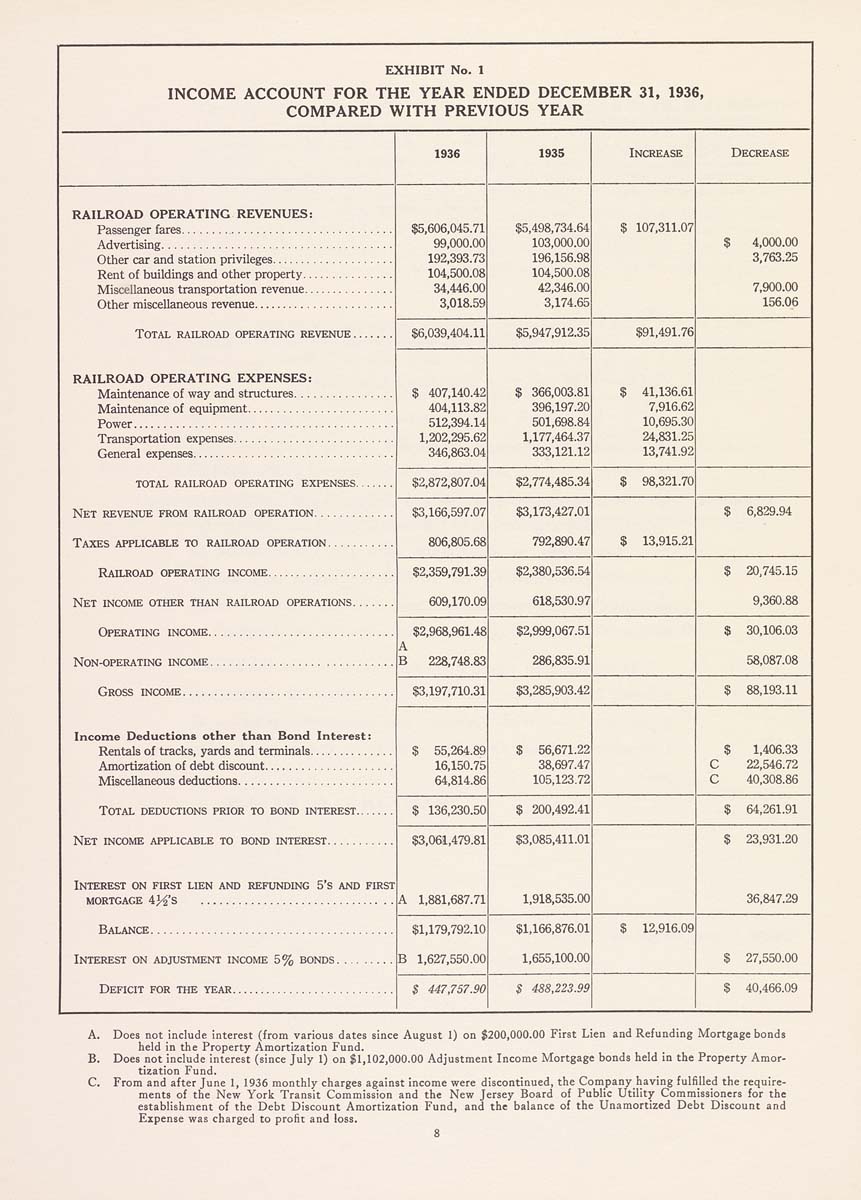

EXHIBIT No. 1

INCOME ACCOUNT FOR THE YEAR ENDED DECEMBER 31, 1936,

COMPARED WITH PREVIOUS YEAR

1936

1935

INCREASE

Decrease

RAILROAD OPERATING REVENUES:

$5,606,045.71

99,000.00

192,393.73

104,500.08

34,446.00

3,018.59

$5,498,734.64

103,000.00

196,156.98

104,500.08

42,346.00

3,174.65

$ 107,311.07

$ 4,000.00

3,763.25

7,900.00

156.06

Total railroad operating revenue.......

RAILROAD OPERATING EXPENSES:

$6,039,404.11

$5,947,912.35

$91,491.76

$ 407,140.42

404,113.82

512,394.14

1,202,295.62

346,863.04

$ 366,003.81

396,197.20

501,698.84

1,177,464.37

333,121.12

$ 41,136.61

7,916.62

10.695.30

24,831.25

13,741.92

TOTAL RAILROAD OPERATING EXPENSES.......

$2,872,807.04

$2,774,485.34

$ 98,321.70

$3,166,597.07

806,805.68

$3,173,427.01

792,890.47

$ 13,915.21

$ 6,829.94

$2,359,791.39

609,170.09

$2,380,536.54

618,530.97

$ 20,745.15

9,360.88

Net INCOME OTHER THAN E.11LR0AD OPERATIONS.......

$2,968,961.48

A

B 228,748.83

$2,999,067.51

286,835.91

$ 30,106.03

58,087.08

$3,197,710.31

$3,285,903.42

$ 88,193.11

Income Deductions other than Bond Interest:

$ 55,264.89

16,150.75

64,814.86

$ 56,671.22

38,697.47

105,123.72

$ 1,406.33

C 22,546.72

C 40.308.86

Total deductions prior to bond interest.......

$ 136,230.50

$ 200,492.41

$ 64,261.91

$3,061,479.81

A 1,881,687.71

$3,085,411.01

1,918,535.00

$ 23,931.20

36.847.29

INTEREST ON FIRST LIEN AND REFUNDING 5'S AND FIRST

$1,179,792.10

B 1,627,550.00

$1,166,876.01

1,655,100.00

$ 12916.09

$ 27,550.00

$ 447,757.90

$ 4S8,223.99

J 40.466.09

Does not include interest {from various dates since August 1) on $200,000.00 First Lien and Refunding Mortgage bonds

held in the Property Amortization Fund.

Does not include interest (since July 1) on $1,102,000.00 Adjustment Income Mortgage bonds held in the Property Amor¬

tization Fund.

From and after June I, J936 monthly charges against income were discontinued, the Company having fulfilled the require¬

ments of the New York Transit Commission and the New Jersey Board of Public Utility Commissioners for the

establishment of the Debt Discount Amortization Fund, and the balance of the Unamortized Debt Discount and

Expense was charged to profit and loss.

|