57

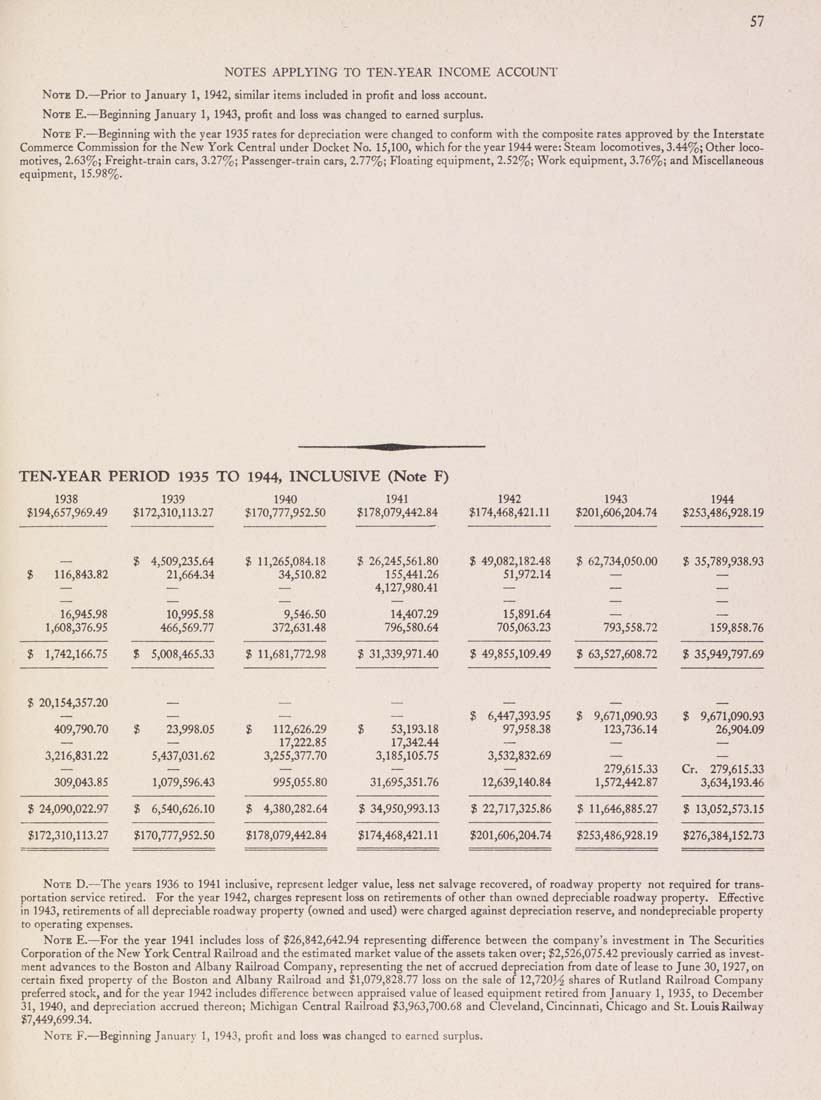

NOTES APPLYING TO TEN-YEAR INCOME ACCOUNT

Note D.—Prior to January 1, 1942, similar items included in profit and loss account.

Note E.—Beginning January 1, 1943, profit and loss was changed to earned surplus.

Note F.—Beginning with the year 1935 rates for depreciation were changed to conform with the composite rates approved by the Interstate

Commerce Commission for the New York Central under Docket No. 15,100, which for the year 1944 were: Steam locomotives, 3.44%; Other loco¬

motives, 2.63%; Freight-train cars, 3.27%; Passenger-train cars, 2.77%; Floating equipment, 2.52%; Work equipment, 3.76%; and Miscellaneous

equipment, 15.98%.

TEN-YEAR PERIOD 1935 TO 1944, INCLUSIVE (Note F)

1938 1939 1940 1941 1942 1943 1944

$194,657,969.49 $172,310,113.27 $170,777,952.50 $178,079,442.84 $174,468,421.11 $201,606,204.74 $253,486,928.19

— $ 4,509,235.64 $ 11,265,084.18 $ 26,245,561.80 $ 49,082,182.48 $ 62,734,050.00 $ 35,789,938.93

$ 116,843.82 21,664.34 34,510.82 155,441.26 51,972.14 — —

— — — 4,127,980.41 _ _ _

16,945.98 10,995.58 9,546.50 14,407.29 15,891.64 — —

1,608,376.95 466,569.77 372,631.48 796,580.64 705,063.23 793,558.72 159,858.76

$ 1,742,166.75 $ 5,008,465.33 $ 11,681,772.98 $ 31,339,971.40 $ 49,855,109.49 $ 63,527,608.72 $ 35,949,797.69

$ 20,154,357.20

— — — $ 6,447,393.95 $ 9,671,090.93 $ 9,671,090.93

409,790.70 $ 23,998.05 $ 112,626.29 $ 53,193.18 97,958.38 123,736.14 26,904.09

— — 17,222.85 17,342.44 _ _ _

3,216,831.22 5,437,031.62 3,255,377.70 3,185,105.75 3,532,832.69 — —

— — — — — 279,615.33 Cr. 279,615.33

309,043.85 1,079,596.43 995,055.80 31,695,351.76 12,639,140.84 1,572,442.87 3,634,193.46

$ 24,090,022.97 $ 6,540,626.10 $ 4,380,282.64 $ 34,950,993.13 $ 22,717,325.86 $ 11,646,885.27 $ 13,052,573.15

$172,310,113.27 $170,777,952.50 $178,079,442.84 $174,468,421.11 $201,606,204.74 $253,486,928.19 $276,384,152.73

Note D.—The years 1936 to 1941 Inclusive, represent ledger value, less net salvage recovered, of roadway property not required for trans¬

portation service retired. For the year 1942, charges represent loss on retirements of other than owned depreciable roadway property. Eff'ectlve

in 1943, retirements of all depreciable roadway property (owned and used) were charged against depreciation reserve, and nondepreciable property

to operating expenses.

Note E.—For the year 1941 Includes loss of $26,842,642.94 representing diff^erence between the company's investment In The Securities

Corporation of the New York Central Railroad and the estimated market value of the assets taken over; $2,526,075.42 previously carried as invest¬

ment advances to the Boston and Albany Railroad Company, representing the net of accrued depreciation from date of lease to June 30,1927, on

certain fixed property of the Boston and Albany Railroad and $1,079,828.77 loss on the sale of 12,7203^ shares of Rutland Railroad Company

preferred stock, and for the year 1942 Includes difl^erence between appraised value of leased equipment retired from January 1, 1935, to December

31, 1940, and depreciation accrued thereon; Michigan Central Railroad $3,963,700.68 and Cleveland, Cincinnati, Chicago and St. Louis Railway

$7,449,699.34.

Note F.—Beginning January 1, 1943, profit and loss was changed to earned surplus.

|