50

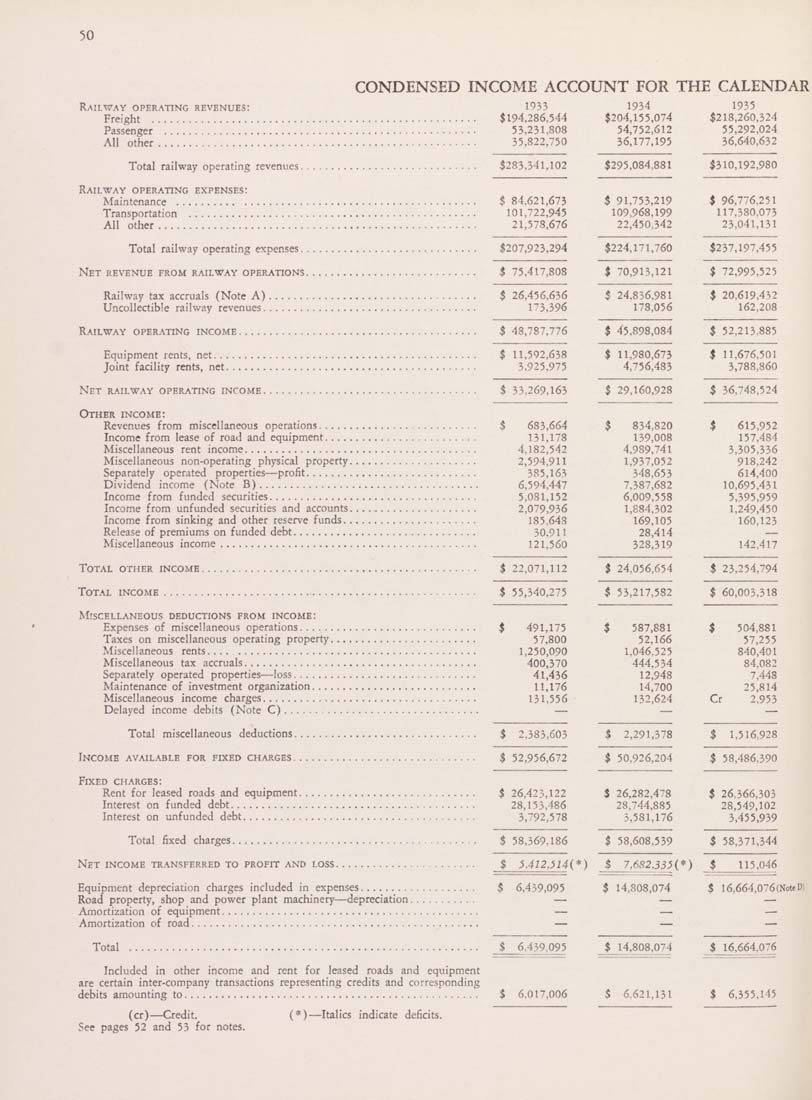

CONDENSED INCOME ACCOUNT FOR THE CALENDAR

Railway operating revenues: 1933 1934 1935

Freight ..................................................... $194,286,544 $204,155,074 $218,260,324

Passenger ................................................... 53,231,808 54,752,612 55,292,024

All other.................................................... 35,822,750 36,177,195 36,640,632

Total railway operating revenues............................. $283,341,102 $295,084,881 $310,192,980

Railway operating expenses:

Maintenance ................................................ $ 84,621,673 $ 91,753,219 $ 96,776,251

Transportation ............................................... 101,722,945 109,968,199 117.380,073

All other.................................................... 21,578,676 22,450,342 23,041,131

Total railway operating expenses............................. $207,923,294 $224,171,760 $237,197,455

Net revenue from railway operations............................ $ 75,417,808 $ 70,913,121 $ 72,995,525

Railway tax accruals (Note A).................................. $ 26,456,636 $ 24.836,981 $ 20,619,432

Uncollectible railway revenues................................... l''3,396 178,056 162,208

Railway oper.\ting income....................................... $ 48,787,776 $ 45,898,084 $ 52,213,885

Equipment rents, net........................................... $ 11,592,638 $ 11,980,673 I 11,676,501

Joint facility rents, net......................................... 3.925,975 4,756,483 3,788,860

Net railway operating income................................... $ 33,269,163 $ 29,160,928 $ 36,748,524

Other income:

Revenues from miscellaneous operations......................... S 683,664 $ 834,820 $ 615,952

Income from lease of road and equipment......................... 131,178 139,008 157,484

Miscellaneous rent income...................................... 4,182,542 4,989,741 3,305,336

Miscellaneous non-operating physical property..................... 2,594,911 1,937,052 918,242

Separately operated properties—profit............................ 385,163 348,653 614,400

Dividend income (Note B).................................... 6,594,447 7,387,682 10,695,431

Income from funded securities.................................. 5,081,152 6,009,558 5,395,959

Income from unfunded securities and accounts..................... 2,079,936 1,884,302 1,249,450

Income from sinking and other reserve funds...................... 185,643 169,105 160,123

Release of premiums on funded debt.............................. 30.911 28,414 —

Miscellaneous income.......................................... 121,560 328,319 142,417

Total other income............................................. $ 22,071,112 $ 24,056,654 $ 23,254,794

ToT.\L income................................................... $ 55,340,275 $ 53,217,582 $ 60,003,318

Miscellaneous deductions from income:

Expenses of miscellaneous operations............................. $ 491,175 $ 587,881 $ 504,881

Taxes on miscellaneous operating property........................ 57,800 52,166 57,255

Miscellaneous rents........................................... 1,250,090 1,046,525 840,401

Miscellaneous tax accruals...................................... 400,370 444,534 84,082

Separately operated properties—loss.............................. 41,436 12,948 7,448

Maintenance of investment organization........................... 11,176 14,700 25,814

Miscellaneous income charges................................... 131,556 132,624 Cr 2,953

Delayed income debits (Note C)................................ — — —

Total miscellaneous deductions.............................. $ 2,383,603 $ 2,291,378 $ 1,516,928

Income avail.^ble for fixed charges.............................. $ 52,956,672 $ 50,926,204 $ 58,486.390

Fixed charges:

Rent for leased roads and equipment............................. $ 26,423,122 $ 26,282,478 $ 26.366,303

Interest on funded debt........................................ 28,153,486 28,744,885 28,549,102

Interest on unfunded debt...................................... 3,792,578 3,581,176 3,455,939

Total fixed charges........................................ $ 58,369,186 $ 58,608.539 $ 58,371,344

Net income tr.\nsferred to profit and loss....................... $ 5.412.514i*) _$__7,682.35.5(*) $ 115.046

Equipment depreciation charges included in expenses................... $ 6,439,095 $ 14,808,074 $ 16,664,076(Note D;

Road property, shop and power plant machinery—depreciation........... — — —

Amortization of equipment.......................................... — — —

Amortization of road............................................... — — —

Total ......................................................... $ 6.439,095 $ 14,808,074 $ 16,664,076

Included in other income and rent for leased roads and equipment

are certain inter-company transactions representing credits and corresponding

debits amounting to................................................ $ 6.017,006 $ 6.621,131 $ 6,355,145

(cr)—Credit. (*)—Italics indicate deficits.

See pages 52 and 53 for notes.

|