21

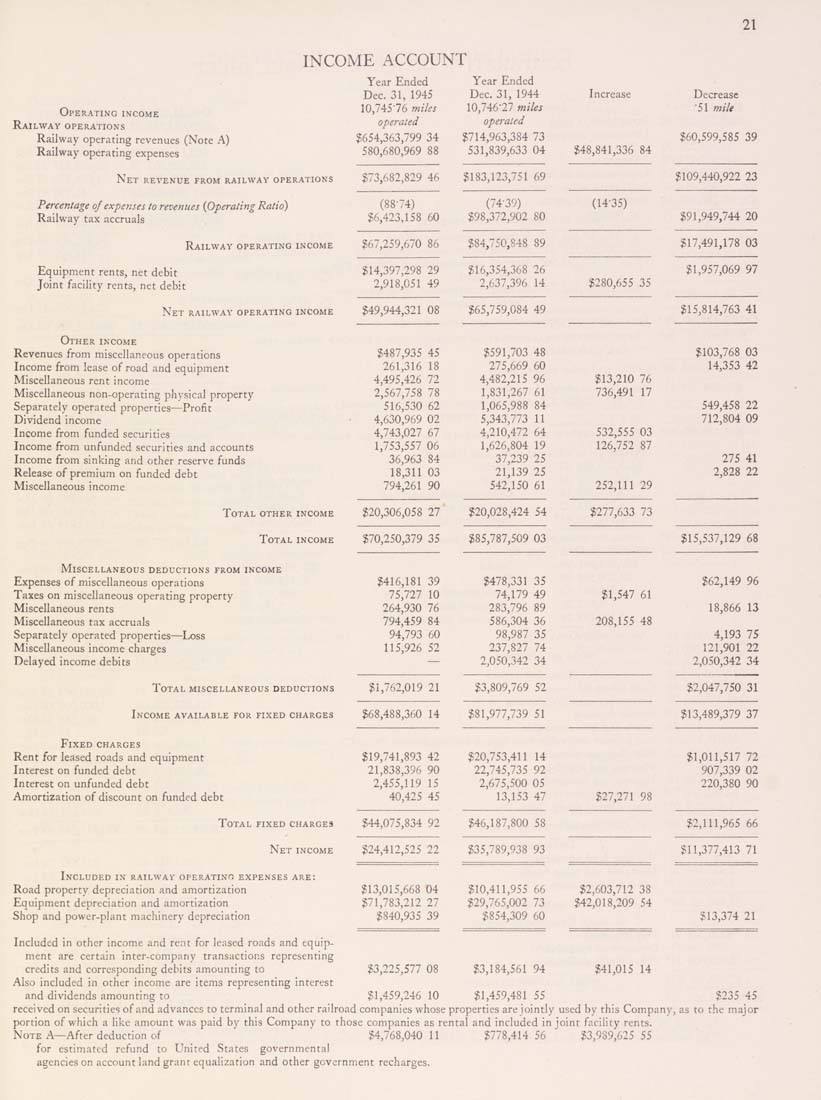

INCOME ACCOUNT

Operating income

Railway operations

Railway operating revenues (Note A)

Railway operating expenses

Year Ended

Dec. 31, 1945

10,74576 miles

operated

2654,363,799 34

580,680,969 88

Year Ended

Dec. 31, 1944

10,746-27 miles

operated

$714,963,384 73

531,839,633 04

Increase

$48,841,336 84

Net revenue from railway operations $73,682,829 46 $183,123,751 69

Percentage of expenses to revenues {Operating Ratio)

Railway tax accruals

Railway operating income

Equipment rents, net debit

Joint facility rents, net debit

(88-74)

$6,423,158 60

$67,259,670 86

$14,397,298 29

2,918,051 49

(74-39)

$98,372,902 80

$84,750,848 89

$16,354,368 26

2,637,396 14

(14-35)

$280,655 35

Net railway operating income $49,944,321 08 $65,759,084 49

Other income

Revenues from miscellaneous operations

Income from lease of road and equipment

Miscellaneous rent income

Miscellaneous non-operating physical property

Separately operated properties—Profit

Dividend income

Income from funded securities

Income from unfunded securities and accounts

Income from sinking and other reserve funds

Release of premium on funded debt

Miscellaneous income

Total other income

Total income

Miscellaneous deductions from income

Expenses of miscellaneous operations

Taxes on miscellaneous operating property

Miscellaneous rents

Miscellaneous tax accruals

Separately operated properties—Loss

Miscellaneous income charges

Delayed income debits

Total miscellaneous deductions

Income available for fixed charges

Fixed charges

Rent for leased roads and equipment

Interest on funded debt

Interest on unfunded debt

Amortization of discount on funded debt

$20,306,058 27 $20,028,424 54

$70,250,379 35 $85,787,509 03

$416,181 39

75,727 10

264,930 76

794,459 84

94,793 60

115,926 52

$1,762,019 21

$478,331 35

74,179 49

283,796 89

586,304 36

98,987 35

237,827 74

2,050,342 34

$3,809,769 52

$277,633 73

$1,547 61

208,155 48

,488,360 14 $81,977,739 51

$19,741,893 42

21,838,396 90

2,455,119 15

40,425 45

$20,753,411 14

22,745,735 92

2,675,500 05

13,153 47

$27,271 98

Total fixed charges $44,075,834 92 $46,187,800 58

524,412,525 22

$35,789,938 93

$13,015,668 04

$71,783,212 27

),935 39

$3,225,577

$10,411,955 66

$29,765,002 73

$854,309 60

$3,184,561 94

$1,459,481 55

$2,603,712 38

$42,018,209 54

$41,015 14

Decrease

-51 mile

$60,599,585 39

$109,440,922 23

$91,949,744 20

$17,491,178 03

$1,957,069 97

$15,814,763 41

$487,935 45

$591,703 48

$103,768 03

261,316 18

275,669 60

14,353 42

4,495,426 72

4,482,215 96

$13,210 76

2,567,758 78

1,831,267 61

736,491 17

516,530 62

1,065,988 84

549,458 22

4,630,969 02

5,343,773 11

712,804 09

4,743,027 67

4,210,472 64

532,555 03

1,753,557 06

1,626,804 19

126,752 87

36,963 84

37,239 25

275 41

18,311 03

21,139 25

2,828 22

794,261 90

542,150 61

252,111 29

$15,537,129 68

$62,149 96

18,866 13

4,193 75

121,901 22

2,050,342 34

$2,047,750 31

$13,489,379 37

$1,011,517 72

907,339 02

220,380 90

$2,111,965 66

$11,377,413 71

$13,374 21

Net income

Included in railway operatino expenses are:

Road property depreciation and amortization

Equipment depreciation and amortization

Shop and power-plant machinery depreciation

Included in other income and rent for leased roads and equip¬

ment are certain inter-company transactions representing

credits and corresponding debits amounting to

Also included in other income are items representing interest

and dividends amounting to $1,459,246 10 $1,459,48155 $235 45

received on securities of and advances to terminal and other railroad companies whose properties are jointly used by this Company, as to the major

portion of which a like amount was paid by this Company to those companies as rental and included in joint facility rents.

Note A—After deduction of $4,768,040 11 $778,414 56" $3,989,625 55

for estimated refund to United States governmental

agencies on account land grant equalization and other government recharges.

|