,675.00 Bonds at Investment Value: United States Government Bonds........ 12,990,099.86 Bonds of States, Counties and Cities......... 19,441,556.40 Railroad Bonds, 1st Mortgage 41,204,322.78 Loans on Passbooks .... 36,740.00 Banking House and Lot . . . 400,000.00 Accrued Interest ..... 2,199,485.06 Cash on hand and in Banks and Trust Companies .... 3,969,377.08 Due 147,618 Depositors . . . $158,066,809.38 Surplus for the Protection of Depositors At Investment Value . . . 27,395,446.80 Surplus at Market Value, as fur¬ nished by the Banking Depart¬ ment of the State of New York, $23,365,081.26 $185,462,256.18 $185,462,256.18 A mutual Savings Bank has no capital stock and no stockholders to whom dividends must be paid. It is managed solely for the depositors. The earnings are paid out in interest to them, with the exception of a reasonable amount set aside to surplus. This adds to the strength of the Bank and to be strong is the Bank's first consideration. A depositor in a Savings Bank is a part owner of the Bank. His money is working for HIM. |

| 1929: Page [1] |