53

In the past year, the depreciation reserve has been equivalent

to 2%<^ on the capital stock, leaving the net earnings for 1898 on

stock, after excluding depreciation charges, over 10^.

In accordance with the general plan of providing reserve

accounts, the Company began in 1895 an insurance reserve

which has now reached $50,055 and is increasing at the rate

of approximately $io,ooo per year. The high rate of insurance

at that time and the co-insurance requirement made the cost of

insuring the fire-proof stations altogether extravagant, and it was

therefore decided as the Company had so many stations, it

could afford to become its own insurer and set aside the

equivalent of premiums for an insurance reserve. The Com¬

pany's property, outside its main^tations, has been kept insured

in the regular companies and';sQme."ihsu3'a|i^c;'-,'ha-s also been

carried on the main stations, the differehte-b&twreen^ these pay¬

ments and full insurance premium^;tjeiijg^credited to the re'serve

account. The insurance fund has be^n-^/n^ested "COpserv:atively

in outside securities, ° ''■'°'' ° :

Company PRO^&R|Tfj' .\ =-„ ,

It is by the application of the princi^les°''a5oye^ c'iled, and

through the co-operation of the men above named, that the Com¬

pany has steadily held its own as the largest electricity supply

company in the world, to the benefit of investors in its securities

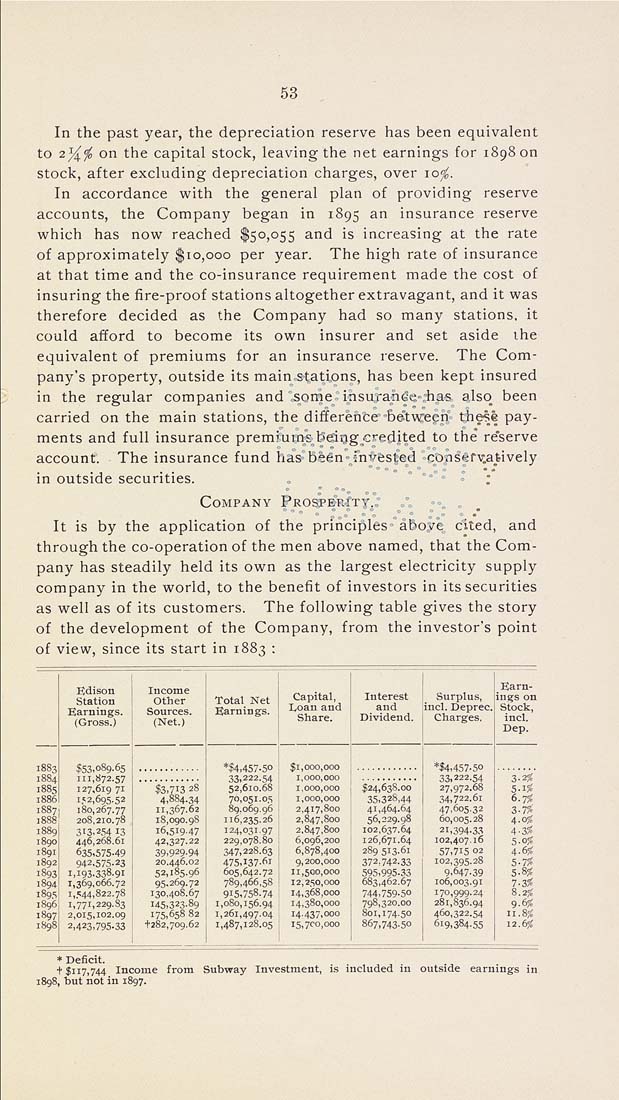

as well as of its customers. The following table gives the story

of the development of the Company, from the investor's point

of view, since its start in 1883 ;

Edison

Income

Capital,

Interest

Surplus,

Earn¬

ings on

Earnings.

(Gross.)

Sources.

(Net.)

Earnings.

Loan and

Share.

and

Dividend.

incl. Deprec.

Charges.

Stock,

incl.

Dep.

1883

1884

T8SH

$53,089.65

111,672.57

127,619 71

*$4,457-5D

33,222.54

52,610.68

*l4.457-50

33,222.54

27,972.68

000

3

5

$3,713 28

1.000

000

§24,638.00

i^

tK«(S

i,'2,695.52

4,884.34

70,051.05

1,000

000

35,328,44

34,722.61

7%

1HS7

t8RF

11,367.62

89.069.96

2,417

800

41,464.64

47,605.32

3

1%

208,210.78

18,090.98

116,235.26

2,847

800

56.229.98

60,005.28

4

OS

tJ^Hq

313,254 13

16,51947

124,031.97

2.847

800

102,637.64

21,394.33

4

,3iS

tKiio

446,268.61

229,078,80

6,096

200

126,671.64

102,407.16

^

0%

tHqi

635.575.49

39,929.94

347,228.63

400

289 513.61

57.715 02

4

bS

iHn?

20.446.02

475.137-61

9,200

000

372,742.33

102,395.28

.S

7%

laq^

52,185.96

605,642.72

11,500

opo

595,995.33

9.647.39

5

8S

i8q4

1,369,066.72

95,269.72

789,466.58

12,250

000

683,462.67

106,003.91

7

3%

iKq=;

i,";44,822.78

130,408.67

915.758.74

14,368

000

744,759-50

170,999.24

2«

^Hqh

U5>323.89

1,080,156.94

14,380

ODO

798,320.00

281,836.94

y

w

1«Q7

2,015,102.09

175,658 82

1,261,497.04

14437

000

801,174.50

460,322.54

II

8;^

1898

2,423.795.33

1-282,709.62

1,487,128,05

l5,7<'o

000

867,743-50

619.384-55

12 6^

* Deficit,

■F $117,744 Income from Subway Investment, is included in outside ear

1898, hut not in 1897.

|