53

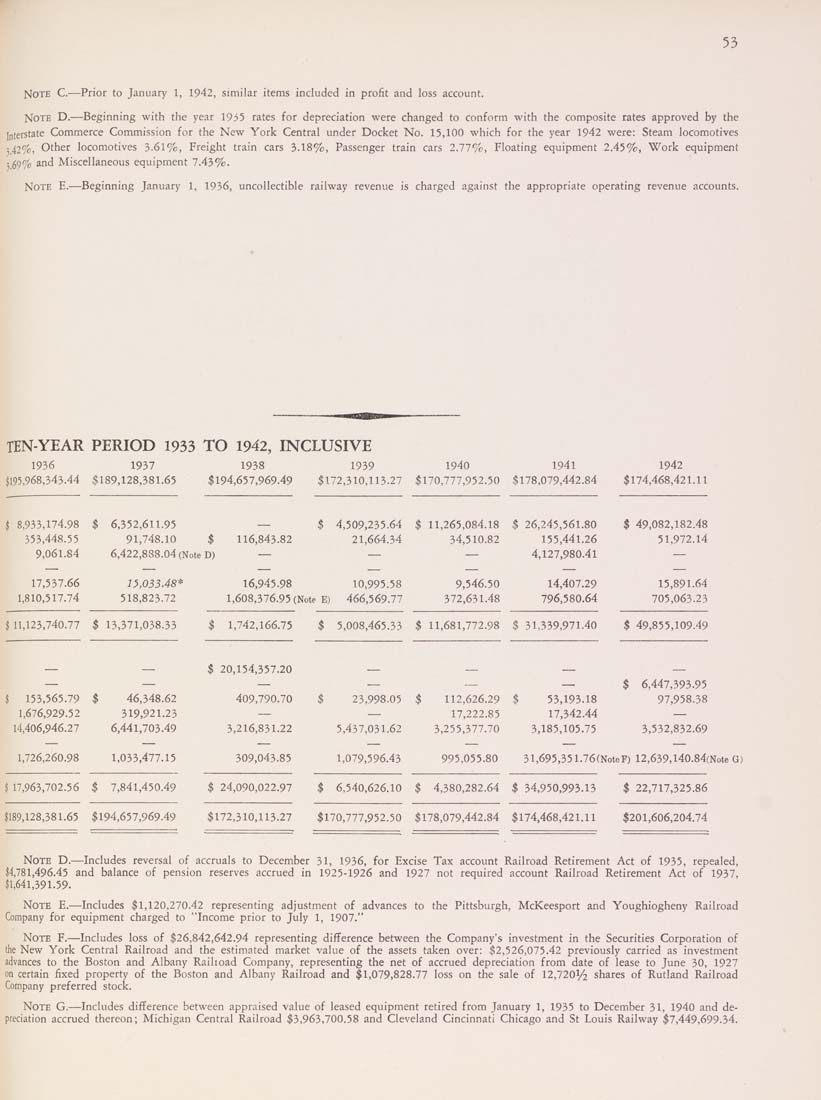

Note C.—Prior to January 1, 1942, similar items included in profit and loss account.

Note D.—Beginning with the year 1935 rates for depreciation were changed to conform with the composite rates approved by the

Interstate Commerce Commission for the New York Central under Docket No. 15,100 which for the year 1942 were: Steam locomotives

3 42%, Other locomotives 3-61%, Freight train cars 3-18%, Passenger train cars 2.77%, Floating equipment 2.45%, Work equipment

559% and Miscellaneous equipment 7.43%.

Note E.—Beginning January 1, 1936, uncollectible railway revenue is charged against the appropriate operating revenue accounts.

TEN-YEAR PERIOD 1933 TO 1942, INCLUSIVE

1936 1937 1938 1939 1940 1941 1942

5195,968,343.44 $189,128,381.65 $194,657,969.49 $172,310,113.27 $170,777,952.50 $178,079,442.84 $174,468,421.11

I 8,933,174.98 $ 6,352,611.95 — $ 4,509,235.64 $ 11,265,084.18 $ 26,245,561.80 $ 49,082,182.48

353,448.55 91,748.10 $ 116,843.82 21,664.34 34,510.82 155,441.26 51,972.14

9,061.84 6,422,888.04 (Note D) — — — 4,127,980.41 —

17,537.66 13,033.48* 16,945.98 10,995.58 9,546.50 14,407.29 15,891.64

1,810,517.74 518,823.72 1,608,376.95 (Note E) 466,569.77 372,631.48 796,580.64 705,063.23

$11,123,740.77 $13,371,038.33 $ 1,742,166.75 $ 5,008,465.33 $11,681,772.98 $31,339,971.40 $49,855,109.49

— — $ 20,154,357.20 _ _ _ _

— — — — — — $ 6,441,393.95

J 153,565.79 $ 46,348.62 409,790.70 $ 23,998.05 $ 112,626.29 $ 53,193.18 97,958.38

1,676,929.52 319,921.23 — — 17,222.85 17,342.44 —

14,406,946.27 6,441,703.49 3,216,831.22 5,437,031.62 3,255,377.70 3,185,105.75 3,532,832.69

1,726,260.98 1,033,477.15 309,043.85 1,079,596.43 995,055.80 31,695,351.76(NotoF) 12,639,l40.84(Note G)

I 17,963,702.56 $ 7,841,450.49 $ 24,090,022.97 $ 6,540,626.10 $ 4,380,282.64 $ 34,950,993.13 $ 22,717,325.86

,128,381.65 $194,657,969.49 $172,310,113.27 $170,777,952.50 $178,079,442.84 $174,468,421.11 $201,606,204.74

Note D.—Includes reversal of accruals to December 31, 1936, for Excise Tax account Railroad Retirement Act of 1935, repealed,

14,781,496.45 and balance of pension reserves accrued in 1925-1926 and 1927 not required account Railroad Retirement Act of 1937,

$1,641,391.59.

Note E.—Includes $1,120,270.42 representing adjust.ment of advances to the Pittsburgh, McKeesport and Youghiogheny Railroad

Company for equipment charged to "Income prior to July 1, 1907."

Note F.—Includes loss of $26,842,642.94 representing difference between the Company's investment in the Securities Corporation of

the New York Central Railroad and the estimated market value of the assets taken over: $2,526,075.42 previously carried as investment

advances to the Boston and Albany Railioad Company, representing the net of accrued depreciation from date of lease to June 30, 1927

on certain fixed property of the Boston and Albany Railroad and $1,079,828.77 loss on the sale of 12,720^/2 shares of Rutland Railroad

Company preferred stock.

Note G.—Includes difference between appraised value of leased equipment retired from January 1, 1935 to December 31, 1940 and de¬

preciation accrued thereon; Michigan Central Railroad $3,963,700.58 and Cleveland Cincinnati Chicago and St Louis Railway $7,449,699.34.

|