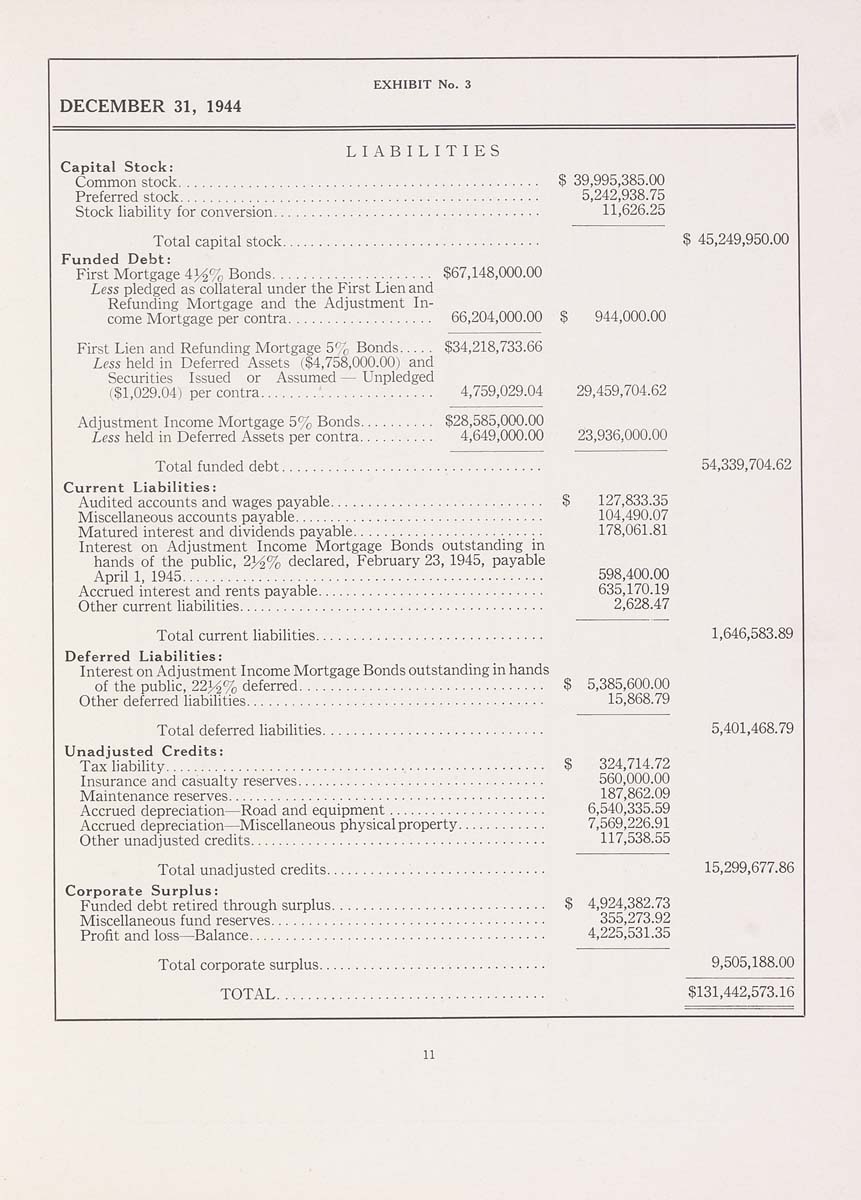

EXHIBIT No. 3

DECEMBER 31, 1944

LIABILITIES

Capital Stock:

Common stock............................................... $ 39,995,385.00

Preferred stock............................................... 5,242,938.75

Stock liability for conversion................................... 11,626.25

Total capital stock.................................. $ 45,249,950.00

Funded Debt;

First Mortgage 4A% Bonds..................... $67,148,000.00

Less pledged as collateral under the First Lien and

Refunding Mortgage and the Adjustment In¬

come Mortgage per contra................... 66,204,000.00 $ 944,000.00

First Lien and Refunding Mortgage 5% Bonds..... $34,218,733.66

Less held in Deferred Assets ($4,758,000.00) and

Securities Issued or Assumed — Unpledged

($1,029.04) per contra........'............... 4,759,029.04 29,459,704.62

Adjustment Income Mortgage 5% Bonds.......... $28,585,000.00

Less held in Deferred Assets per contra.......... 4,649,000.00 23,936,000.00

Total funded debt.................................. 54,339,704.62

Current Liabilities:

Audited accounts and wages payable............................ $ 127,833.35

Miscellaneous accounts payable................................. 104,490.07

Matured interest and dividends payable......................... 178,061.81

Interest on Adjustment Income Mortgage Bonds outstanding in

hands of the public, 2A% declared, February 23, 1945, payable

April 1, 1945................................................ 598,400.00

Accrued interest and rents payable.............................. 635,170.19

Other current liabihties........................................ 2,628.47

Total current habihties.............................. 1,646,583.89

Deferred Liabilities:

Interest on Adjustment Income Mortgage Bonds outstanding in hands

of the public, 22K% deferred................................ $ 5,385,600.00

Other deferred habihties....................................... 15,868.79

Total deferred liabilities............................. 5,401,468.79

Unadjusted Credits;

Tax liability.................................................. $ 324,714.72

Insurance and casualty reserves................................. 560,000.00

Maintenance reserves.......................................... 187,862.09

Accrued depreciation—Road and equipment..................... 6,540,335.59

Accrued depreciation—Miscellaneous physical property............ 7,569,226.91

Other unadjusted credits....................................... 117,538.55

Total unadjusted credits............................. 15,299,677.86

Corporate Surplus:

Funded debt retired through surplus............................ $ 4,924,382.73

Miscellaneous fund reserves.................................... 355,273.92

Profit and loss—Balance....................................... 4,225,531.35

Total corporate surplus.............................. 9,505,188.00

TOTAL................................... $131,442,573.16

|