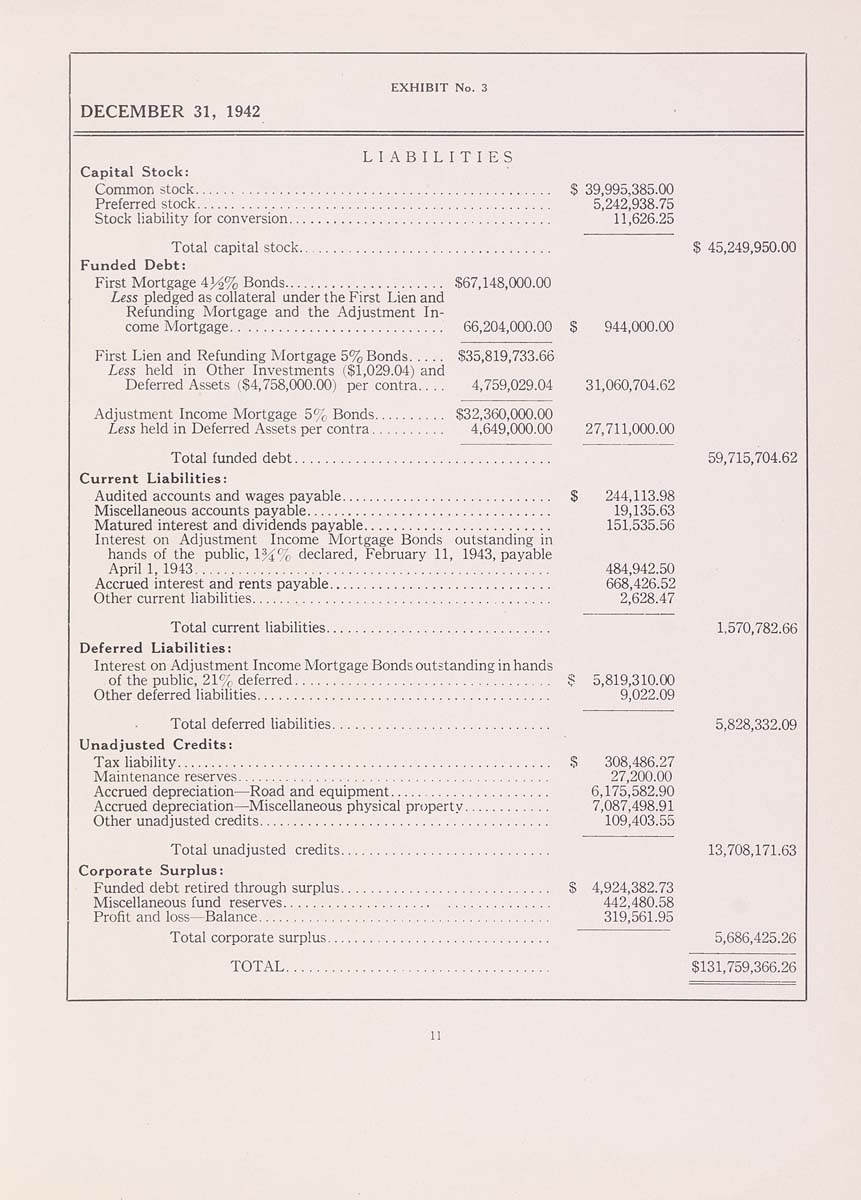

EXHIBIT No,

DECEMBER 31, 1942

LIABILITIES

Capital Stock;

Common stock............................................... $ 39,995,385.00

Preferred stock............................................... 5,242,938.75

Stock liability for conversion................................... 11,626.25

Total capital stock................................. $ 45,249,950.00

Funded Debt:

First Mortgage 4H% Bonds...................... .$67,148,000.00

Less pledged as collateral under the First Lien and

Refunding Mortgage and the Adjustment In¬

come Mortgage............................ 66,204,000.00 $ 944,000.00

First Lien and Refunding Mortgage 5% Bonds..... $35,819,733.66

Less held in Other Investments ($1,029.04) and

Deferred Assets ($4,758,000.00) per contra.. . . 4,759,029,04 31,060,704,62

Adjustment Income Mortgage 5% Bonds.......... $32,360,000,00

Less held in Deferred Assets per contra.......... 4,649,000.00 27,711,000,00

Total funded debt.................................. 59,715,704.62

Current Liabilities:

Audited accounts and wages payable............................. S 244,113.98

Miscellaneous accounts payable................................. 19,135.63

Matured interest and dividends payable......................... 151,535,56

Interest on Adjustment Income Mortgage Bonds outstanding in

hands of the public, IK'( declared, February 11, 1943, payable

April 1, 1943................................................. 484,942,50

Accrued interest and rents payable.............................. 668,426.52

Other current liabilities........................................ 2,628.47

Total current liabilities.............................. 1,570,782.66

Deferred Liabilities:

Interest on Adjustment Income Mortgage Bonds outstanding in hands

of the public, 21% deferred................................. 5 5,819,310.00

Other deferred liabilities....................................... 9,022.09

Total deferred liabilities............................. 5,828,332,09

Unadjusted Credits:

Tax liability.................................................. .$ 308,486.27

Maintenance reserves.......................................... 27,200.00

Accrued depreciation—Road and equipment...................... 6,175,582.90

Accrued depreciation—MisceUaneous physical property............ 7,087,498.91

Other unadjusted credits....................................... 109,403.55

Total unadjusted credits............................ 13,708,171.63

Corporate Surplus:

Funded debt retired through surplus............................ $ 4,924,382.73

Miscellaneous fund reserves.................................. 442,480.58

Profit and loss—Balance....................................... 319,561.95

Total corporate surplus.............................. 5,686,425.26

TOTAL................................... $131,759,366.26

|