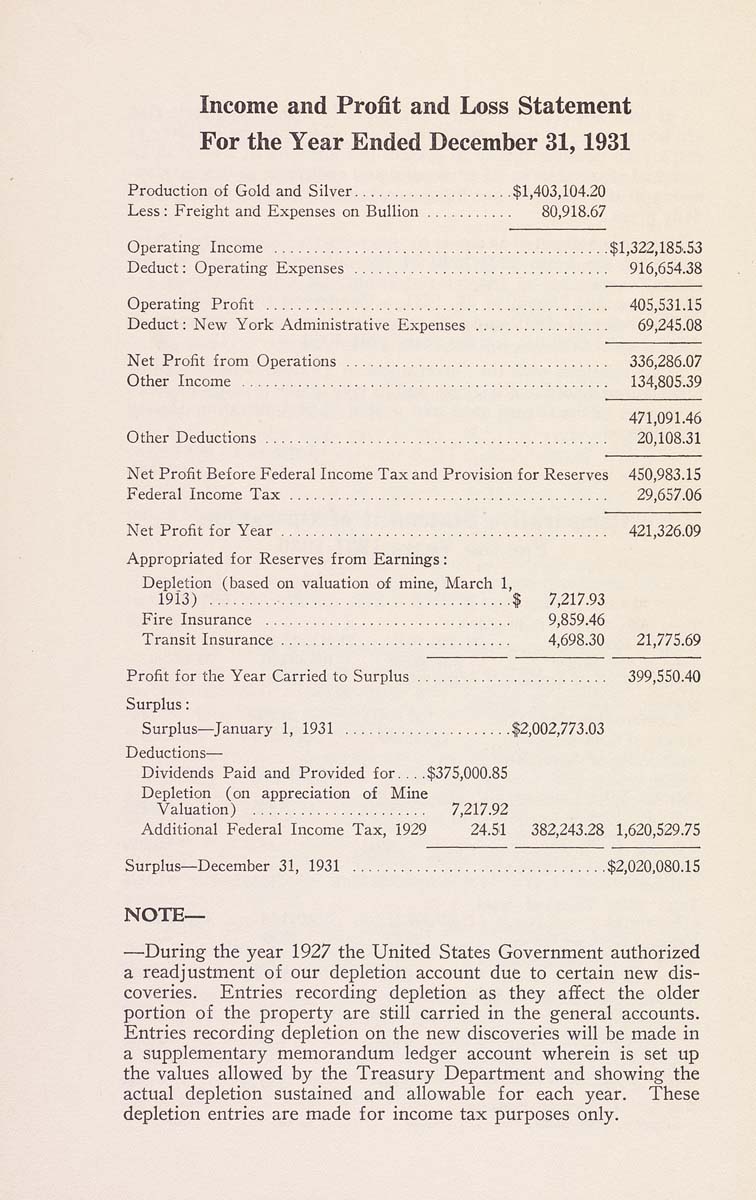

Income and Profit and Loss Statement

For the Year Ended December 31,1931

Production of Gold and Silver....................$1,403,104.20

Less: Freight and Expenses on Bullion........... 80,918.67

Operating Income ..........................................$1,322,185.53

Deduct: Operating Expenses ................................ 916,654.38

Operating Profit ........................................... 405,531.15

Deduct: New York Administrative Expenses ................. 69,245.08

Net Profit from Operations ................................. 336,286.07

Other Income .............................................. 134,805,39

471,091,46

Other Deductions ........................................... 20,108,31

Net Profit Before Federal Income Tax and Provision for Reserves 450,983,15

Federal Income Tax ........................................ 29,657,06

Net Profit for Year......................................... 421,326,09

Appropriated for Reserves from Earnings :

Depletion (based on valuation of mine, March 1,

1913) ......................................$ 7,217,93

Fire Insurance ............................... 9,859,46

Transit Insurance............................. 4,698,30 21,775,69

Profit for the Year Carried to Surplus........................ 399,550.40

Surplus:

Surplus—January 1, 1931 .....................$2,002,773.03

Deductions—

Dividends Paid and Provided for. . . .$375,000.85

Depletion (on appreciation of Mine

Valuation) ...................... 7,217.92

Additional Federal Income Tax, 1929 24.51 382,243.28 1,620,529.75

Surplus—December 31, 1931 ................................$2,020,080,15

NOTE—

—During the year 1927 the United States Government authorized

a readjustment of our depletion account due to certain new dis¬

coveries. Entries recording depletion as they affect the older

portion of the property are still carried in the general accounts.

Entries recording depletion on the new discoveries will be made in

a supplementary memorandum ledger account wherein is set up

the values allowed by the Treasury Department and showing the

actual depletion sustained and allowable for each year. These

depletion entries are made for income tax purposes only.

|