Hudson & Manhattan Railroad Company

1948 Annual Report

Exchange Place. Nevertheless, on July 7, 1948,

the Commission, with two members dissenting,

rejected the examiner's report and refused to

change the existing divisions. It held that the

Increased share recommended for the Company

by the examiner would result in a return to the

Pennsylvania on its Investment in the joint

service "lower than the circumstances warrant",

that the benefits to the Pennsylvania from its

use of the Company's facilities are "largely, if

not entirely, offset by the benefits flowing to the

Company from the same operations", and that

it would not assume the financial need of the

Company to be any greater than that of the

Pennsylvania. On September 15, 1948 the Com¬

pany petitioned for reconsideration of the Com¬

mission's decision and this petition was denied

without any written opinion on January 3, 1949.

Counsel for the Company are reviewing the

entire record of the case with a view to filing a

further petition for relief. Consideration is also

being given to a possible petition for an increase

in the joint service fares themselves as distinct

from the Company's division thereof.

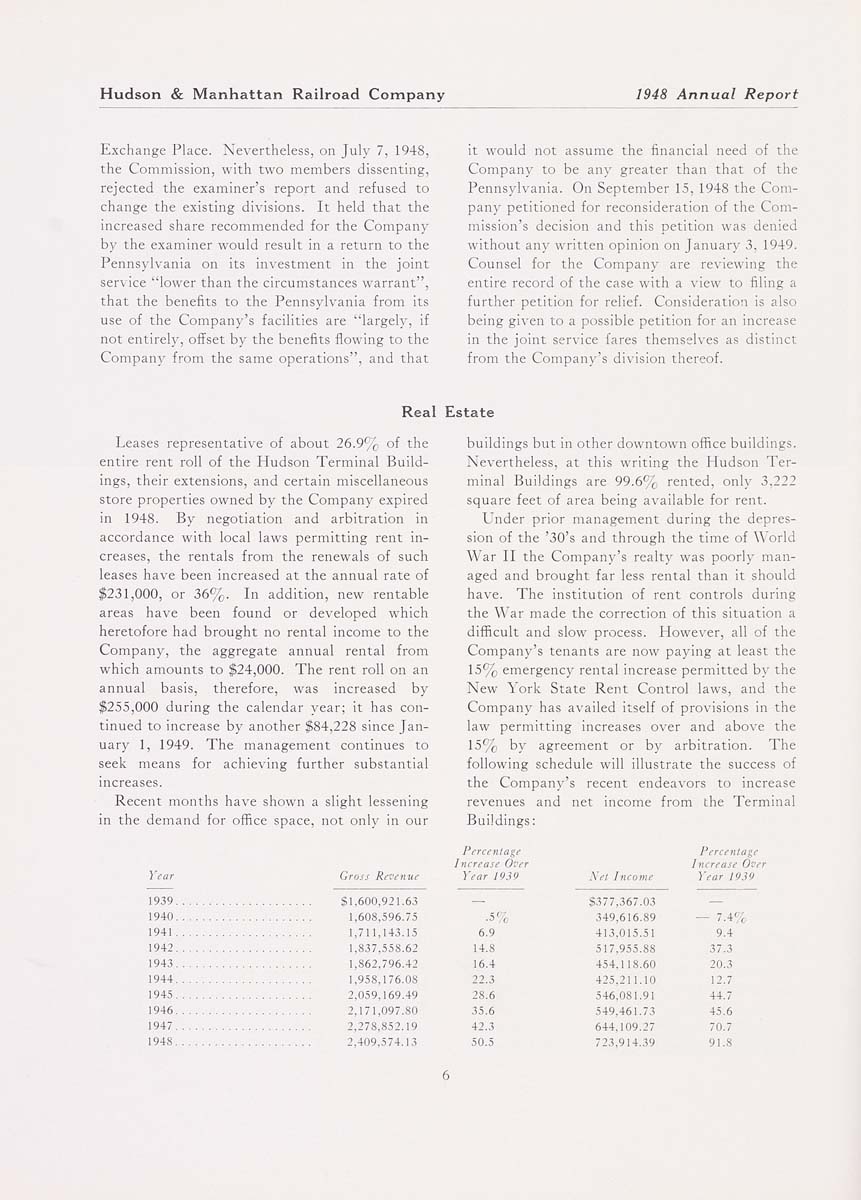

Real Estate

Leases representative of about 26.9% of the

entire rent roll of the Hudson Terminal Build¬

ings, their extensions, and certain miscellaneous

store properties owned by the Company expired

in 1948. By negotiation and arbitration in

accordance with local laws permitting rent in¬

creases, the rentals from the renewals of such

leases have been increased at the annual rate of

$231,000, or 36%. In addition, new rentable

areas have been found or developed which

heretofore had brought no rental income to the

Company, the aggregate annual rental from

which amounts to $24,000. The rent roll on an

annual basis, therefore, was increased by

$255,000 during the calendar year; it has con¬

tinued to increase by another $84,228 since Jan¬

uary 1, 1949. The management continues to

seek means for achieving further substantial

increases.

Recent months have shown a slight lessening

in the demand for office space, not only in our

buildings but in other downtown office buildings.

Nevertheless, at this writing the Hudson Ter¬

minal Buildings are 99.6% rented, only 3,222

square feet of area being available for rent.

Under prior management during the depres¬

sion of the '30's and through the time of World

W^ar II the Company's realty was poorly man¬

aged and brought far less rental than it should

have. The Institution of rent controls during

the War made the correction of this situation a

difficult and slow process. However, all of the

Company's tenants are now paying at least the

15% emergency rental increase permitted by the

New York State Rent Control laws, and the

Company has availed itself of provisions in the

law permitting Increases over and above the

15% by agreement or by arbitration. The

following schedule will illustrate the success of

the Company's recent endeavors to increase

revenues and net income from the Terminal

Buildings:

Year

1939.

1940.

1941,

1942.

1943.

1944.

1945.

1946.

1947..

1948.,

Perceiiiagr

Increase Over

Percentage

Increase Over

Gross Revenue

Year 1939

Net Income

Year 1939

51,600,921.63

—

£377,367,03

—

1

608,596.75

-5%

349,616,89

— '■-4%

1

711,143.15

6.9

413,015,51

9.4

1

837,558.62

14.8

517,955,88

37.3

1

862,796.42

16.4

454,118,60

20.3

1

958.176.08

22,3

425,211.10

12.7

2

059,169.49

28,6

546,081.91

44.7

2

171,097.80

35.6

549,461.73

45.6

2

278,852.19

42,3

644,109.27

70.7

2

409,574.13

50.5

723,914.39

91.8

|