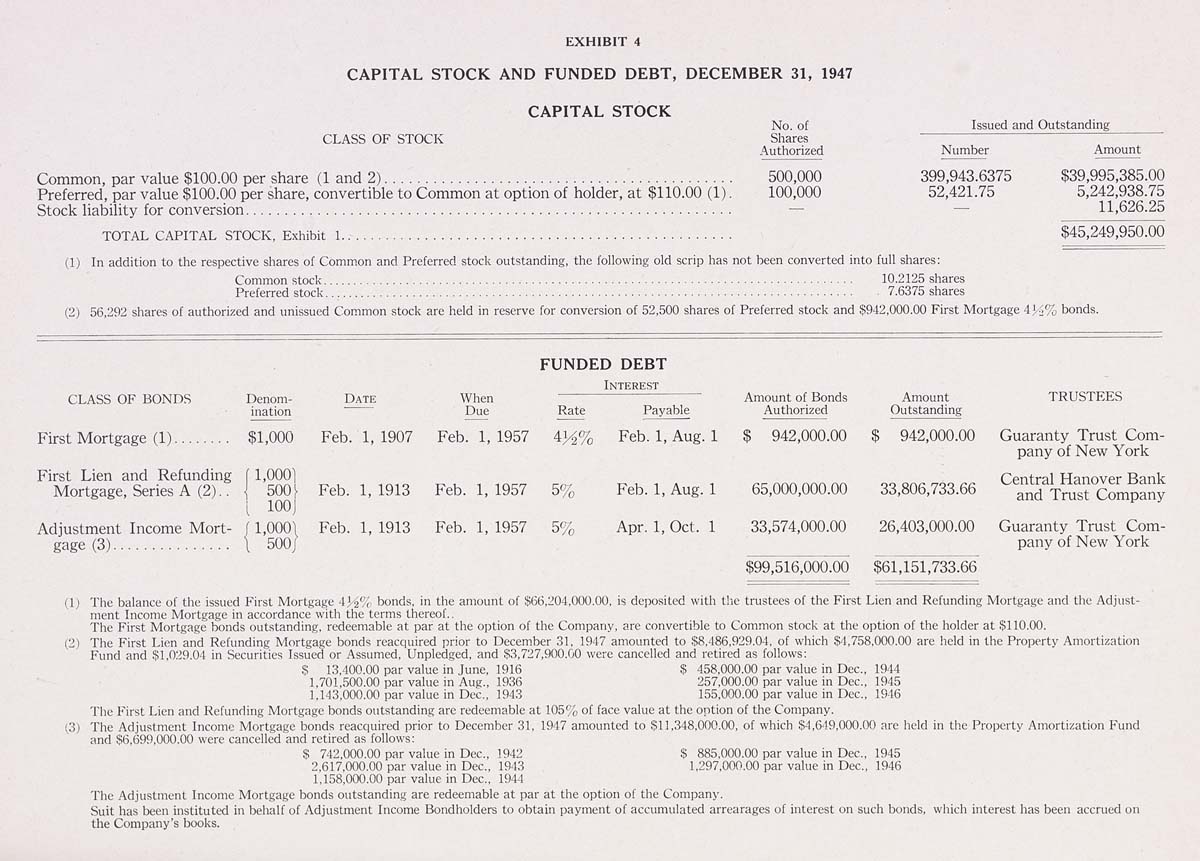

EXHIBIT 4

CAPITAL STOCK AND FUNDED DEBT, DECEMBER 31, 1947

CAPITAL STOCK

No. of _______Issued and Outstanding_______

CLASS OF STOCK Shares

■Authorized Number Amount

Common, par value $100.00 per share (1 and 2)........................................... 500,000 399,943.6375 $39,995,385.00

Preferred, par value $100.00 per share, convertible to Common at option of holder, at $110.00 (1). 100,000 52,421.75 5,242,938.75

Stock liability for conversion............................................................ — — 11,626.25

TOTAL CAPITAL STOCK, Exhibit I................................................. $45,249,950.00

(1) In addition to the respective shares of Common and Preferred stoclv outstanding, the following old scrip has not been converted into full shares:

Common stock................................................................................. 10.2125 shares

Preferred stock................................................................................. 7.6375 shares

(2) 56,292 shares of authorized and unissued Common stock arc held in reserve for conversion of 52,500 shares of Preferred stock and $942,000.00 First Mortgage -iy.% bonds.

FUNDED DEBT

CLASS OF BONDS

Denom¬

ination

When

Due

Amount of Bonds

Authorized

Amount

Outstanding

First Mortgage (1)........ $1,000 Feb. 1, 1907 Feb. 1, 1957 4)4% Feb. 1, Aug. 1 $ 942,000.00 $ 942,000.00 Guaranty Trust Com¬

pany of New York

First Lien and Refunding f 1,000] Central Hanover Bank

Mortgage, Series A (2).. ] 500J Feb. 1, 1913 Feb. 1, 1957 5% Feb. 1, Aug. 1 65,000,000.00 33,806,733.66 aS Trust Comoanv

[ lOOJ

Adjustment Income Mort- /1,0001 Feb. 1, 1913 Feb. 1, 1957 5% Apr. 1, Oct. 1 33,574,000.00 26,403,000.00 Guaranty Trust Com-

gage (3)............... 1 500/ pany of New York

$99,516,000.00 $61,151,733.66

(0 The balance of the issued First Mortgage 4li% bonds, in the amount of $66,204,000.00, is deposited with the trustees of the First Lien and Refunding Mortgage and the Adjust¬

ment Income Mortgage in accordance with the terms thereof.,

The First Mortgage bonds outstanding, redeemable at par at the option of the Company, are convertible to Common stock at the option of the holder at SI 10.00.

(2) The First Lien and Refunding Mortgage bonds reacquired prior to December 31, 1947 amounted to $8,486,929.04, of which .$4,758,000.00 are held in the Property Amortization

Fund and $1,029.04 in Securities Issued or Assumed. Unpledged, and $3,727,900.00 were cancelled and retired as follows:

$ 13,400.00 par value in June, I9I6 $ 458,000.00 par value in Dec, 1944

1,701,500.00 par value in Aug., 1936 257,000.00 par value in Dec, 1945

1,143,000.00 par value in Dec, 1943 155,000.00 par value in Dec, 19.16

Tlie First Lien and Refunding Mortgage bonds outstanding arc redeemable at 105% of face value at the option of the Company.

',3) The Adjustment Income Mortgage bonds reacquired prior to December 31, 1947 amounted to $11,348,000.00, of which $4,649,000.00 are held in the Property Amortization Fund

and $6,699,000.00 were cancelled and retired as follows:

$ 742,000.00 par value in Dec, 1942 8 885,000.00 par value in Dec, 1945

2,617,000.00 par value in Dec, 1943 1,297,000.00 par value in Dec, 1946

1,158,000.00 par value in Dec, 1944

The .Adjustment Income Mortgage bonds outstanding are redeemable at par at the option of the Company.

Suit has been instituted in behalf of Adjustment Income Bondholders to obtain payment of accumulated arrearages of interest on such bonds, which interest has been accrued on

the Company's books.

|