52

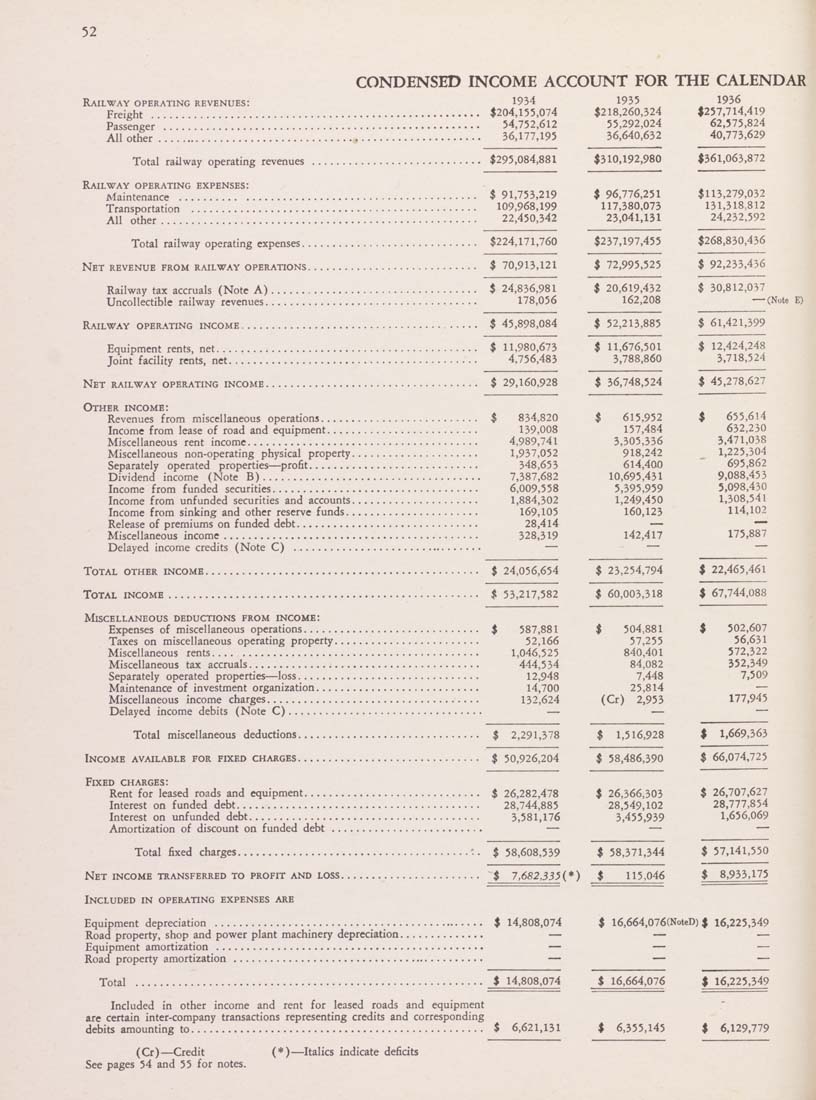

CONDENSED INCOME ACCOUNT FOR THE CALENDAR

Railway operating revenues: 1934 1935 1936

Freight ............................ $204,155,074 $218,260,324 |257,7l4,4l9

Passenger ........................ 54,752,612 55,292,024 62,575,824

All other .'..'.'..'..'.............................................. 36,177,195 36,640,632 40,773,629

Total railway operating revenues ............................ $295,084,881 $310,192,980 $361,063,872

Railway operating expenses:

Maintenance ....................................... $ 91,753,219 $ 96,776,251 $113,279,032

Transportation ............................................... 109,968,199 117,380,073 131,318,812

All other.................................................... 22,450,342 23,041,131 24,232,592

Total railway operating expenses............................. $224,171,760 $237,197,455 $268,830,436

Net revenue from railway operations............................ $ 70,913,121 $ 72,995,525 $ 92,233,436

Railway tax accruals (Note A).................................. $ 24,836,981 $ 20,619,432 $ 30,812,037

Uncollectible railway revenues................................... 178,056 162,208 —(Note E)

Railway oper.\ting income....................................... $ 45,898,084 $ 52,213,885 $ 61,421,399

Equipment rents, net........................................... $ 11,980,673 $ 11,676,501 $ 12,424,248

Joint facility rents, net......................................... 4,756,483 3,788,860 3.718,524

Net railway operating income................................... $ 29,160,928 $ 36,748,524 $ 45,278,627

Other income:

Revenues from miscellaneous operations.......................... $ 834,820 $ 615,952 $ 655,614

Income from lease of road and equipment......................... 139,008 157,484 632,230

Miscellaneous rent income...................................... 4,989,741 3,305,336 3,471,038

Miscellaneous non-operating physical property..................... 1,937,052 918,242 1,225,304

Separately operated properties—profit............................ 348,653 6l4,40.0 695,862

Dividend income (Note B).................................... 7,387,682 10,695,431 9,088,453

Income from funded securities.................................. 6,009,558 5,395,959 5,098,430

Income from unfunded securities and accounts..................... 1,884,302 1,249,450 1,308,541

Income from sinking and other reserve funds...................... 169,105 160,123 114,102

Release of premiums on funded debt.............................. 28,4l4 — —"

Miscellaneous income.......................................... 328,319 142,417 175,887

Delayed income credits (Note C) ................................ — — —

Total other income............................................. $ 24,056,654 $ 23,254,794 $ 22,465,461

Total income................................................... $ 53,217,582 $ 60,003,318 $ 67,744,088

Miscellaneous deductions from income:

Expenses of miscellaneous operations............................. $ 587,881 $ 504,881 $ 502,607

Taxes on miscellaneous operating property........................ 52,166 57,255 56,631

Miscellaneous rents____....................................... 1,046,525 840,401 572,322

Miscellaneous tax accruals...................................... 4-44,534 84,082 352,349

Separately operated properties—loss.............................. 12,948 7,448 7,509

Maintenance of investment organization........................... 14,700 25,814 —

Miscellaneous income charges................................... 132,624 (Cr) 2,953 177,945

Delayed income debits (Note C)................................ — — —

Total miscellaneous deductions.............................. $ 2,291,378 $ 1,516,928 t 1,669,363

Income available for fixed charges.............................. $ 50,926,204 $ 58,486,390 $ 66,074,725

Fixed charges:

Rent for leased roads and equipment............................. $ 26,282,478 $ 26,366,303 $ 26,707,627

Interest on funded debt........................................ 28,744,885 28,549,102 28,777,854

Interest on unfunded debt...................................... 3,581,176 3,455,939 1,656,069

Amortization of discount on funded debt......................... — — —

Total fixed charges......................................: . $ 58,608,539 $ 58,371,344 $ 57,141,550

Net income transferred to profit and loss....................... $ 7,682,335{*) $ 115,046 $ 8,933,175

Included in operating expenses are

Equipment depreciation............................................. $ 14,808,074 $ 16,664,076(NoteD) $ 16,225,349

Road property, shop and power plant machinery depreciation.............. — — ■—

Equipment amortization ............................................ — —

Road property amortization .......................................... — — —

Total ......................................................... $ 14,808,074 $ 16,664,076 | 16,225,349

Included in other income and rent for leased roads and equipment

are certain inter-company transactions representing credits and corresponding

debits amounting to................................................ $ 6,621,131 $ 6,355,145 $ 6,129,779

(Cr)—Credit (*)—Italics indicate deficits

See pages 54 and 55 for notes.

|