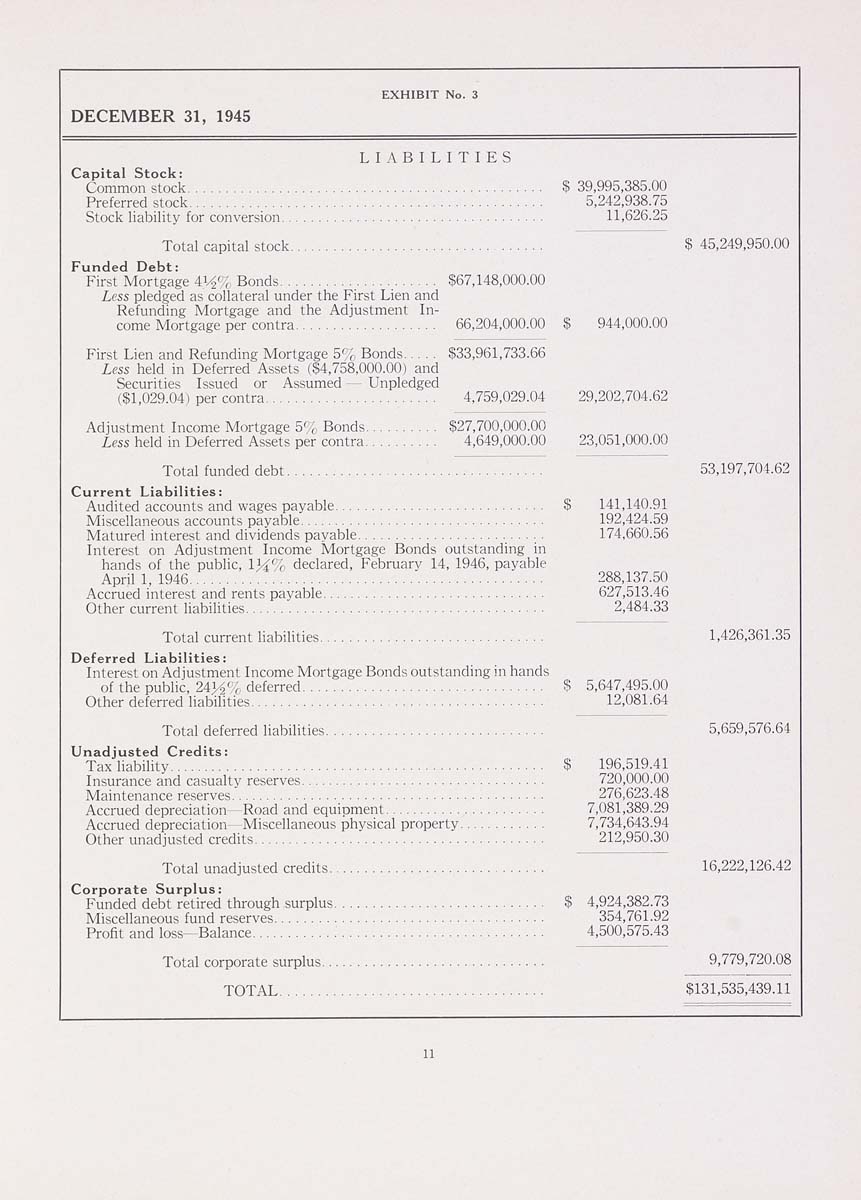

EXHIBIT No

DECEMBER 31, 1945

L I A B I L I T I E S

Capital Stock:

Common stock............................................... $ 39,995,385.00

Preferred stock............................................... 5,242,938.75

Stock liability for conversion................................... 11,626.25

Total capital stock................................. $ 45,249,950.00

Funded Debt;

First Mortgage 41^% Bonds..................... $67,148,000.00

Less pledged as collateral under the First Lien and

Refunding Mortgage and the Adjustment In¬

come Mortgage per contra................... 66,204,000.00 $ 944,000.00

First Lien and Refunding Mortgage 5% Bonds..... $33,961,733.66

Less held in Deferred Assets ($4,758,000.00) and

Securities Issued or Assumed — Unpledged

($1,029.04) per contra....................... 4,759,029.04 29,202,704.62

Adjustment Income Mortgage 5% Bonds.......... $27,700,000.00

Less held in Deferred Assets per contra.......... 4,649,000.00 23,051,000.00

Total funded debt.................................. 53,197,704.62

Current Liabilities:

Audited accounts and wages payable............................ S 141,140.91

Miscellaneous accounts payable................................. 192,424.59

Matured interest and dividends payable......................... 174.660.56

Interest on Adjustment Income Mortgage Bonds outstanding in

hands of the public, 1H% declared, February 14, 1946, payable

April 1, 1946............................................... 288,137.50

Accrued interest and rents payable.............................. 627,513.46

Other current liabiHties........................................ 2,484.33

Total current liabilities.............................. 1,426,361.35

Deferred Liabilities:

Interest on Adjustment Income Mortgage Bonds outstanding in hands

of the public, 24K% deferred................................ S 5,647,495.00

Other deferred liabilities....................................... 12,081.64

Total deferred liabilities............................. 5,659,576.64

Unadjusted Credits:

Tax liability.................................................. $ 196,519.41

Insurance and casualty reserves................................. 720,000.00

Maintenance reserves.......................................... 276,623.48

Accrued depreciation—Road and equipment...................... 7,081,389.29

Accrued depreciation—Miscellaneous physical property............ 7,734,643.94

Other unadjusted credits....................................... 212,950.30

Total unadjusted credits............................. 16,222,126.42

Corporate Surplus:

Funded debt retired through surplus............................ $ 4,924,382.73

Miscellaneous fund reserves.................................... 354,761.92

Profit and loss—Balance....................................... 4,500,575.43

Total corporate surplus.............................. 9,779,720.08

TOTAL................................... $131,535,439.11

|