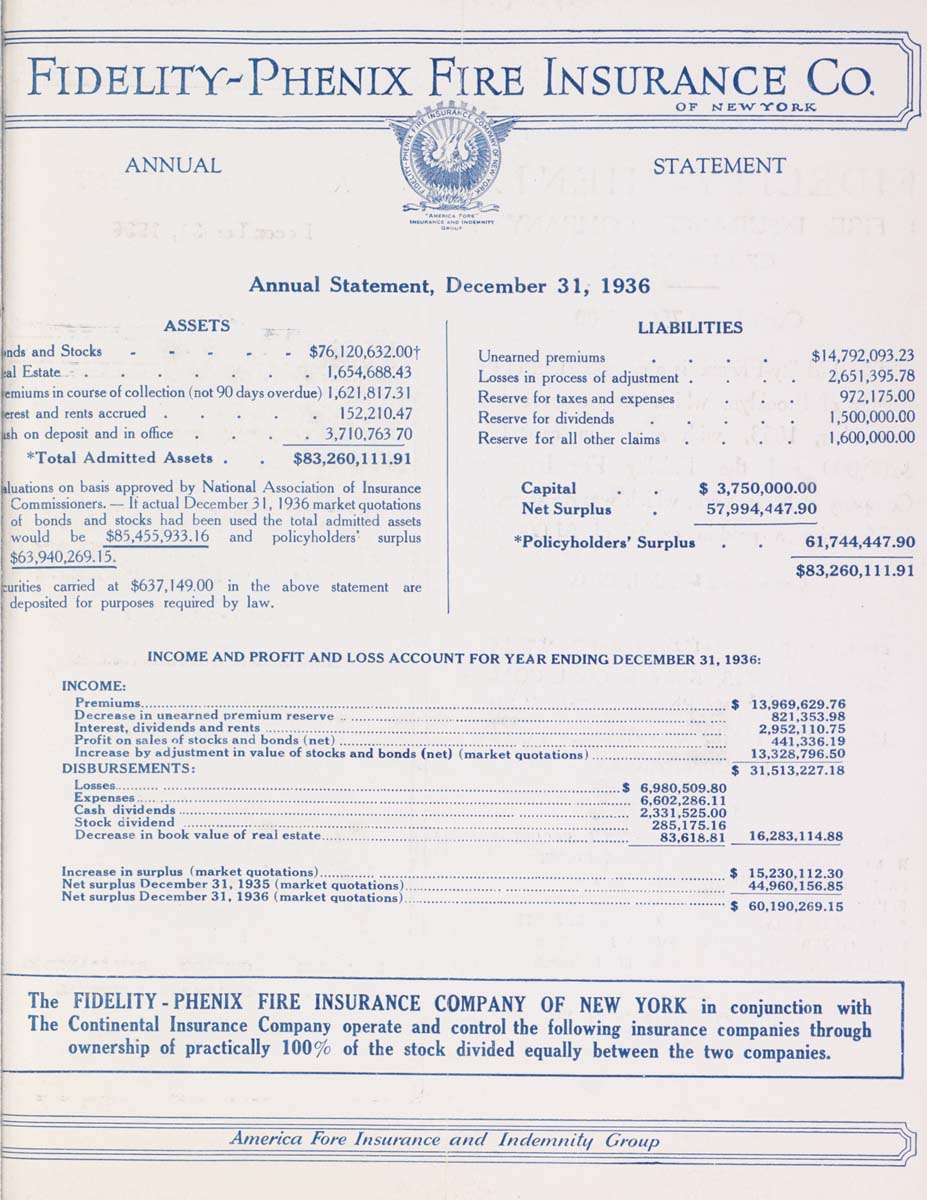

Annual Statement, December 31, 1936

ASSETS

,nd« and Stocks.....$76,120,632,001

al Estate.......1.654.688.43

emiums in course of collection (not 90 days overdue) 1,621,81 7.31

crest and rents accrued ..... 152,210.47

sh on deposit and in office .... 3,710,763 70

*Total Admitted Assets . . $83,260,111.91

iluations on basis approved by National Association of Insurance

Commissioners. — It actual December 31,1936 market quotations

of bonds and stocks had been used the total admitted assets

would be $85,455,933.16 and policyholders' surplus

$63,940,269.15.

lurities carried at $637,149.00 in the above statement are

deposited for purposes required by law.

LIABILITIES

Unearned premiums

Losses in process of adjustment

Reserve for taxes and expenses

Reserve for dividends

Reserve for all other claims

Capital

Net Surplus

$14,792,093.23

2,651,395.78

972.175.00

1,500,000.00

1,600,000.00

$ 3.750,000.00

57,994,447.90

'''Policyholders' Surplus

61,744,447.90

$83,260,111.91

INCOME AND PROFIT AND LOSS ACCOUNT FOR YEAR ENDING DECEMBER 31, 1936:

INCOME:

Premiums...............................................................................................................................................$ 13,969,629.76

Decrease in unearned premium reserve........................................ ................................................ 821,353.98

Interest, dividends and rents ...........................................................................".!.!....."!!........"..."..'.'!.!!! 2,952,110.75

Profit on sales of stocks and bonds (net)............................................................................................ 441,336.19

Increase by adjustment in value of stocks and bonds (net) (market quotations) ........................... 13,328,796.50

DISBURSEMENTS: $ 31.5737227.18

Jrosses...........................................................................................................................$ 6,980,509.80

Expenses........................................................................................................................ 6,602,286.11

Cash dividends............................................................................................................ 2,331,525.00

Stock dividend............................................................................................................. 285,175.16

Decrease in book value of real estate........................................................... ............. 83,618.81 16,283,114.88

Increase in surplus (market quotations)....................................................................................... $ 15,230,112.30

Net surplus December 31, 1935 (market quotations).......................!"..."7......... ...'......'.!"!!!!7.7........... 44,960,156.85

Net surplus December 31, 1936 (market quotations) ..................... ~ " '

.................................................................. $ 60,190,269.15

The FIDELITY-PHENIX FIRE INSURANCE COMPANY OF NEW YORK in conjunction with

The Continental Insurance Company operate and control the following insurance companies through

ownership of practically 100% of the stock divided equally between the two companies.

America Fore Insurance and Inden^nitq Croup

|