Annual report of Hudson & Manhattan Railroad Company

(New York, N.Y. : Hudson and Manhattan Railroad Company )

|

||

|

|

|

|

| 1932: Page 11 |

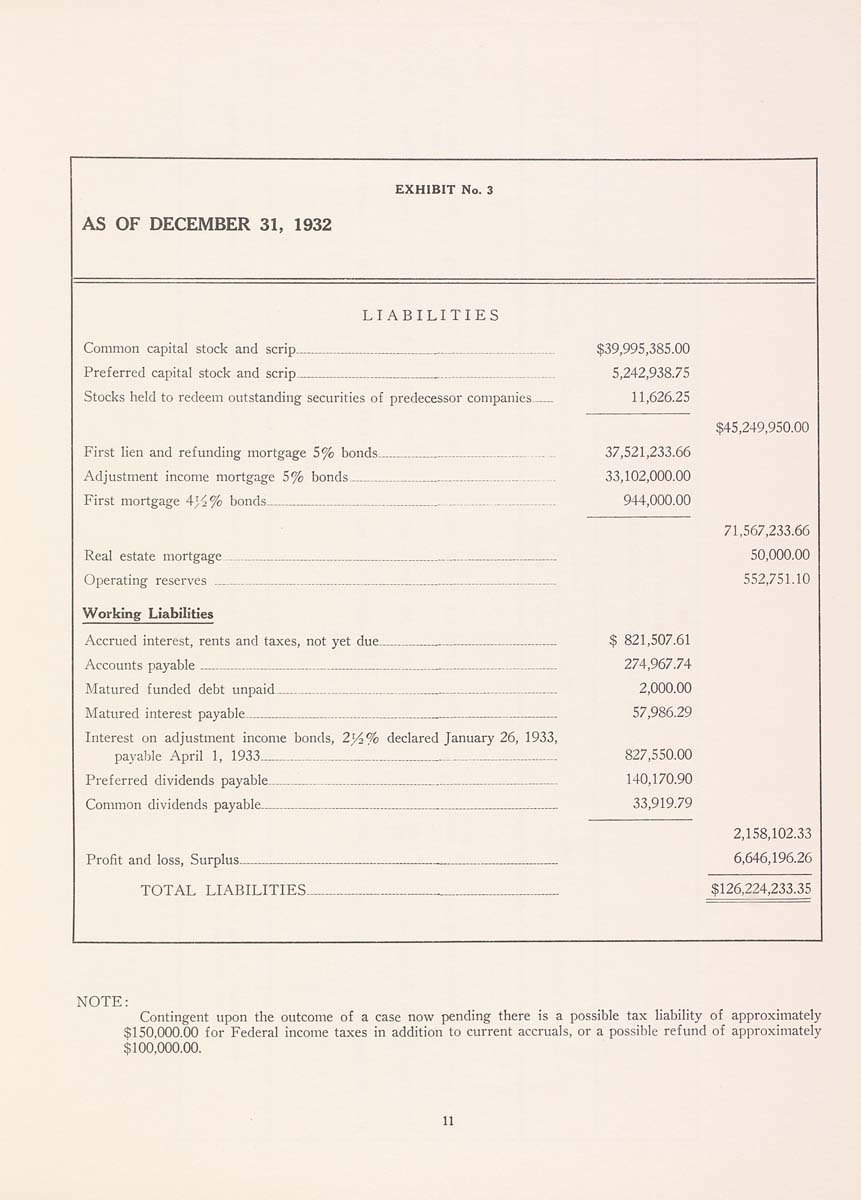

EXHIBIT No. 3 AS OF DECEMBER 31, 1932 LIABILITIES Common capital stock and scrip______.........__________..............-........ Preferred capital stock and scrip____..........______________..........-....... Stocks held to redeem outstanding securities of predecessor companies- First lien and refunding mortgage 5% bonds................______________ Adjustment income mortgage 5% bonds___.................______________ First mortgage 4^^% bonds________.....................__________________ Real estate mortgage -— Operating reserves ____ Working Liabilities Accrued interest, rents and taxes, not yet due- Accounts payable_________________............... Matured funded debt unpaid............................. Matured interest payable................................___ Interest on adjustment income bonds, 2J^^ payable April 1, 1933_______________ Preferred dividends payable_________.......... Common dividends payable_______________ declared January 26, 1933, Profit and loss. Surplus--------------- TOTAL LIABILITIES- $39,995,385.00 5,242,938.75 11,626.25 37,521.233.66 33,102,000.00 944,000.00 $ 821,507.61 274,967.74 2,000.00 57,986.29 827,550.00 140,170.90 33,919.79 $45,249,950.00 71,567,233.66 50,000.00 552,751.10 2,158,102.33 6,646,196.26 $126,224,233.35 Contingent upon the outcome of a case now pending there is a possible tax liability of approximately $150,000.00 for Federal income taxes in addition to current accruals, or a possible refund of approximately $100,000.00. |

| 1932: Page 11 |