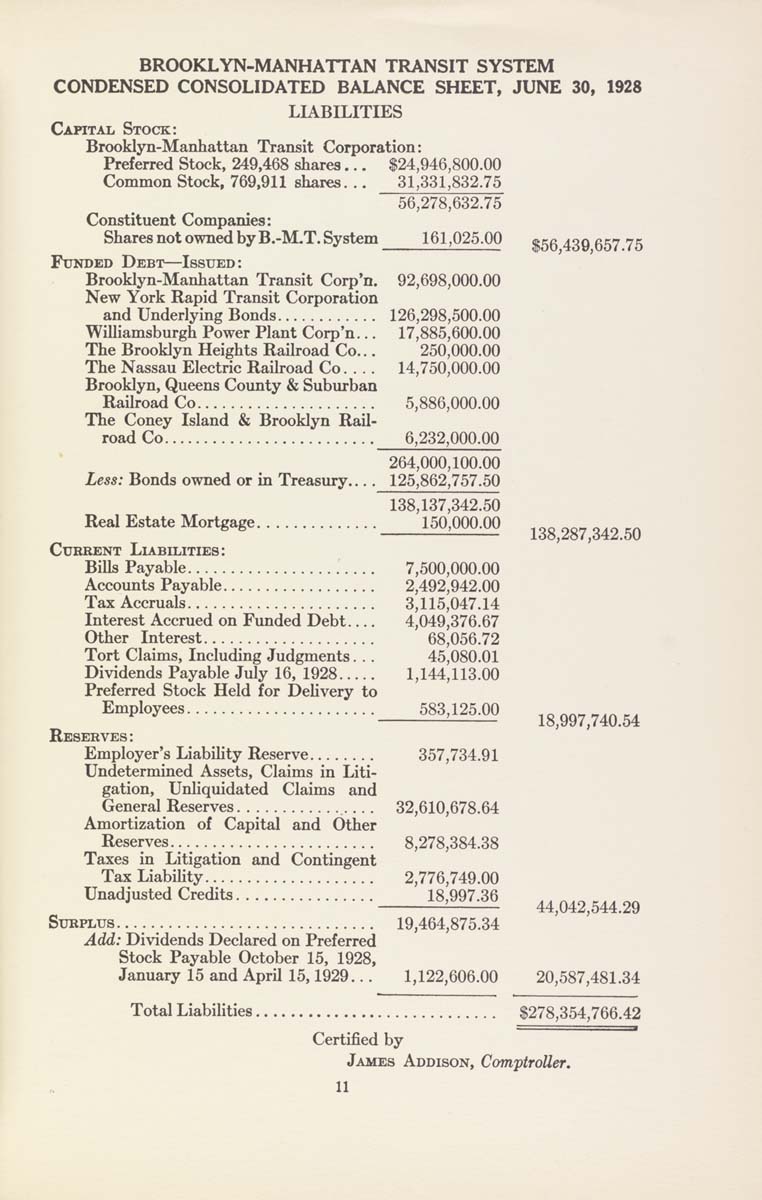

BROOKLYN-MANHATTAN TRANSIT SYSTEM

CONDENSED CONSOLIDATED BALANCE SHEET, JUNE 30, 1928

LUBILITIES

Capital Stock:

Brooklyn-Manhattan Transit Corporation:

Preferred Stock, 249,468 shares... $24,946,800.00

Common Stock, 769,911 shares. .. 31,331,832.75

56,278,632.76

Constituent Companies:

Shares not owned by B.-MT. System 161,025.00 »eg 430 gg^ 75

Funded Debt—Issued:

Brooklyn-Manhattan Transit Corp'n. 92,698,000.00

New York Rapid Transit Corporation

and Underlying Bonds............ 126,298,500.00

Williamsburgh Power Plant Corp'n... 17,885,600.00

The Brooklyn Heights Railroad Co... 250,000.00

The Nassau Electric Railroad Co.... 14,750,000.00

Brooklyn, Queens County & Suburban

Railroad Co..................... 5,886,000.00

The Coney Island & Brooklyn Rail¬

road Co......................... 6,232,000.00

264,000,100.00

Less: Bonds owned or in Treasury.... 125,862,767.50

138,137,342.50

Real Estate Mortgage.............._____150,000.00 138287,342.50

Current Liabilities:

Bills Payable...................... 7,600,000.00

Accounts Payable.................. 2,492,942.00

Tax Accruals...................... 3,115,047.14

Interest Accrued on Funded Debt.... 4,049,376.67

Other Interest.................... 68,056.72

Tort Claims, Including Judgments. .. 45,080.01

Dividends Payable July 16, 1928..... 1,144,113.00

Preferred Stock Held for Dehvery to

^"P'°y^'=^......................-------58342^0 18,997,740.54

Reserves:

Employer's Liability Reserve........ 357,734.91

Undetermined Assets, Claims in Liti¬

gation, Unliquidated Claims and

General Reserves.............___ 32,610,678.64

Amortization of Capital and Other

Reserves.;...._.................. 8,278,384.38

Taxes in Litigation and Contingent

Tax Liability.................... 2,776,749.00

Unadjusted Credits................______18,997.36 44042,544.29

Surplus....._......................... 19,464,875.34

Add: Dividends Declared on Preferred

Stock Payable October 16, 1928,

January 16 and April 15,1929... 1,122,606.00 20,587,481.34

Total Liabilities............................ $278,354,766.42

Certified by

James Addison, Comptroller.

11

|