10

THE NEW YORK CENTRAL RAILROAD COMPANY

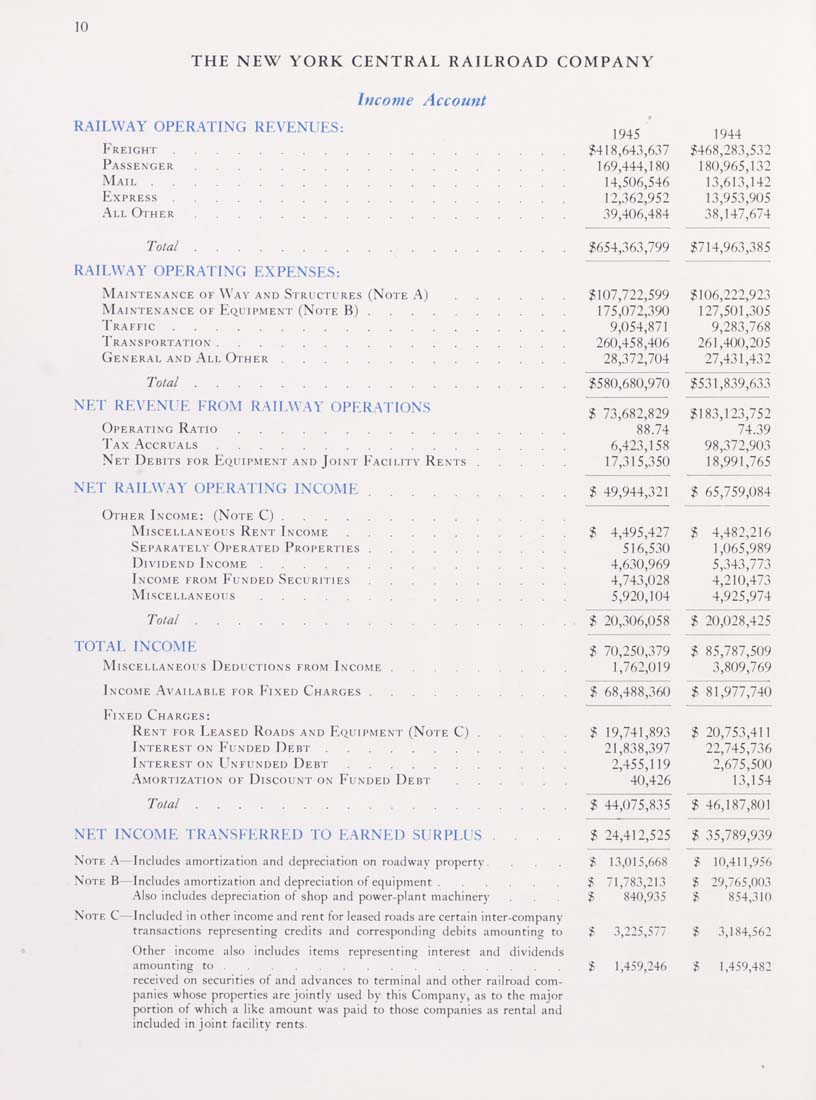

Income Account

RAILWAY OPERATING REVENUES: j^^^ ^,j^^

Freight................... $418,643,637 $468,283,532

Passenger.................. 169,444,180 180,965,132

Mail.................... 14,506,546 13,613,142

Express................... 12,362,952 13,953,905

All Other.................. 39,406,484 38,147,674

Total.................. $654,363,799 $714,963,385

RAILWAY OPERATING EXPENSES:

Maintenance of Way and Structures (Note A)...... $107,722,599 $106,222,923

Maintenance OF Equipment (Note B).......... 175,072,390 127,501,305

Traffic................... 9,054,871 9,283,768

Transportation................. 260,458,406 261,400,205

General and All Other.............. 28,372,704 27,431,432

Total.................. $580,680,970 $531,839,633

NET REVENUE FROM RAILWAY OPERATIONS $ 73,682,829 $183,123,752

Operating Ratio................ 88.74 74.39

Tax Accruals................. 6,423,158 98,372,903

Net Debits FOR Equipment AND Joint Facility Rents..... 17,315,350 18,991,765

NET RAILWAY OPERATING INCOME.......... $ 49,944,321 $ 65,759,084

Other Income: (Note C)..............

Miscellaneous Rent Income........... $ 4,495,427 $ 4,482,216

Separately Operated Properties.......... 516,530 1,065,989

Dividend Income............... 4,630,969 5,343,773

Income from Funded Securities.......... 4,743,028 4,210,473

Miscellaneous............... 5,920,104 4,925,974

Total.................. $ 20,306,058 $ 20,028,425

TOTAL INCOME 3 70,250,379 $ 85,787,509

Miscellaneous Deductions from Income......... 1,762,019 3,809,769

Income Available for Fixed Charges.......... $ 68,488,360 $ 81,977,740

Fixed Charges:

Rent for Leased Roads AND Equipment (Note C)..... $19,741,893 $20,753,411

Interest on Funded Debt............ 21,838,397 22,745,736

Interest ON Unfunded Debt........... 2,455,119 2,675,500

Amortization of Discount on Funded DEBr...... 40,426 13,154

Total.................. $ 44,075,835 $ 46,187,801

NET INCOME TRANSFERRED TO EARNED SURPLUS .... $ 24,412,525 $ 35,789,939

Note A—Includes amortization and depreciation on roadway property. ... $ 13,015,668 $ 10,411,956

Note B—Includes amortization and depreciation of equipment...... $ 71,783,213 $ 29,765,003

Also includes depreciation of shop and power-plant machinery ... $ 840,935 $ 854,310

Note C—Included in other income and rent for leased roads are certain inter-company

transactions representing credits and corresponding debits amounting to $ 3,225,577 $ 3,184,562

Other income also includes items representing interest and dividends

amounting to............... $ 1,459,246 $ 1,459,482

received on securities of and advances to terminal and other railroad com¬

panies whose properties are jointly used by this Company, as to the major

portion ol which a like amount was paid to those companies as rental and

included in joint facility rents.

|