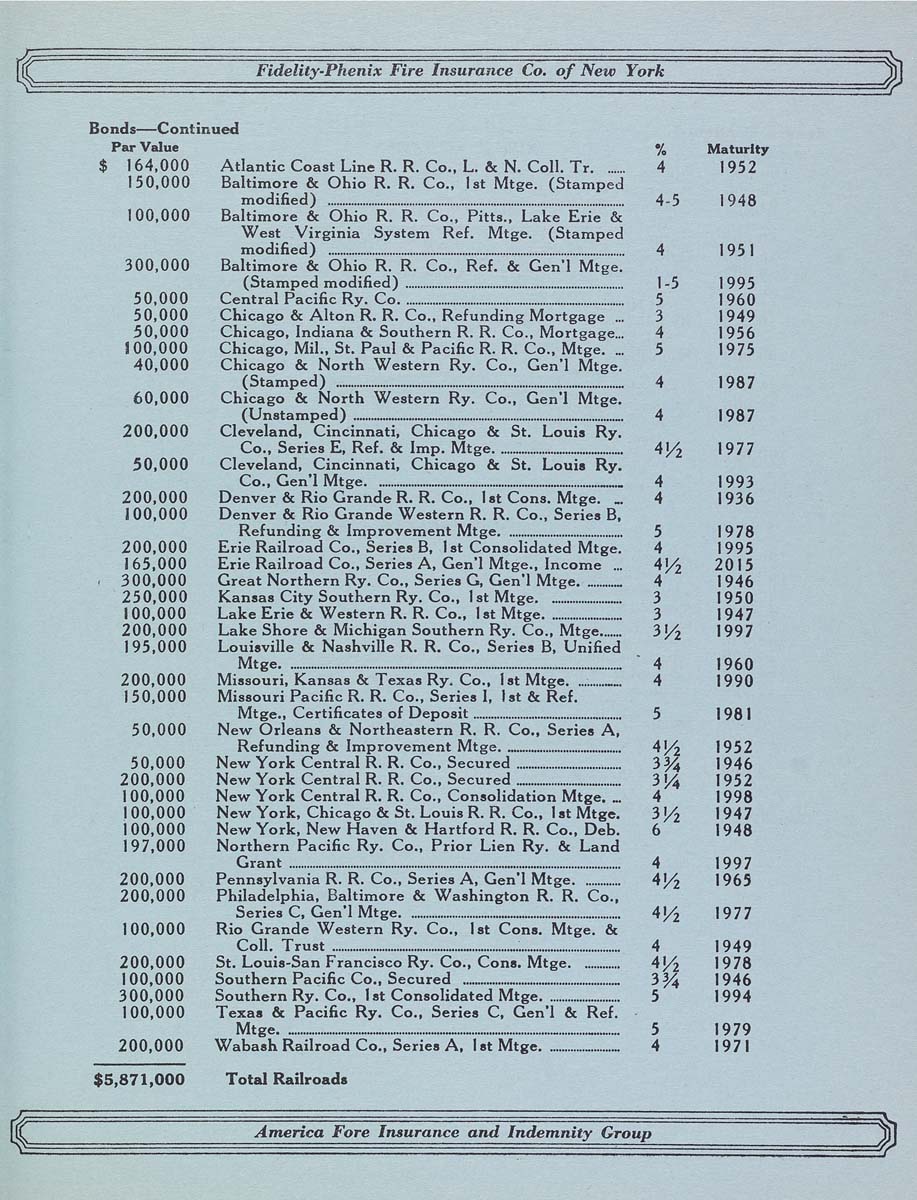

Fidelity-Phenix Fire Insurance Co. of New York

Bonds—Continued

Par Value % Maturity

$ 164,000 Atlantic Coast Line R. R. Co., L. & N. Coll. Tr....... 4 1952

150,000 Baltimore & Ohio R. R. Co., Isl Mtge. (Stamped

modified) ...................................................................................................... 4-5 1948

100,000 Baltimore & Ohio R. R. Co., Pitts., Lake Erie &

West Virginia System Ref. Mtge. (Stamped

modified) ...................................................................................................... 4 1951

300,000 Baltimore & Ohio R. R. Co., Ref. & Gen'l Mtge.

(Stamped modified) ........................................................................... 1-5 1995

50,000 Central Pacific Ry. Co............................................................................ 5 1960

50,000 Chicago & Alton R. R. Co., Refunding Mortgage ... 3 1949

50,000 Chicago, Indiana & Southern R. R. Co., Mortgage... 4 1955

1 00,000 Chicago, Mil., St. Paul & Pacific R. R. Co., Mtge. ... 5 1975

40,000 Chicago & North Western Ry. Co., Gen'l Mtge.

(Stamped).................................................................................................. 4 1987

60,000 Chicago & North Western Ry. Co., Gen'l Mtge.

(Unstamped) .......................................................................................... 4 1987

200,000 Cleveland, Cincinnati, Chicago & St. Louis Ry.

Co., Series E, Ref. & Imp. Mtge.......................________ 41/2 '977

50,000 Cleveland, Cincinnati, Chicago & St. Louis Ry.

Co., Gen'l Mtge......................................................................_____ 4 1 993

200,000 Denver & Rio Grande R.R. Co., 1st Cons. Mtge. .. 4 1935

I 00,000 Denver & Rio Grande Western R. R. Co., Series B,

Refunding & Improvement Mtge........................................ 5 1978

200,000 Erie Railroad Co., Series B, Ist Consolidated Mtge. 4 1995

165,000 Erie Railroad Co., Series A, Gen'l Mtge., Income ... 4!^ 2015

300,000 Great Northern Ry. Co., Series G, Gen'l Mtge........... 4 1945

250,000 Kansas City Southern Ry. Co., 1st Mtge......................... 3 1950

100,000 LakeErie& Western R.R. Co., 1st Mtge..................._.., 3 1947

200,000 Lake Shore & Michigan Southern Ry. Co., Mtge....... 31^ 1997

195,000 Louisville & Nashville R. R. Co., Series B, Unified

Mtge................................................................................................................ '4 1950

200,000 Missouri, Kansas & Texas Ry. Co., Ist Mtge.........._.. 4 1990

150,000 Missouri Pacific R. R. Co., Series I, 1st & Ref.

Mtge., Certificates of Deposit................................................... 5 1981

50,000 New Orleans & Northeastern R. R. Co., Series A,

Refunding & Improvement Mtge. .„.................................... 4}/^ 1952

50,000 New York Central R. R. Co., Secured .................................... 354 '945

200,000 New York Central R. R. Co., Secured................................... 3 !4 1952

100,000 New York Central R. R. Co., Consolidation Mtge. .. 4 1998

100,000 New York, Chicago & St. Louis R.R. Co., 1st Mtge. 31/^ 1947

100,000 New York, New Haven & Hartford R. R. Co., Deb. 6 1948

197,000 Northern Pacific Ry. Co., Prior Lien Ry. & Land

Grant .................................................................................................................. 4 1997

200,000 Pennsylvania R. R. Co., Series A, Gen'l Mtge............. 41/^ 1955

200,000 Philadelphia, Baltimore & Washington R. R. Co.,

Series C, Gen'l Mtge...................................................................... 4J4 1977

100,000 Rio Grande Western Ry. Co., Ist Cons. Mtge. &

Coll. Trust............................................................................................... 4 1949

200,000 St. Louis-San Francisco Ry. Co., Cons. Mtge............ 4'A '978

100,000 Southern Pacific Co., Secured ___.......„.................................. 3J4 1945

300,000 Southern Ry. Co., 1st Consolidated Mtge......................... 5 1994

100,000 Texas & Pacific Ry. Co., Series C, Gen'l & Ref.

Mtge......................................................................................_________ 5 1979

200,000 Wabash Railroad Co., Series A, 1 st Mtge....................„ 4 1971

$5,871,000 Total Railroads

America Fore Insurance and Indemnity Group

|