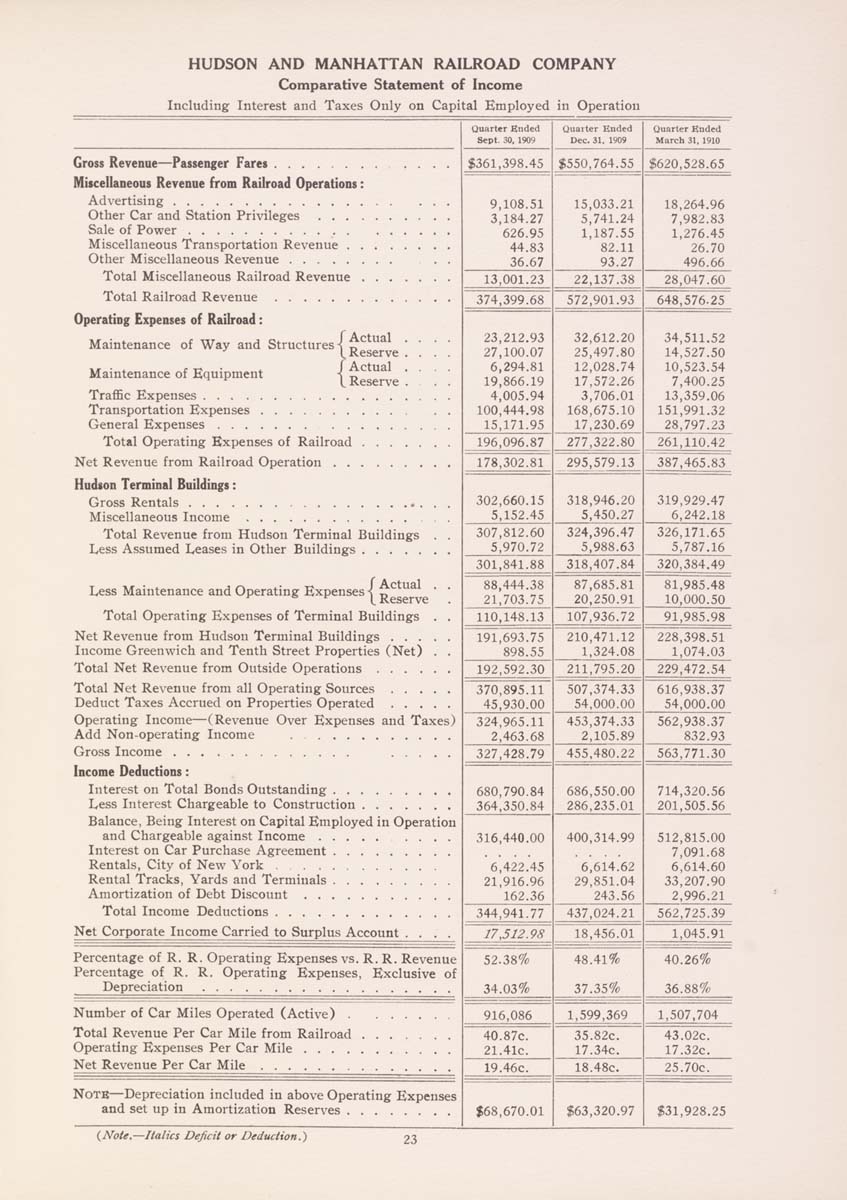

HUDSON AND MANHATTAN RAILROAD COMPANY

Comparative Statement of Income

Including Interest and Taxes Only on Capital Employed in Operation

Quarter Ended

Sept. 30. 1909

Quarter Ended

Dec. 31. 1909

Quarter Ended

Mareh 31. 1910

$361,398.45

$550,764.55

$620,528.65

Miscellaneous Revenue from Railroad Operations:

9,108.51

3,184.27

626.95

44.83

36.67

15,033.21

5,741.24

1,187.55

82.11

93.27

18,264,96

7,982.83

1,276.45

26.70

496.66

13,001.23

22,137.38

28,047.60

374,399.68

572,901.93

648,576.25

Operating Expenses of Railroad:

Maintenance of Way and Structures"{ p . . - ■ ■

Maintenance of Equipment ^ p . '

Transportation Expenses.............

23,212.93

27,100.07

6,294.81

19,866.19

4,005.94

100,444.98

15,171.95

32,612.20

25,497.80

12,028.74

17,572.26

3,706.01

168,675.10

17,230.69

34,511.52

14,527.50

10,523.54

7,400.25

13,359,06

151,991.32

28,797.23

Total Operating Expenses of Railroad.......

196,096.87

277,322.80

261,110.42

178,302.81

295,579.13

387,465.83

Hudson Terminal Buildings:

302,660.15

5,152.45

318,946.20

5,450.27

319,929.47

6,242.18

Total Revenue from Hudson Terminal Buildings . .

Less Assumed Leases in Other Buildings.......

307,812.60

5,970.72

324,396.47

5,988.63

326,171.65

5,787.16

301,841.88

318,407.84

320,384.49

Less Maintenance and Operating Expenses -^ p *^ "^^ ' '

88,444.38

21,703.75

87,685.81

20,250.91

81,985.48

10,000.50

Total Operating Expenses of Terminal Buildings . .

110,148.13

107,936.72

91,985.98

Net Revenue from Hudson Terminal Buildings.....

Income Greenwich and Tenth Street Properties (Net) . .

191,693.75

898.55

210,471.12

1,324.08

228,398.51

1,074.03

Total Net Revenue from Outside Operations......

192,592.30

211,795.20

229,472.54

Deduct Taxes Accrued on Properties Operated.....

370,895.11

45,930.00

507,374.33

54.000.00

616,938.37

54,000.00

Operating Income—(Revenue Over Expenses and Taxes)

324,965.11

2,463.68

453,374.33

2,105.89

562,938.37

832.93

327,428.79

455,480.22

563,771.30

Income Deductions:

680,790,84

364,350.84

686,550.00

286,235.01

714,320.56

201,505.56

Balance, Being Interest on Capital Employed in Operation

316,440.00

6,422.45

21,916.96

162.36

400,314.99

6,614.62

29,851.04

243.56

512,815.00

Rentals, City of New York...........

6,614.60

33,207.90

2,996.21

344,941.77

437,024.21

562,725.39

Net Corporate Income Carried to Surplus Account ....

17,512.98

18,456.01

1,045.91

Percentage of R. R. Operating Expenses vs. R. R. Revenue

Percentage of R. R. Operating Expenses, Exclusive of

52.38%

34.03%>

48.41%

37.35%

40.26%

36.88%

Number of Car Miles Operated (Active)......

916,086

1,599,369

1,507,704

Total Revenue Per Car Mile from Railroad . . .

40.87c.

21.41c.

35.82c.

17.34c.

43.02c.

19.46c.

18.48c.

25.70c.

NoTB—Depreciation included in above Operating Expenses

and set up in Amortization Reserves.......

$68,670.01

$63,320.97

$31,928.25

|