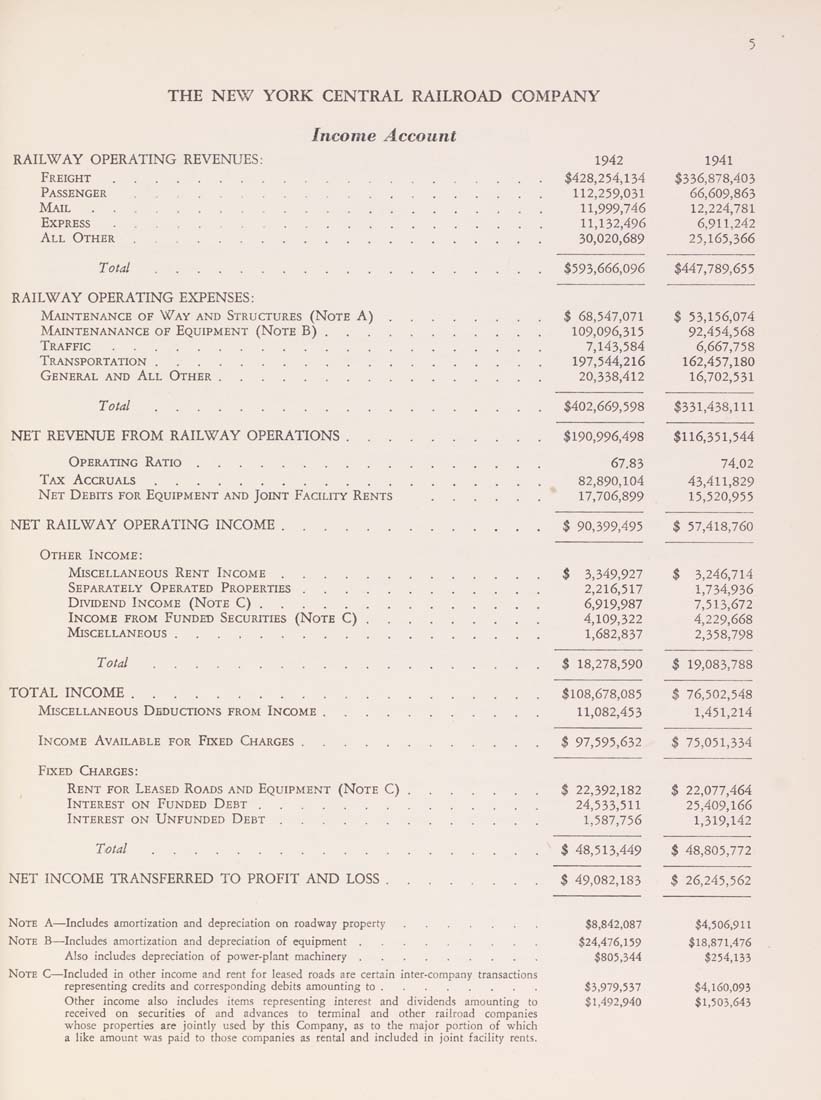

THE NEW YORK CENTRAL RAILROAD COMPANY

Income Account

RAILWAY OPERATING REVENUES: 1942 1941

Freight..................... $428,254,134 $336,878,403

Passenger .................... 112,259,031 66,609,863

Mail...................... 11,999,746 12,224,781

Express . . ..................... 11,132,496 6,911,242

All Other.................... 30,020,689 25,165,366

Total...................$593,666,096 $447,789,655

RAILWAY OPERATING EXPENSES:

Maintenance of Way and Structures (Note A)........ $ 68,547,071 $ 53,156,074

Maintenanance of Equipment (Note B)........... 109,096,315 92,454,568

Traffic..................... 7,143,584 6,667,758

Transportation................... 197,544,216 162,457,180

General and All Other................ 20,338,412 16,702,531

Total...................$402,669,598 $331,438,111

NET REVENUE FROM RAILWAY OPERATIONS.......... $190,996,498 $116,351,544

Operating Ratio................. 67.83 74.02

Tax Accruals................... 82,890,104 43,411,829

Net Debits for Equipment and Joint Facility Rents ...... 17,706,899 15,520,955

NET RAILWAY OPERATING INCOME.............$ 90,399,495 $ 57,418,760

Other Income:

Miscellaneous Rent Income............. $ 3,349,927 $ 3,246,714

Separately Operated Properties............ 2,216,517 1,734,936

Dividend Income (Note C).............. 6,919,987 7,513,672

Income from Funded Securities (Note C)......... 4,109,322 4,229,668

Miscellaneous.................. 1,682,837 2,358,798

Total...................$ 18,278,590 $ 19,083,788

TOTAL INCOME....................$108,678,085 $ 76,502,548

Miscellaneous Deductions from Income........... 11,082,453 1,451,214

Income Available for Fixed Charges............$ 97,595,632 $ 75,051,334

Fixed Charges:

Rent for Leased Roads and Equipment (Note C)....... $ 22,392,182 $ 22,077,464

Interest on Funded Debt.............. 24,533,511 25,409,166

Interest on Unfunded Debt............. 1,587,756 1,319,142

Total...................$ 48,513,449 $ 48,805,772

NET INCOME TRANSFERRED TO PROFIT AND LOSS........$ 49,082,183 $ 26,245,562

Note A—Includes amortization and depreciation on roadway property....... $8,842,087 $4,506,911

Note B—Includes amortization and depreciation of equipment......... $24,476,159 $18,871,476

Also includes depreciation of power-plant machinery......... $805,344 $254,133

Note C—Included in other income and rent for leased roads are certain inter-company transactions

representing credits and corresponding debits amounting to........ $3,979,537 $4,160,093

Other income also includes items representing interest and dividends amounting to $1,492,940 $1,503,643

received on securities of and advances to terminal and other railroad companies

whose properties are jointly used by this Company, as to the major portion of which

a like amount was paid to those companies as rental and included in joint facility rents.

|