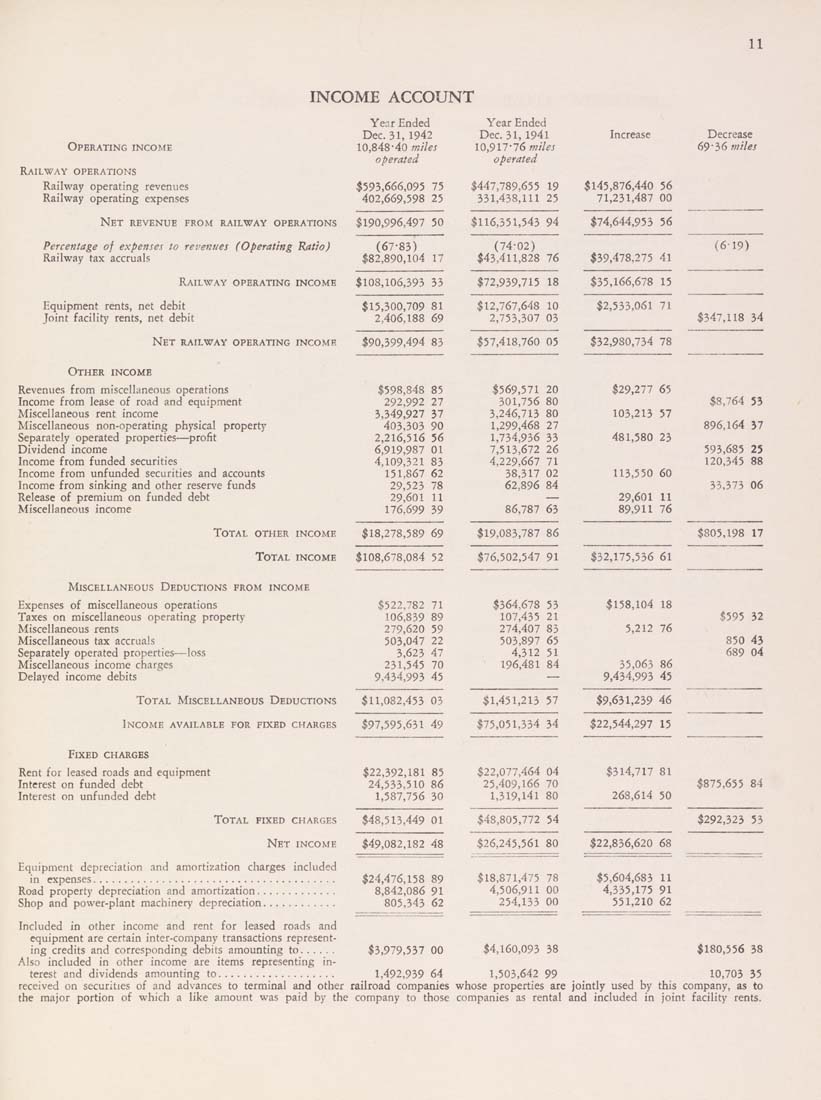

INCOME ACCOUNT

11

Operating income

Railway operations

Railway operating revenues

Railway operating expenses

Net revenue from railway operations

Percentage of expenses to revenues (Operating Ratio)

Railway tax accruals

Railway operating income

Equipment rents, net debit

Joint facility rents, net debit

Year Ended

Year Ended

Dec. 31, 1942

Dec. 31, 1941

Increase

Decrease

10,848-40 miles

10,917-76 w//^j

69-36 miles

operated

operated

$593,666,095 75

$447,789,655

19

$145,876,440 56

402,669,598 25

331,438,111

25

71,231,487 00

$190,996,497 50

$116,351,543 94

$74,644,953 56

(67-83)

(74-02)

(619)

$82,890,104 17

$43,411,828 76

$39,478,275 4l

$108,106,393 33

$72,939,715

18

$35,166,678 15

$15,300,709 81

$12,767,648

10

$2,533,061 71

2,406,188 69

2,753,307

03

$347,118 34

$90,399,494 83

$57,418,760 05

$32,980,734 78

$598,848 85

$569,571

20

$29,277 65

292,992 27

301,756

80

$8,764 53

3,349,927 37

3,246,713

80

103,213 57

403,303 90

1,299,468

27

896,164 37

2,216,516 56

1,734,936

33

481,580 23

6,919,987 01

7,513,672

26

593,685 25

4,109,321 83

4,229,667

71

120,345 88

151,867 62

38,317

02

113,550 60

29,523 78

62,896 84

33,373 06

29,601 11

—

29,601 11

176,699 39

86,787

63

89,911 76

$18,278,589 69

$19,083,787

86

$805,198 17

$108,678,084 52

$76,502,547

91

$32,175,536 61

$522,782 71

$364,678

53

$158,104 18

106,839 89

107,435

21

$595 32

279,620 59

274,407

83

5,212 76

503,047 22

503,897

65

850 43

3,623 47

4,312

51

689 04

231,545 70

196,481

84

35,063 86

9,434,993 45

—

9,434,993 45

$11,082,453 03

$1,451,213

57

$9,631,239 46

$97,595,631 49

$75,051,334

34

$22,544,297 15

Net railway operating income

Other income

Revenues from miscellaneous operations

Income from lease of road and equipment

Miscellaneous rent income

Miscellaneous non-operating physical propert}'

Separately operated properties—profit

Dividend income

Income from funded securities

Income from unfunded securities and accounts

Income from sinking and other reserve funds

Release of premium on funded debt

Miscellaneous income

Total other incOiME

Total income

Miscellaneous Deductions from income

Expenses of miscellaneous operations

Taxes on miscellaneous operating property

Miscellaneous rents

Miscellaneous tax accruals

Separately operated properties-—loss

Miscellaneous income charges

Delayed income debits

Total Miscellaneous Deductions

Income available for fdced charges

Fixed charges

Rent for leased roads and equipment $22,392,181 85 $22,077,464 04 $314,717 81

Interest on funded debt 24,533,510 86 25,409,166 70 $875,655 84

Interest on unfunded debt 1,587,756 30 1,319,141 80 268,614 50

Total fixed charges $48,513,449 01 $48,805,772 54 $292,323 53

Net income $49,082,182 48 $26,245,561 80 $22,836,620 68

Equipment depreciation and amortization charges included

in expenses....................................... $24,476,158 89 $18,871,475 78 $5,604,683 11

Road property depreciation and amortization............. 8,842,086 91 4,506,911 00 4,335,175 91

Shop and power-plant machinery depreciation............ 805,343 62 254,133 00 551,210 62

Included in other income and rent for leased roads and

equipment are certain inter-company transactions represent¬

ing credits and corresponding debits amounting to...... $3,979,537 00 $4,160,093 38 $180,556 38

Also included in other income are items representing in¬

terest and dividends amounting to................... 1,492,939 64 1,503,642 99 10,703 35

received on securities of and advances to terminal and other railroad companies whose properties are jointly used by this company, as to

the major portion of which a like amount was paid by the company to those companies as rental and included in joint facility rents.

|