15

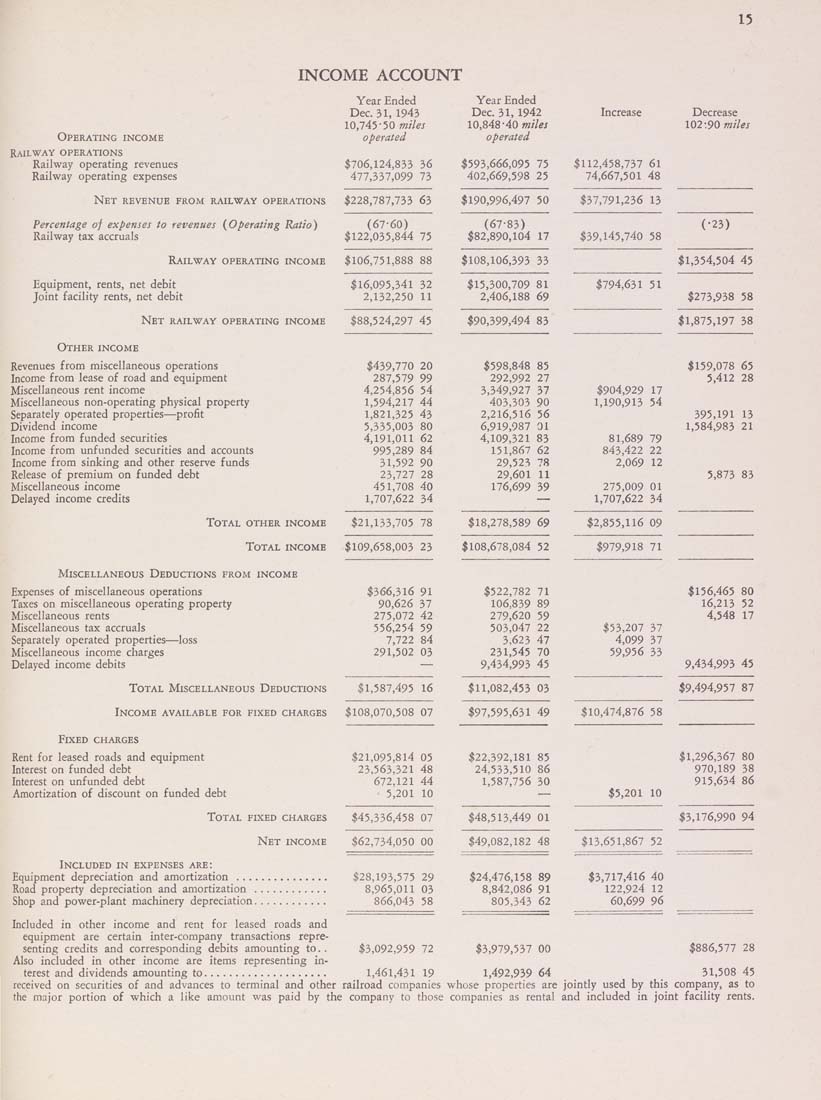

Operating income

Railway operations

Railway operating revenues

Railway operating expenses

INCOME ACCOUNT

Year Ended

Dec. 31, 1943

10,745-50 miles

operated

$706,124,833 36

477,337,099 73

Percentage of expenses to revenues {Operating Ratio)

Railway tax accruals

(67-60)

$122,035,844 75

Equipment, rents, net debit

Joint facility rents, net debit

Net railway operating income

$16,095,341 32

2,132,250 11

$88,524,297 45

Year Ended

Dec. 31, 1942

10,848-40 miles

$593,666,095 75

402,669,598 25

Net revenue from railway operations $228,787,733 63 $190,996,497 50

(67-83)

$82,890,104 17

Railway operating income $106,751,888 88 $108,106,393 33

$15,300,709 81

2,406,188 69

$90,399,494 83

Increase

^112,458,737 61

74,667,501 48

$37,791,236 13

,145,740 58

$794,631 51

Decrease

102:90 miles

(•23)

$1,354,504 45

$273,938 58

$1,875,197 38

Other income

Revenues from miscellaneous operations

Income from lease of road and equipment

Miscellaneous rent income

Miscellaneous non-operating physical property

Separately operated properties—profit

Dividend income

Income from funded securities

Income from unfunded securities and accounts

Income from sinking and other reserve funds

Release of premium on funded debt

Miscellaneous income

Delayed income credits

Total other income

287.

4,254,

1,594.

1,821.

5,335.

4,191.

995.

31

23

451

1,707

,770 20

,579 99

,856 54

,217 44

,325 43

,003 80

,011 62

,289 84

,592 90

,727 28

,708 40

,622 34

!1,133,705 78

Miscellaneous Deductions from income

Expenses of miscellaneous operations

Taxes on miscellaneous operating property

Miscellaneous rents

Miscellaneous tax accruals

Separately operated properties—loss

Miscellaneous income charges

Delayed income debits

Total Miscellaneous Deductions

$366,316 91

90,626 37

275,072 42

556,254 59

7,722 84

291,502 03

$1,587,495 16

Income available for fixed charges $108,070,508 07

$598,

292.

3,349,

403,

2,216,

6,919,

4,109,

151,

29,

29.

176.

848 85

992 27

927 37

303 90

516 56

987 01

321 83

867 62

,523 78

,601 11

699 39

$18,278,589 69

Total income $109,658,003 23 $108,678,084 52

$522,782 71

106,839 89

279,620 59

503,047 22

3,623 47

231,545 70

9,434,993 45

$11,082,453 03

1,929 17

1,190,913 54

81,689 79

843,422 22

2,069 12

275,009 01

1,707,622 34

$2,855,116 09

$979,918 71

$53,207 37

4,099 37

59,956 33

$97,595,631 49 $10,474,876 58

$159,078 65

5,412 28

395,191 13

1,584,983 21

5,873 83

$156,465 80

16,213 52

4,548 17

9,434,993 45

$9,494,957 87

Fixed charges

Rent for leased roads and equipment $21,095,814 05 $22,392,181 85 $1,296,367 80

Interest on funded debt 23,563,321 48 24,533,510 86 970,189 38

Interest on unfunded debt 672,121 44 1,587,756 30 915,634 86

Amortization of discount on funded debt 5,201 10 — $5,201 10

Total fixed charges $45,336,458 07 $48,513,449 01 $3,176,990 94

Net income $62,734,050 00 $49,082,182 48 $13,651,867 52

Included in expenses are:

Equipment depreciation and amortization ............... $28,193,575 29 $24,476,158 89 $3,717,416 40

Road property depreciation and amortization ............ 8,965,011 03 8,842,086 91 122,924 12

Shop and power-plant machinery depreciation............ 866,043 58 805,343 62 60,699 96

Included in other income and rent for leased roads and

equipment are certain inter-company transactions repre¬

senting credits and corresponding debits amounting to.. $3,092,959 72 $3,979,537 00 $886,577 28

Also included in other income are items representing in¬

terest and dividends amounting to.................... 1,461,431 19 1,492,939 64 _ 31,508 45

received on securities of and advances to terminal and other railroad companies whose properties are jointly used by this company, as to

the major portion of which a like amount was paid by the company to those companies as rental and included in joint facility rents.

|