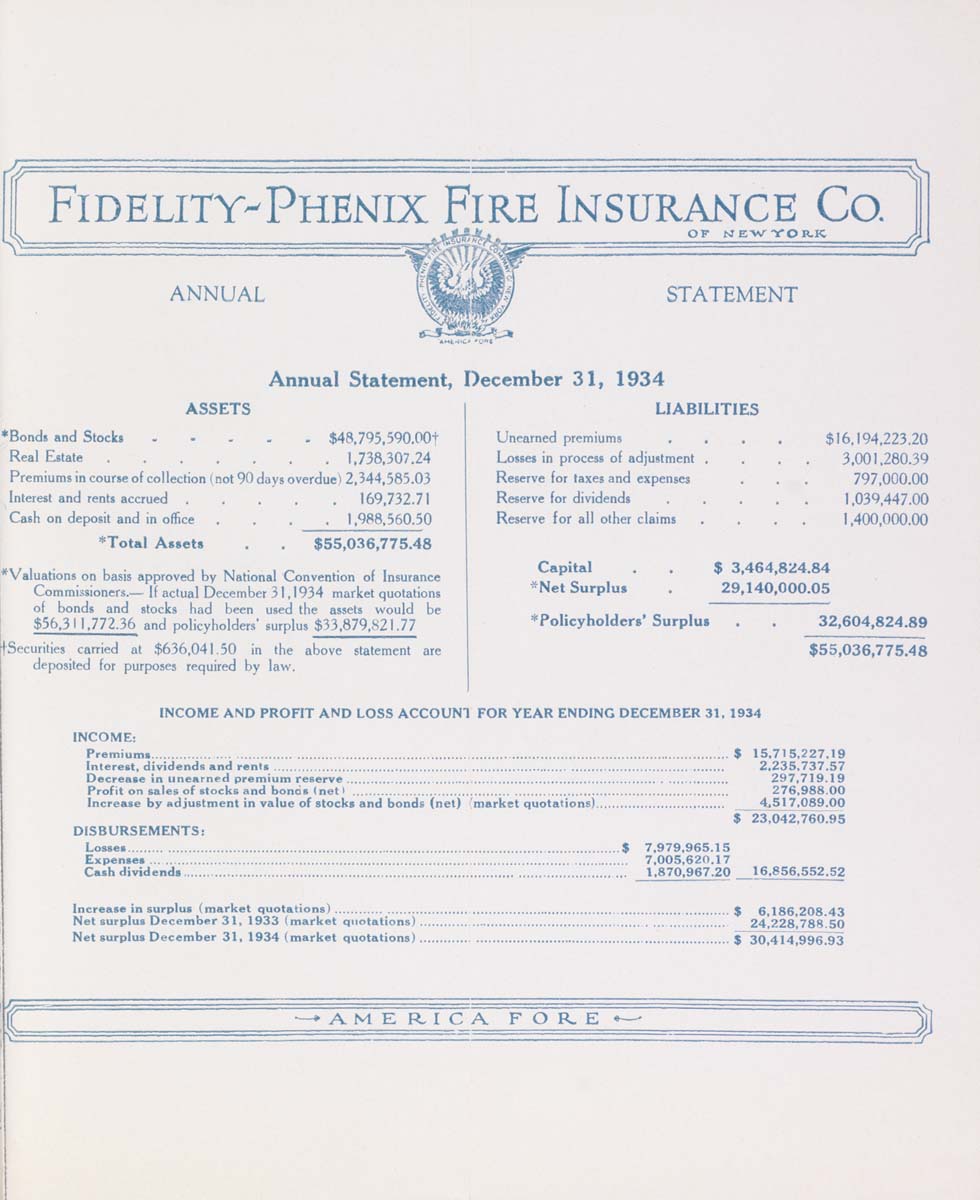

Annual Statement, December 31, 1934

ASSETS

•Bonds and Stocks.....$48,795,590.00t

Real Estate.......1,738.307.24

Premiums in course ol collection (not 90 days overdue) 2,344,585.03

Interest and rents accrued ..... 169,732.71

Cash on deposit and in office .... 1,988.560,50

*Total Assets . $55,036,775.48

*Valuations on basis approved by National Convention of Insurance

Commissioners.— If actual December 3 1.1934 market quotations

of bonds and stocks had been used ttie assets would be

$56,311.772.36 and policyholders' surplus $33,879,821.77

Securities carried at $636,041.50 in the above statement are

deposited for purposes required by law.

LIABILITIES

Unearned premiums

$16,194,223.20

Losses in process of adjustment ,

. . 3,001,280.39

Reserve for taxes and expenses

. . 797,000.00

Reserve for dividends

. . 1.039,447.00

Reserve for all other claims

. . 1,400,000.00

Capital

$ 3.464.824.84

*Net Surplus

29.140.000.05

* Policyholders' Surplus

32.604.824.89

$55,036,775.48

INCOME AND PROFIT AND LOSS ACCOUNI FOR YEAR ENDING DECEMBER 31. 1934

INCOME:

Premium............................................................................................................................................. $ 15.715,227.19

Interest, dividends and rents............................................................................................................. 2.235.737.57

Decrease in unearned premium reserve............................................................................................ 297.719.19

Profit on sales of stocks and bonds (netl ............................................................................................ 276,988.00

Increase by adjustment in value of stocks and bonds (net) 'market quotations)................................ __ 4^517,089.00

$ 23,042.760.95

DISBURSEMENTS:

Losses...................................................................................................... ..................$ 7.979,965.15

Expenses..................................................................................................................... 7.005,620.17

Cash dividends............................................................................................................ 1.870,967.20__16.856,552.52

Increase in surplus (market quotations).................................................................................... ...........$ 6.186.208.43

Net surplus December 31, 1933 (market quotations).......................................................... .............. 24,228.788.50

Net surplus December 31, 1934 (market quotations)............................................................................$ 30,414,996,93

AMERICA FOB.E

3

|