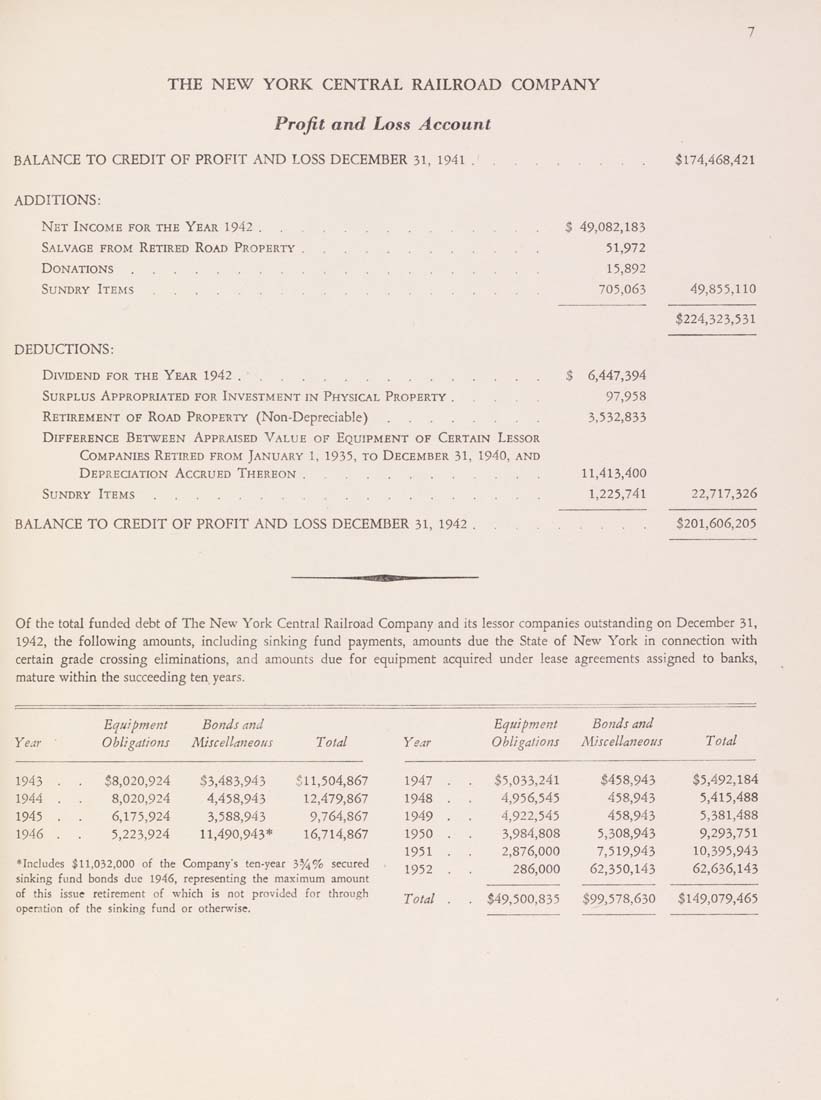

THE NEW YORK CENTRAL RAILROAD COMPANY

Profit and Loss Account

BALANCE TO CREDIT OF PROFIT AND LOSS DECEMBER 31, 1941.......

$174,468,421

ADDITIONS:

Net Income for the Year 1942

Salvage from Retired Road Property

Donations........

Sundry Items.......

DEDUCTIONS:

Dividend for the Year 1942...............

Surplus Appropriated for Investment in Physical Property.....

Retirement of Road Property (Non-Depreciable)........

Difference Between Appraised Value of Equipment of Certain Lessor

Companies Retired from January l, 1935, to December 31, 1940, and

Depreciation Accrued Thereon

Sundry Items.......

$ 49,082,183

51,972

15,892

705,063

$ 6,447,394

97,958

3,532,833

11,413,400

1,225,741

49,855,110

$224,323,531

BALANCE TO CREDIT OF PROFIT AND LOSS DECEMBER 31, 1942

22,717,326

$201,606,205

Of the total funded debt of The New York Central Railroad Company and its lessor companies outstanding on December 31,

1942, the following amounts, including sinking fund payments, amounts due the State of New York in connection with

certain grade crossing eliminations, and amounts due for equipment acquired under lease agreements assigned to banks,

mature within the succeeding ten years.

Equipment

Bonds and

Equipment

Bonds and

Year '

Obligations

Miscellaneous

Total

Year

Obligations

Miscellaneous

Total

1943 .

$8,020,924

53,483,943

•511,504,867

19 Al .

$5,033,241

$458,943

$5,492,184

1944 .

8,020,924

4,458,943

12,479,867

1948 .

4,956,545

458,943

5,415,488

1945 .

6,175,924

3,588,943

9,764,867

1949 .

4,922,545

458,943

5,381,488

1946 .

5,223,924

11,490,943*

16,714,867

1950 .

3,984,808

5,308,943

9,293,751

* Includes

sinking fi

$11,032,000 of the

nd bonds due 1946,

sue retirement of •«

of the sinking fund

Company's ten-year 3^4% secured

representing the maximum amount

rhxch is not provided for through

or otherwise.

1951 .

1952 .

Total .

2,876,000

286,000

7,519,943

62,350,143

10,395,943

62,636,143

of this is

operation

. $49,500,835

$99,578,630

$149,079,465

|