Annual report of Hudson & Manhattan Railroad Company

(New York, N.Y. : Hudson and Manhattan Railroad Company )

|

||

|

|

|

|

| 1948: Page 10 |

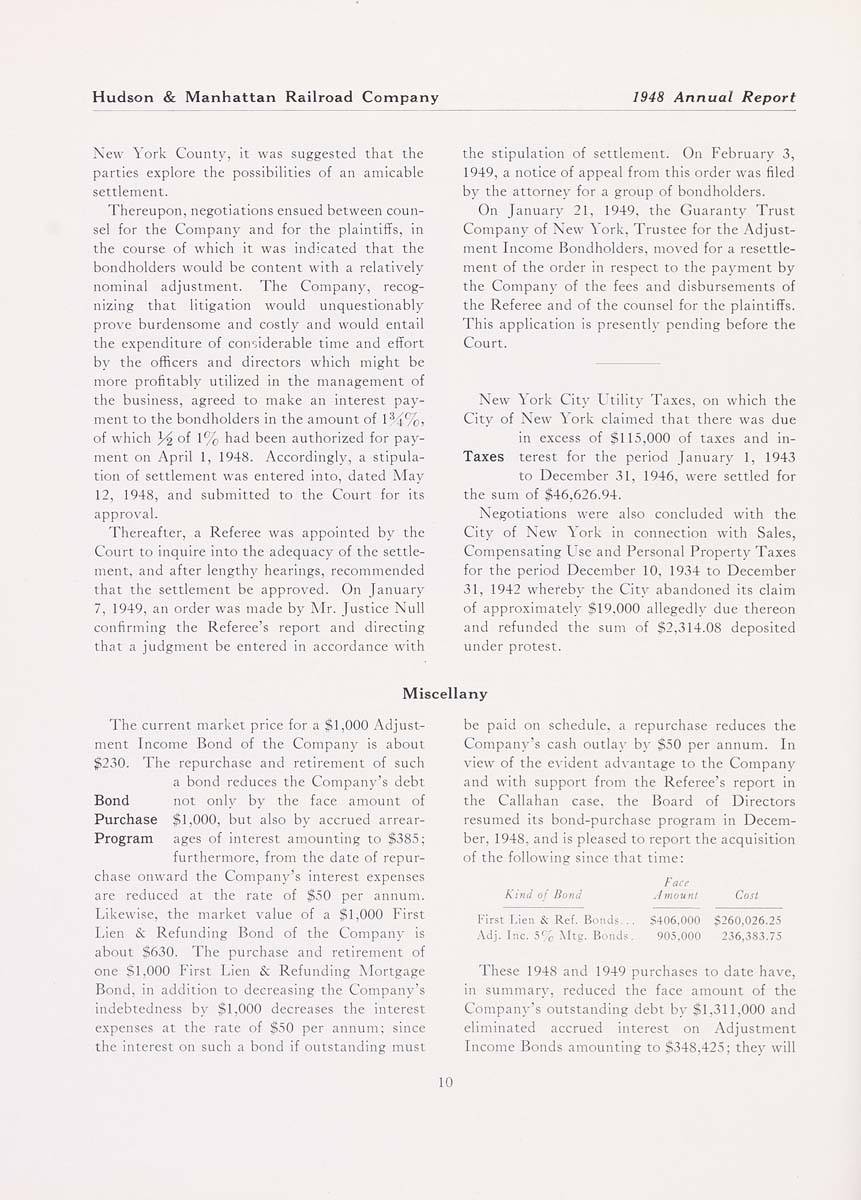

Hudson & Manhattan Railroad Company 1948 Annual Report New York County, it was suggested that the parties explore the possibilities of an amicable settlement. Thereupon, negotiations ensued between coun¬ sel for the Company and for the plaintiffs, in the course of which it was indicated that the bondholders would be content with a relatively nominal adjustment. The Company, recog¬ nizing that litigation would unquestionably prove burdensome and costly and would entail the expenditure of considerable time and effort by the officers and directors which might be more profitably utilized in the management of the business, agreed to make an interest pay¬ ment to the bondholders in the amount of 1^%, of which 3^ of 1% had been authorized for pay¬ ment on April 1, 1948. Accordingly, a stipula¬ tion of settlement was entered into, dated May 12, 1948, and submitted to the Court for its approval. Thereafter, a Referee was appointed by the Court to inquire Into the adequacy of the settle¬ ment, and after lengthy hearings, recommended that the settlement be approved. On January 7, 1949, an order was made by Mr. Justice Null confirming the Referee's report and directing that a judgment be entered in accordance with the stipulation of settlement. On February 3, 1949, a notice of appeal from this order was filed by the attorney for a group of bondholders. On Januar>' 21, 1949, the Guaranty Trust Company of New \ ork. Trustee for the Adjust¬ ment Income Bondholders, moved for a resettle¬ ment of the order in respect to the payment by the Company of the fees and disbursements of the Referee and of the counsel for the plaintiffs. This application is presently pending before the Court. New \ ork City Ltility Taxes, on which the City of New York claimed that there was due in excess of $115,000 of taxes and in- Taxes tcrest for the period January 1, 1943 to December 31. 1946, were settled for the sum of $46,626.94. Negotiations were also concluded with the City of New ^ork in connection with Sales, Compensating Use and Personal Property Taxes for the period December 10, 1934 to December 31, 1942 whereby the City abandoned its claim of approxlmateh^ $19,000 allegedly due thereon and refunded the sum of S2,314.08 deposited under protest. Miscellany The current market price for a $1,000 Adjust¬ ment Income Bond of the Company is about $230. The repurchase and retirement of such a bond reduces the Company's debt Bond not only by the face amount of Purchase $1,000, but also by accrued arrear- Program ages of interest amounting to $385; furthermore, from the date of repur¬ chase onward the Company's interest expenses are reduced at the rate of $50 per annum. Likewise, the market value of a $1,000 First Lien & Refunding Bond of the Company Is about $630. The purchase and retirement of one $1,000 First Lien & Refunding Mortgage Bond, in addition to decreasing the Company's Indebtedness by $1,000 decreases the interest expenses at the rate of $50 per annum; since the interest on such a bond if outstanding must be paid on schedule, a repurchase reduces the Company's cash outia\- by $50 per annum. In view of the e\'ident advantage to the Company and with support from the Referee's report in the Callahan case, the Board of Directors resumed its bond-purchase program in Decem¬ ber, 1948, and is pleased to report the acquisition of the following since that time: Face Kind 01 Bond First Lie Adj. Inc, & Ref. Bonds-. 5% Mte. Bonds .Im 5406,000 905,000 Cost 5260,026.25 236,383.75 These 1948 and 1949 purchases to date have, in summary, reduced the face amount of the Company's outstanding debt b\' $1,311,000 and eliminated accrued interest on Adjustment Income Bonds amounting to S348,425; they will |

| 1948: Page 10 |