21

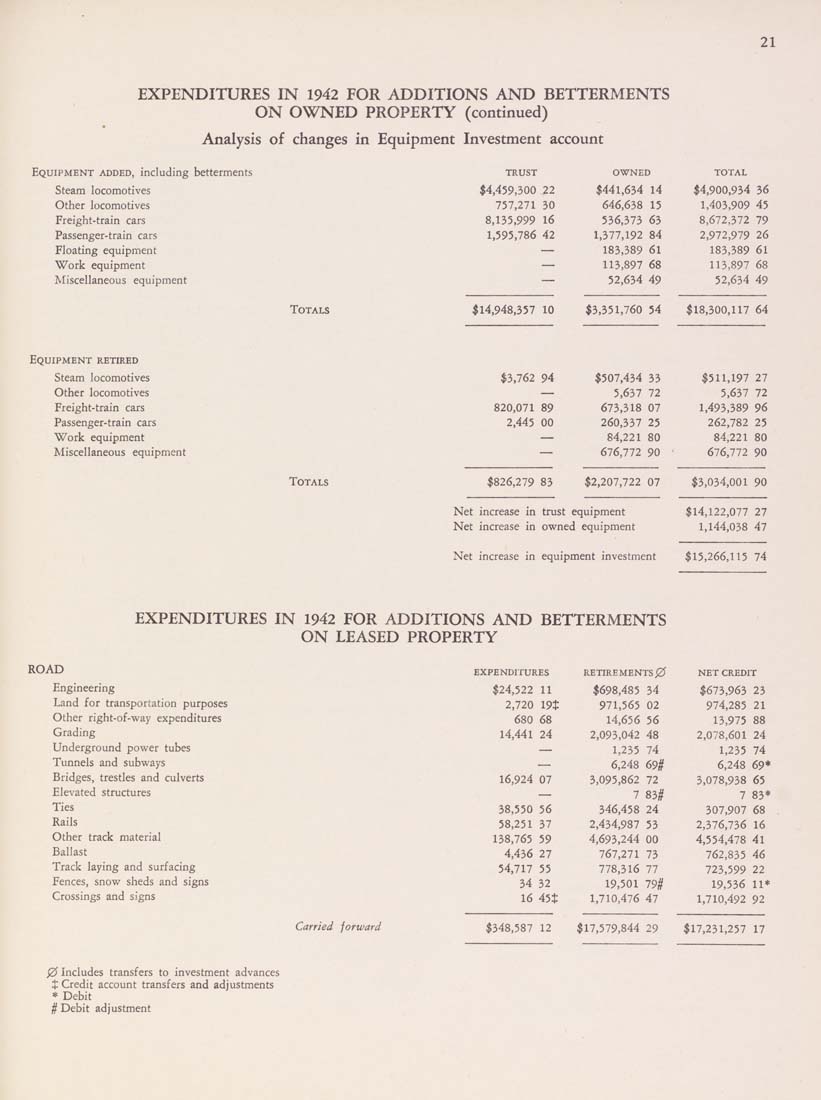

EXPENDITURES IN 1942 FOR ADDITIONS AND BETTERMENTS

ON OWNED PROPERTY (continued)

Analysis of changes in Equipment Investment account

Equipment added, including betterments

Steam locomotives

Other locomotives

Freight-train cars

Passenger-train cars

Floating equipment

Work equipment

Miscellaneous equipment

Totals

TRUST

$4,459,300 22

757,271 30

8,135,999 16

1,595,786 42

$14,948,357 10

OWNED

$441,634 14

646,638 15

536,373 63

1,377,192 84

183,389 61

113,897 68

52,634 49

TOTAL

$4,900,934 36

1,403,909 45

8,672,372 79

2,972,979 26

183,389 61

113,897 68

52,634 49

$3,351,760 54 $18,300,117 64

Equipment retired

Steam locomotives

Other locomotives

Freight-train cars

Passenger-train cars

Work equipment

Miscellaneous equipment

Totals

$3,762 94

820,071 89

2,445 00

$507,434 33

5,637 72

673,318 07

260,337 25

84,221 80

676,772 90

$826,279 83 $2,207,722 07

Net increase in trust equipment

Net increase in owned equipment

$511,197 27

5,637 72

1,493,389 96

262,782 25

84,221 80

676,772 90

$3,034,001 90

$14,122,077 27

1,144,038 47

Net increase in equipment investment $15,266,115 74

EXPENDITURES IN 1942 FOR ADDITIONS AND BETTERMENTS

ON LEASED PROPERTY

ROAD

Engineering

Land for transportation purposes

Other right-of-way expenditures

Grading

Underground power tubes

Tunnels and subways

Bridges, trestles and culverts

Elevated structures

Ties

Rails

Other track material

Ballast

Track laying and surfacing

Fences, snow sheds and signs

Crossings and signs

expenditures

$24,522 11

2,720 19t

680 68

14,441 24

16,924 07

38,550 56

58,251 37

138,765 59

4,436 27

54,717 55

34 32

16 45i-

retirements 0

$698,485 34

971,565 02

14,656 56

2,093,042 48

1,235 74

6,248 69#

3,095,862 72

7 83#

346,458 24

2,434,987 53

4,693,244 00

767,271 73

778,316 77

19,501 79#

1,710,476 47

net credit

$673,963 23

974,285 21

13,975 88

2,078,601 24

1,235 74

6,248 69*

3,078,938 65

7 83*

307,907 68

2,376,736 16

4,554,478 4l

762,835 46

723,599 22

19,536 11*

1,710,492 92

Carried forward

$348,587 12 $17,579,844 29 $17,231,257 17

0 Includes transfers to investment advances

X Credit account transfers and adjustments

* Debit

# Debit adjustment

|