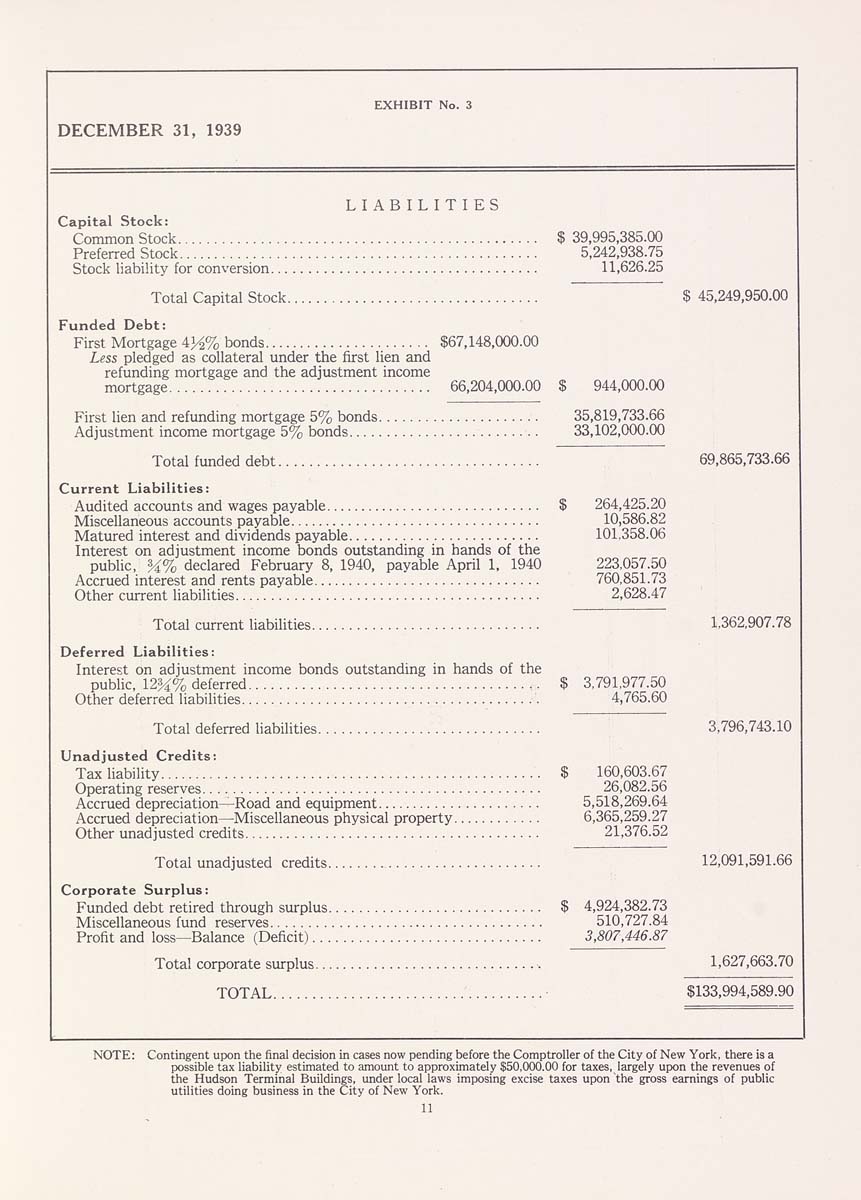

EXHIBIT No,

DECEMBER 31, 1939

LIABILITIES

Capital Stock:

Common Stock............................................... $ 39,995,385.00

Preferred Stock............................................... 5,242,938.75

Stock liability for conversion................................... 11,626.25

Total Capital Stock.................................

Funded Debt;

First Mortgage 4^% bonds...................... $67,148,000.00

Less pledged as collateral under the first lien and

refunding mortgage and the adiustment income

mortgage.................................. 66,204,000.00 $ 944,000.00

First lien and refunding mortgage 5% bonds..................... 35,819,733.66

Adjustment income mortgage 5% bonds......................... 33,102,000.00

Total funded debt..................................

Current Liabilities:

Audited accounts and wages payable............................. $ 264,425.20

MisceUaneous accounts payable................................. 10,586.82

Matured interest and dividends payable......................... 101,358.06

Interest on adjustment income bonds outstanding in hands of the

public, M% declared February 8, 1940, payable April 1, 1940 223,057.50

Accrued interest and rents payable.............................. 760,851.73

Other current liabilities........................................ 2,628.47

Total current liabilities..............................

Deferred Liabilities:

Interest on adjustment income bonds outstanding in hands of the

public, 123^% deferred...................................... $ 3,791,977.50

Other deferred liabilities....................................... 4,765.60

Total deferred liabilities.............................

Unadjusted Credits:

Tax liability.................................................. $ 160,603.67

Operating reserves............................................ 26,082.56

Accrued depreciation—Road and equipment...................... 5,518,269.64

Accrued depreciation—-Miscellaneous physical property............ 6,365,259.27

Other unadjusted credits....................................... 21,376.52

Total unadjusted credits............................

Corporate Surplus:

Funded debt retired through surplus............................ $ 4,924,382.73

Miscellaneous fund reserves.................................... 510,727.84

Profit and loss—Balance (Deficit).............................. 3,807,446.87

Total corporate surplus..............................

TOTAL...................................

; 45,249,950.00

69,865,733.66

1.362,907.78

3,796,743.10

12,091,591.66

1,627,663.70

£133,994,589.90

Contingent upon the final decision in cases now pending before the Comptroller of the City of New York, there is a

possible tax liability estimated to amount to approximately $50,000.00 for taxes, largely upon the revenues of

the Hudson Terminal Buildings, under local laws imposing excise taxes upon "the gross earnings of public

utilities doing business in the City of New York.

11

|