60

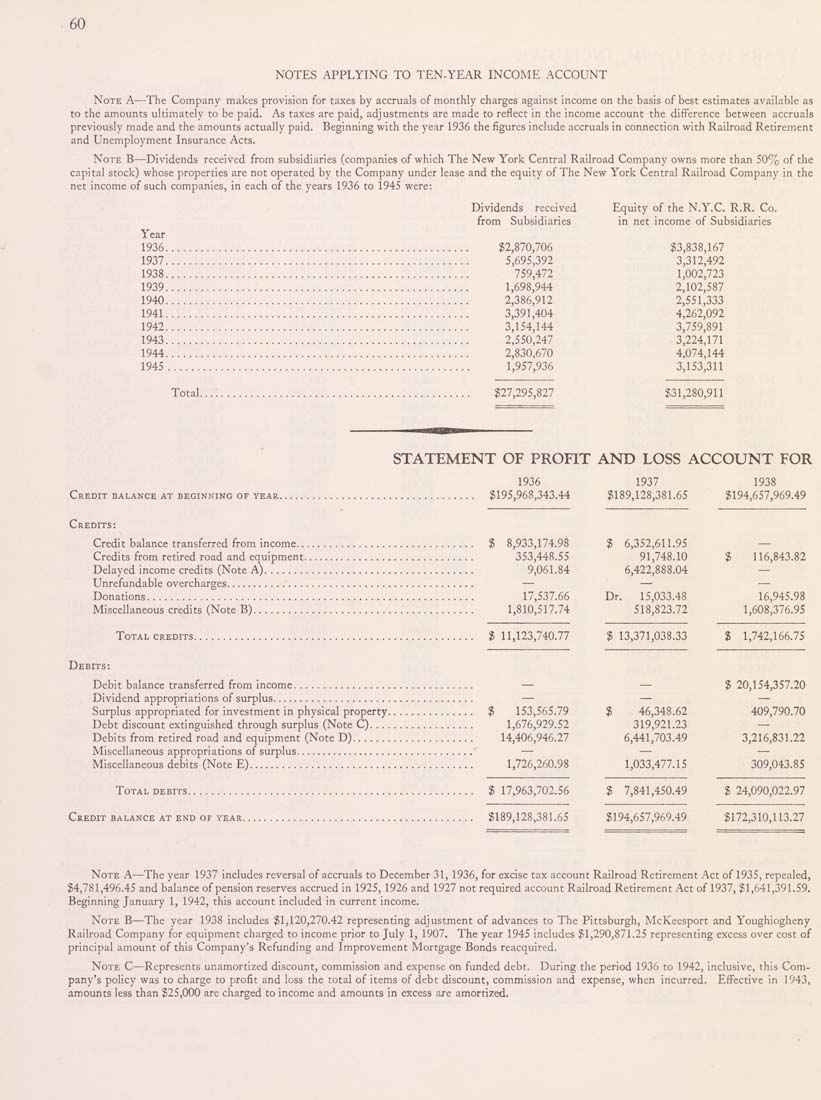

NOTES APPLYING TO TEN-YEAR INCOME ACCOUNT

Note A—The Company makes provision for taxes by accruals of monthly charges against income on the basis of best estimates available as

to the amounts ultimately to be paid. As taxes are paid, adjustments are made to reflect in the income account the difference between accruals

previously made and the amounts actually paid. Beginning with the year 1936 the figures include accruals in connection with Railroad Retirement

and Unemployment Insurance Acts.

Note B—Dividends received from subsidiaries (companies of which The New York Central Railroad Company owns more than 50% of the

capital stock) whose properties are not operated by the Company under lease and the equity of The New York Central Railroad Company in the

net income of such companies, in each of the years 1936 to 1945 were:

Dividends received Equity of the N.Y.C. R.R. Co.

from Subsidiaries in net income of Subsidiaries

Year

1936.................................................... $2,870,706 $3,838,167

1937.................................................... 5,695,392 3,312,492

1938.................................................... 759,472 1,002,723

1939.................................................... 1,698,944 2,102,587

1940.................................................... 2,386,912 2,551,333

1941.................................................... 3,391,404 4,262,092

1942.................................................... 3,154,144 3,759,891

1943.................................................... 2,550,247 3,224,171

1944.................................................... 2,830,670 4,074,144

1945.................................................... 1,957,936 3,153,311

Total...;........................................... $27,295,827 $31,280,911

STATEMENT OF PROFIT AND LOSS ACCOUNT FOR

1936 1937 1938

Credit balance at beginning of year.................................. $195,968,343.44 $189,128,381.65 $194,657,969.49

Credits:

Credit balance transferred from income............................... $ 8,933,174.98 $ 6,352,611.95 —

Credits from retired road and equipment.............................. 353,448.55 91,748.10 $ 116,843.82

Delayed income credits (Note A).................................... 9,061.84 6,422,888.04 —

Unrefundable overcharges........................................... — — —

Donations........................................................ 17,537.66 Dr. 15,033.48 16,945.98

Miscellaneous credits (Note B)...................................... 1,810,517.74 518,823.72 1,608,376.95

Total credits................................................ $ 11,123,740.77 $ 13,371,038.33 $ 1,742,166.75

Debits:

Debit balance transferred from income............................... — — $ 20,154,357.20

Dividend appropriations of surplus................................... — — —

Surplus appropriated for investment in physical property............... $ 153,565.79 $ 46,348.62 409,790.70

Debt discount extinguished through surplus (Note C).................. 1,676,929.52 319,921.23 —

Debits from retired road and equipment (Note D)..................... 14,406,946.27 6,441,703.49 3,216,831.22

Miscellaneous appropriations of surplus................................ — — —

Miscellaneous debits (Note E)....................................... 1,726,260.98 1,033,477.15 309,043.85

Total debits................................................. $ 17,963,702.56 $ 7,841,450.49 $ 24,090,022.97

Credit balance at end of year........................................ $189,128,381.65 $194,657,969.49 $172,310,113.27

Note A—The year 1937 includes reversal of accruals to December 31, 1936, for excise tax account Railroad Retirement Act of 1935, repealed,

$4,781,496.45 and balance of pension reserves accrued in 1925, 1926 and 1927 not required account Railroad Retirement Act of 1937, $1,641,391.59.

Beginning January 1, 1942, this account included in current income.

Note B—The year 1938 includes $1,120,270.42 representing adjustment of advances to The Pittsburgh, McKeesport and Youghiogheny

Railroad Company for equipment charged to income prior to July 1, 1907. The year 1945 includes $1,290,871.25 representing excess over cost of

principal amount of this Company's Refunding and Improvement Mortgage Bonds reacquired.

Note C—Represents unamortized discount, commission and expense on funded debt. During the period 1936 to 1942, inclusive, (his Com¬

pany's policy was to charge to profit and loss the total of items of debt discount, commission and expense, when incurred. Effective in 1943,

amounts less than $25,000 are charged to income and amounts in excess are amortized.

|