Annual report of Hudson & Manhattan Railroad Company

(New York, N.Y. : Hudson and Manhattan Railroad Company )

|

||

|

|

|

|

| 1940: Page 11 |

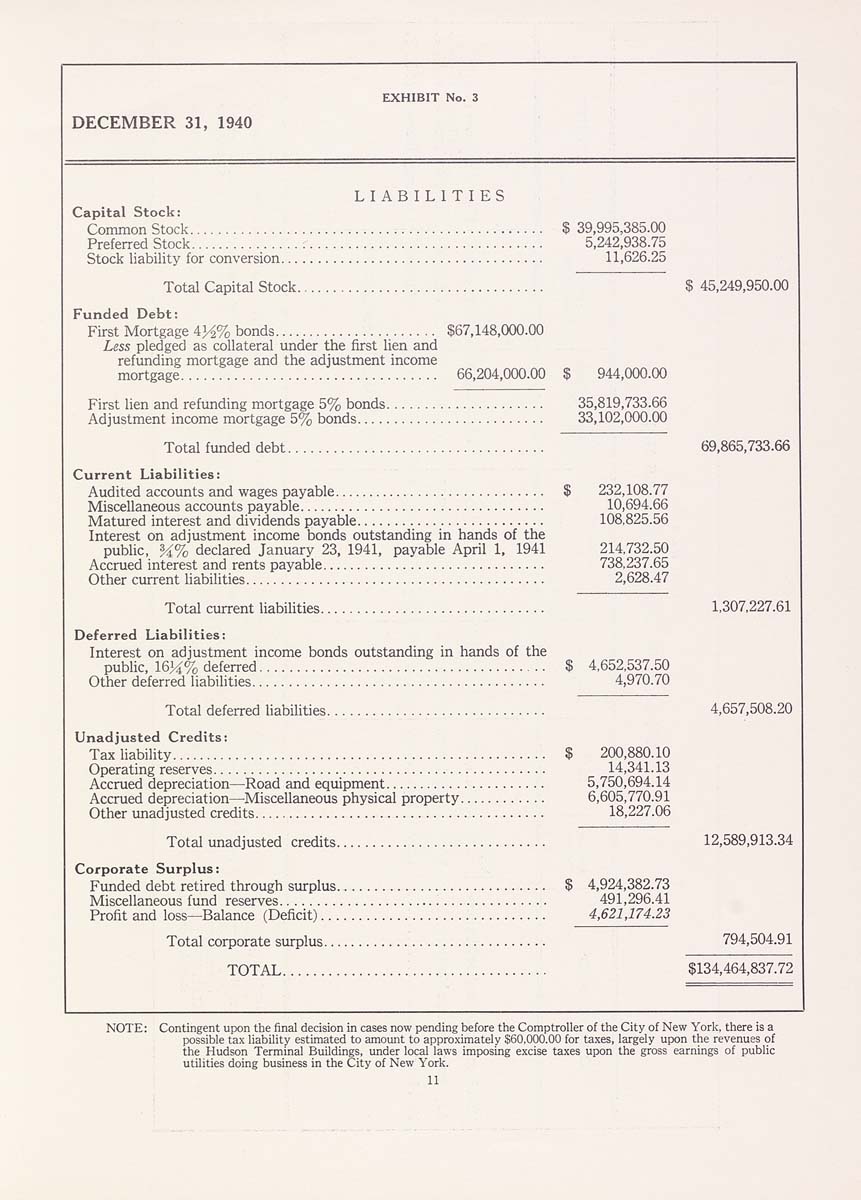

EXHIBIT No. 3 DECEMBER 31, 1940 LIABILITIES Capital Stock: Common Stock............................................... $ 39,995,385.00 Preferred Stock............................................... 5,242,938.75 Stock liability for conversion................................... 11,626.25 Total Capital Stock................................. $ 45,249,950.00 Funded Debt; First Mortgage 4^% bonds...................... $67,148,000.00 Less pledged as collateral under the first lien and refunding mortgage and the adjustment income mortgage.................................. 66,204,000.00 £ 944,000.00 First hen and refunding mortgage 5% bonds..................... 35,819,733.66 Adjustment income mortgage 5% bonds......................... 33,102,000.00 Total funded debt.................................. 69,865,733.66 Current Liabilities: Audited accounts and wages payable............................. $ 232,108.77 Miscellaneous accounts payable................................. 10,694.66 Matured interest and dividends payable......................... 108,825.56 Interest on adjustment income bonds outstanding in hands of the public, H% declared January 23, 1941, payable April 1, 1941 214,732.50 Accrued interest and rents payable.............................. 738,237.65 Other current liabilities........................................ 2,628.47 Total current liabilities.............................. 1.307,227.61 Deferred Liabilities: Interest on adjustment income bonds outstanding in hands of the public, l6^A7o deferred...................................... $ 4,652,537.50 Other deferred liabilities....................................... 4,970.70 Total deferred liabilities............................. 4,657,508.20 Unadjusted Credits: Tax habiiity.................................................. $ 200,880.10 Operating reserves............................................ 14,341.13 Accrued depreciation—Road and equipment...................... 5,750,694.14 Accrued depreciation—-Miscellaneous physical property............ 6,605,770.91 Other unadjusted credits....................................... 18,227.06 Totai unadjusted credits............................ 12,589,913.34 Corporate Surplus: Funded debt retired through surplus............................ $ 4,924,382.73 Miscellaneous fund reserves.................................... 491,296.41 Profit and loss—Balance (Deficit).............................. 4,621,174.23 Total corporate surplus.............................. 794,504.91 TOTAL................................... $134,464,837.72 Contingent upon the final decision in cases now pending before the Comptroller of the City of New York, there is a possible tax liability estimated to amount to approximately $60,000.00 for taxes, largely upon the revenues of the Hudson Terminal Buildings, under local laws imposing excise taxes upon the gross earnings of public utilities doing business in the City of New York. 11 |

| 1940: Page 11 |