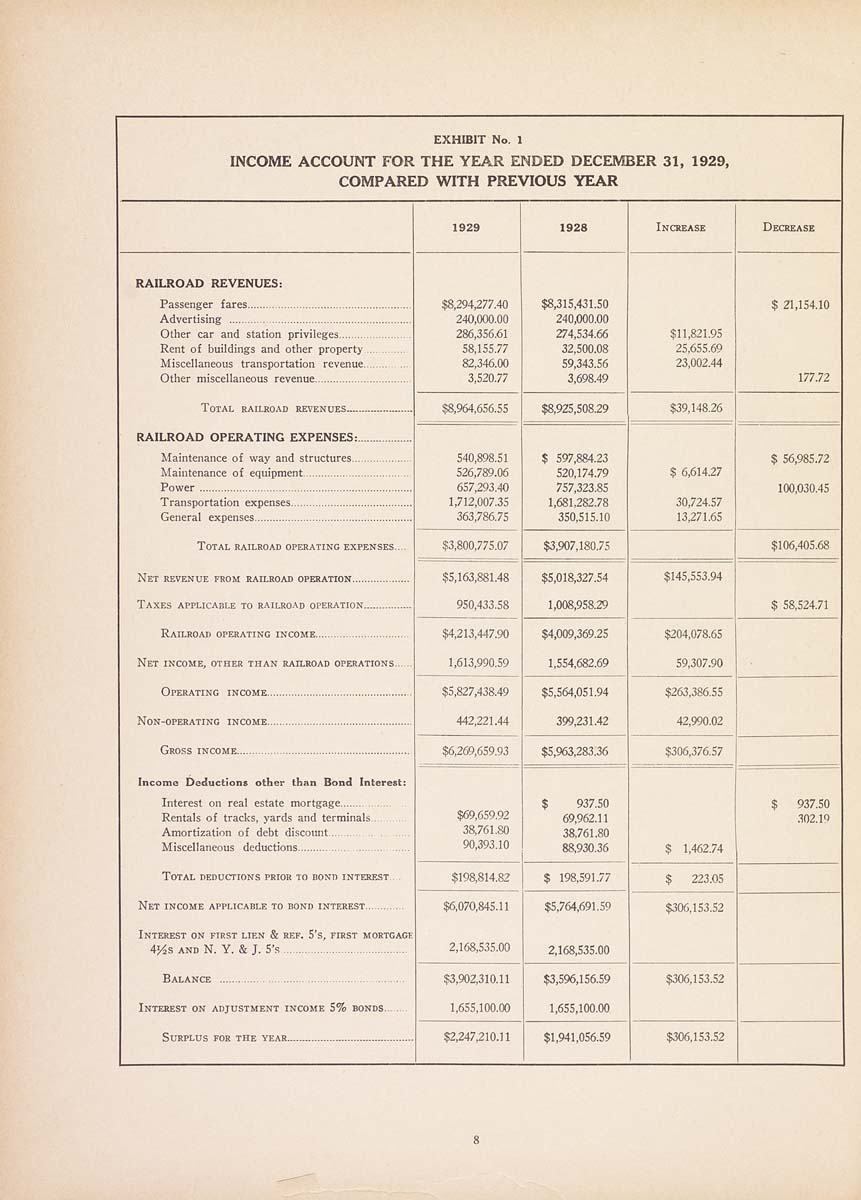

EXHIBIT No. 1

INCOME ACCOUNT FOR THE YEAR ENDED DECE^5BER 31, 1929,

COMPARED WITH PREVIOUS YEAR

1929

1928

Increase

Decrease

RAILROAD REVENUES:

$8,294,277.40

240,000.00

286,356.61

58,155.77

82,346.00

3,520.77

$8,315,431.50

240,000.00

274,534.66

32,500.08

59,343.56

3,698.49

$11,821.95

25,655.69

23,002.44

$ 21,154.10

177.72

Other car and station privileges.......................

Rent of buildings and other property ..........

Miscellaneous transportation revenue

$8,964,656.55

$8,925,508.29

$39,14826

540,898.51

526,789.06

657,293.40

1,712,007.35

363,786.75

$ 597,884.23

520,174.79

757,323.85

1,681,282.78

350,515.10

$ 6,614.27

30,724.57

13,271.65

$ 56,985.72

100,03045

Total railroad operating expenses...

$3,800,775.07

$3,907,180.75

$106,405.68

$5,163,881.48

950,433.58

$5,018,327.54

1,008,95829

$145,553.94

$ 58524.71

Railroad operating income...........................

Net income, other than railroad operations.

Operating income...............................................

$4,213,447.90

1,613,990.59

$4,009,369.25

1,554,682.69

$204,078.65

59,307.90

$5,827,438.49

442,221.44

$5,564,051.94

399,231.42

$263,386.55

42,990.02

Gross income.........................................................

Income Deductions other than Bond Interest;

Interest on real estate mortgage..........

Rentals of tracks, yards and terminals

Amortization of debt discount.

Miscellaneous deductions........................

Total deductions prior to bond interest

Net income applicable to bond interest...........

Interest on first lien & ref. S's, first mortcagf

4!4s AND N. Y. & J. 5'B........................................

Balance ........................................................

Interest on adjustment income 5% bonds.......

$6,269,659.93

$5,963,283.36

$306,37657

$69,659.92

38,761.80

90,393.10

$ 937.50

69,962.11

38,761.80

88,930.36

$ 1,462.74

$ 937.50

,302.10

$198,814.82

$ 198,591.77

$ 223.05

$6,070,845.11

2,168,535.00

$5,764,691.59

2,168,535.00

$306,153.52

$3,902,310.11

1,655,100.00

$3,596,156.59

1,655,100.00

$306,153.52

$2,247,210.11

$1,941,056.59

$306,153.52

|