stantial reduction in the shipment of war materials,

but also to a decrease in the movement of raw ma¬

terials and finished products as a result of labor

difficulties in a number of the major industries in the

territory served by the New York Central.

Gross earnings of the Company receded moderate¬

ly from the record high reached in 1944. Net income

was $24,412,525, or $3.79 per share.

Operating Results

Total operating revenues were 8.5% lower than in

1944. The decline in freight revenues was 10.6% and

1 788

^ 800

Z soo

3 411

S 380

208

100

|j|littH*Hii|Hi imm% \m

■

1

OEVENUES VHn

1 EXPENSES -^^Ki

mill

- 100

- 700

- 100

- SOO

- 400

- 300

- 200

- too

1936 '37 '38 "38 '40 '41 '42 '43 '44 '45

in passenger revenues 6.4%. Other operating reve¬

nues increased 0.85%.

The volume of freight moved, as measured by the

number of tons moved one mile, was 14.56% less than

that of 1944. The revenue per ton mile was 9.44 mills.

Passenger traffic, as measured by the number of

passengers carried one mile, was 5.44% below the

record level of 1944. Revenue per passenger mile

averaged 1.928 cents, compared with 1.948 cents in

1944. Movement of the armed forces on active duty

and in demobilization contributed greatly to passen¬

ger volume, as did also travel at reduced rates by

large numbers of service men and women on furlough

and by discharged veterans.

Railway operating expenses (not including taxes,

or other deductions and fixed charges) were higher

than in 1944 by $48,841,337, or 9.2%. The principal

reason for the rise in the year's operating expenses

was that they included $45,595,147, representing un¬

amortized expenditures for emergency facilities ac¬

quired prior to September 1, 1945. These facilities

embraced additional cars, locomotives and other

equipment, as well as roadway improvements, found

necessary in the interest of national defense. Their

cost could, as provided by law, after certification by

appropriate government authority, be amortized over

a sixty-month period, or a shortened period upon

proclamation determining the end of the war emer¬

gency. Prior to September 29, 1945, amortization of

such facilities had been accrued on the books of the

Company at the rate of 20% annually from the time

of acquisition. Under date of September 29, 1945, the

President of the United States proclaimed the end of

the emergency as it affected this situation, and the

Company elected to include in its expense accounts

for the year 1945 the balance of the unamortized

cost. These emergency facilities having now been

fully depreciated, there will be no subsequent de¬

preciation charges in respect of them.

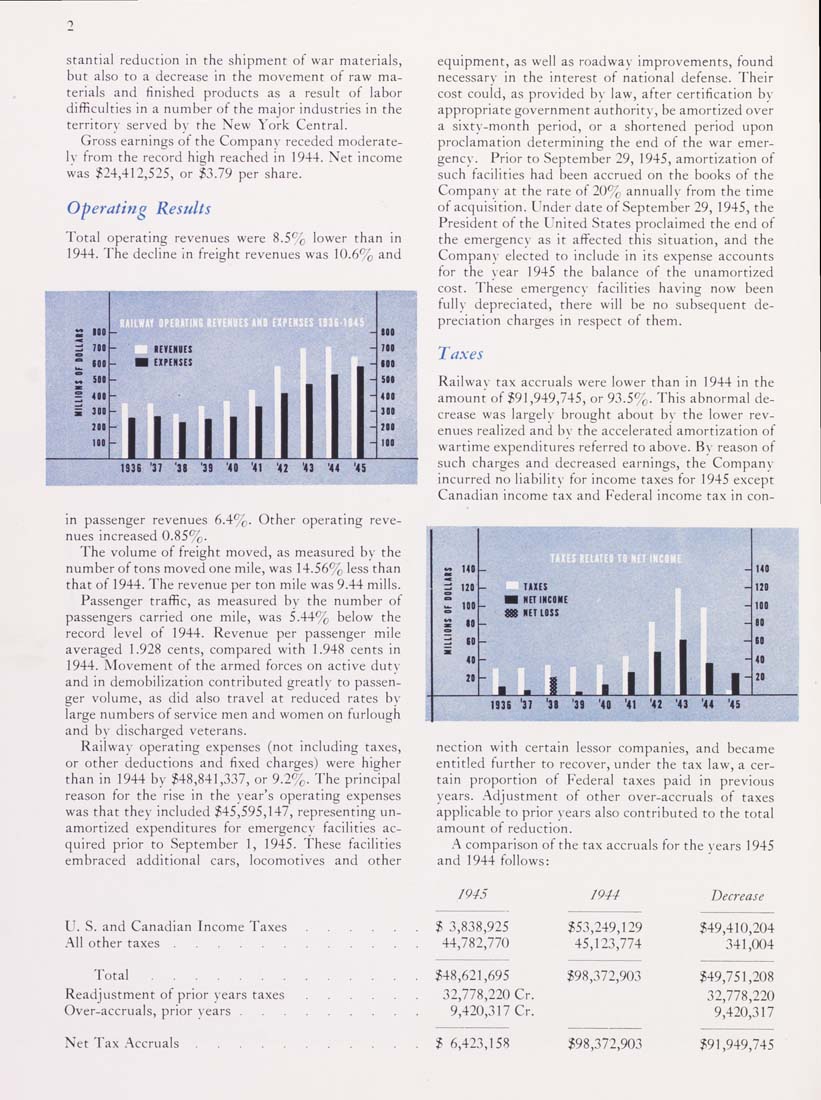

Taxes

Railway tax accruals were lower than in 1944 in the

amount of $91,949,745, or 93.5%. This abnormal de¬

crease was largely brought about by the lower rev¬

enues realized and by the accelerated amortization of

wartime expenditures referred to above. By reason of

such charges and decreased earnings, the Company

incurred no liability for income taxes for 1945 except

Canadian income tax and Federal income tax in con-

2 140

140

5 120

TAXES

_

128

MtUiONS OF Bl

■1 NET INCOME

m NET LOSS

1

1

■

-

100

80

10

40

28

1

1

1

|-

20

133B '37 '38 '39

'40

'41 '42

'43

'44

'45

nection with certain lessor companies, and became

entitled further to recover, under the tax law, a cer¬

tain proportion of Federal taxes paid in previous

years. Adjustment of other over-accruals of taxes

applicable to prior years also contributed to the total

amount of reduction.

A comparison of the tax accruals for the years 1945

and 1944 follows:

1945

1944

U. S. and Canadian Income Taxes...... $ 3,838,925

All other taxes............ 44,782,770

Total............. $48,621,695

Readjvistment of prior years taxes...... 32,778,220 Cr.

Over-accruals, prior years......... 9,420,317 Cr.

Net Tax Accruals........... $ 6,423,158

$53,249,129

45,123,774

$98,372,903

$98,372,903

Decrease

$49,410,204

341,004

$49,751,208

32,778,220

9,420,317

$91,949,745

|