Annual report of Hudson & Manhattan Railroad Company

(New York, N.Y. : Hudson and Manhattan Railroad Company )

|

||

|

|

|

|

| 1935: Page 11 |

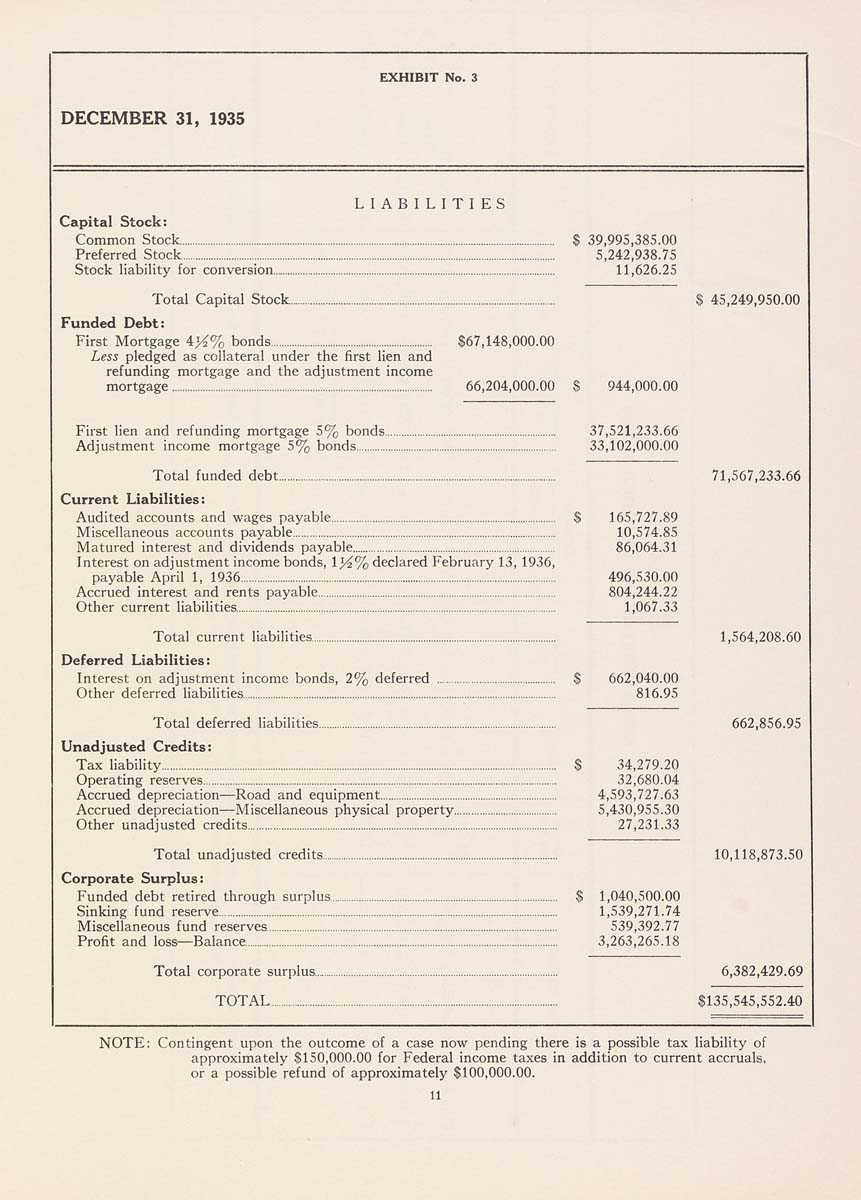

EXHIBIT No. 3 DECEMBER 31, 1935 LIABILITIES Capital Stock: Common Stock................................................................................................................................................... $ 39,995,385.00 Preferred Stock.................................................................................................................................................. 5,242,938.75 Stock liability for conversion............................................................................................................... 11,626.25 Total Capita! Stock........................................................................................................ S 45,249,950.00 Funded Debt: First Mortgage 4K% bonds............................................................... 867,148,000.00 Less pledged as collateral under the first lien and refunding mortgage and the adjustment income mortgage..................................................................................................... 66,204,000.00 S 944,000.00 First lien and refunding mortgage 5% bonds.................................................................. 37,521,233.66 Adjustment income mortgage 5% bonds............................................................................. 33,102,000.00 Total funded debt............................................................................................................ 71,567,233.66 Current Liabilities: Audited accounts and wages payable....................................................................................... S 165,727.89 Miscellaneous accounts payable...................................................................................................... 10,574.85 Matured interest and dividends payable.............................................................................. 86,064.31 Interest on adjustment income bonds, \}4% declared February 13, 1936, payable April 1, 1936........................................................................................................................... 496,530.00 Accrued interest and rents payable............................................................................................. 804,244.22 Other current liabilities,............................................................................................................................. 1,067.33 Total current liabilities................................................................................................ Deferred Liabilities: Interest on adjustment income bonds, 2% deferred ............................................. S 662,040.00 Other deferred liabilities........................................................................................................................... 816.95 Total deferred liabilities... Unadjusted Credits: Tax liability......................................................................................................................................................... $ 34,279.20 Operating reserves.......................................................................................................................................... 32,680.04 Accrued depreciation—Road and equipment..................................................................... 4,593,727.63 Accrued depreciation—Miscellaneous physical property....................................... 5,430,955.30 Other unadjusted credits...................................................................................................................... 27,231.33 Total unadjusted credits............................................................................................. 10,118,873.50 Corporate Surplus: Funded debt retired through surplus........................................................................................ $ 1,040,500.00 Sinking fund reserve.................................................................................................................................... 1,539,271.74 Miscellaneous fund reserves.................................................................................................................. 539,392.77 Profit and loss—Balance........................................................................................................................... 3,263,265.18 Total corporate surplus... TOTAL.............................................................................................................. $135,545,552.40 NOTE: Contingent upon the outcome of a case now pending there is a possible tax liability of approximately SI50,000.00 for Federal income taxes in addition to current accruals, or a possible refund of approximately 5100,000.00. |

| 1935: Page 11 |