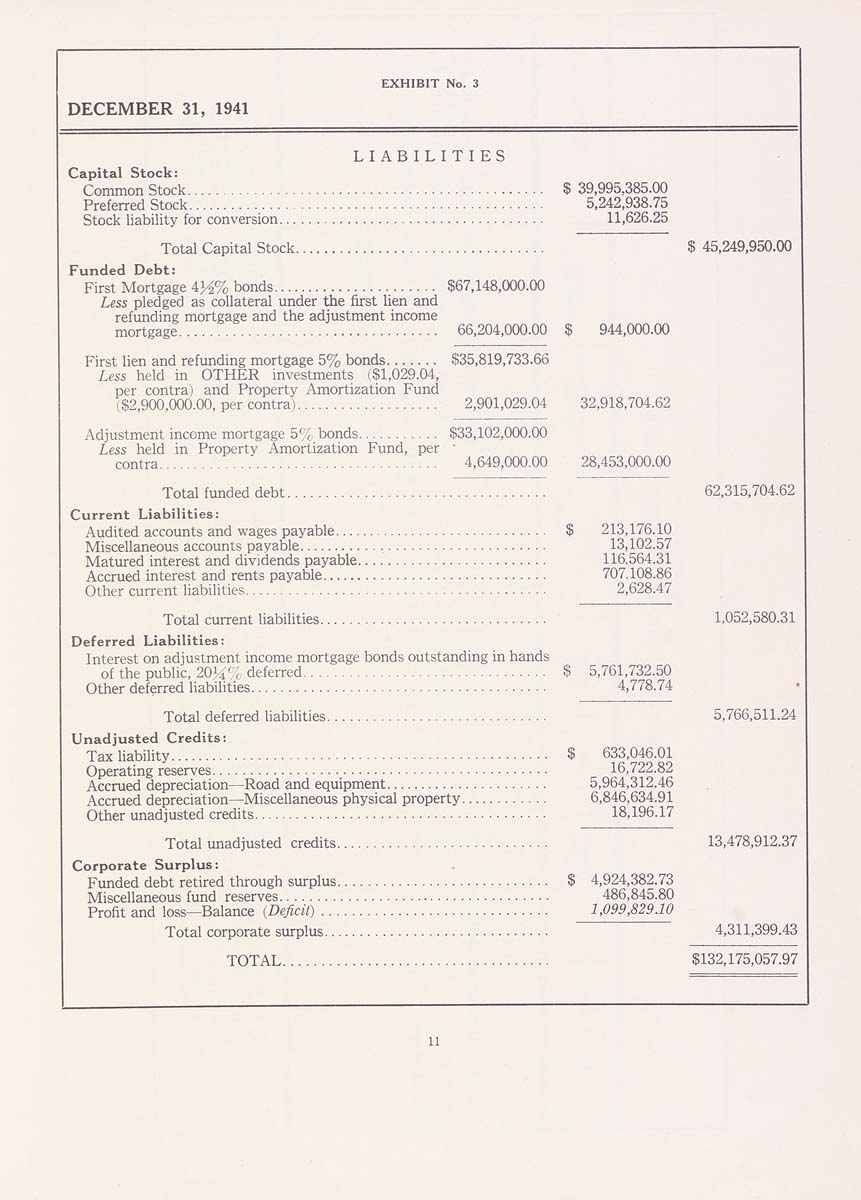

EXHIBIT No. 3

DECEMBER 31, 1941

LIABILITIES

Capital Stock:

Common Stock............................................... $ 39,995,385.00

Preferred Stock............................................... 5,242,938.75

Stock liability for conversion................................... 11,626.25

Total Capita! Stock................................. $ 45,249,950.00

Funded Debt:

First Mortgage 4}^% bonds...................... $67,148,000.00

Less pledged as collateral under the first lien and

refunding mortgage and the adjustment income

mortgage.................................. 66,204,000.00 $ 944,000.00

First lien and refunding mortgage 5% bonds....... $35,819,733.66

Less held in OTHER investments ($1,029.04,

per contra) and Property Amortization Fund

($2,900,000.00, per contra)................... 2,901,029.04 32,918,704.62

Adjustment income mortgage 5% bonds........... $33,102,000.00

Less held in Property Amortization Fund, per '

contra..................................... 4,649,000.00 28,453,000.00

Total funded debt.................................. 62,315,704.62

Current Liabilities:

Audited accounts and wages payable............................. $ 213,176.10

Miscellaneous accounts payable................................. 13,102.57

Matured interest and dividends payable......................... 116,564.31

Accrued interest and rents payable.............................. 707,108.86

Other current liabilities........................................ 2,628.47

Total current liabilities.............................. 1,052,580.31

Deferred Liabilities:

Interest on adjustment income mortgage bonds outstanding in hands

of the public, 203^':^ deferred................................ $ 5,761,732.50

Other deferred liabilities....................................... 4,778.74

Total deferred liabilities............................. 5,766,511.24

Unadjusted Credits:

Tax liability.................................................. $ 633.046.01

Operating reserves............................................ 16,722.82

Accrued depreciation—Road and equipment...................... 5,964,312.46

Accrued depreciation—Miscellaneous physical property............ 6,846,634.91

Other unadjusted credits....................................... 18,196.17

Total unadjusted credits............................ 13,478,912.37

Corporate Surplus:

Funded debt retired through surplus............................ $ 4,924,382.73

Miscellaneous fund reserves.................................... 486,845.80

Profit and loss—Balance (Deficil).............................. 1,099,829.10

Total corporate surplus.............................. 4,311,399.43

TOTAL................................... $132,175,057.97

|