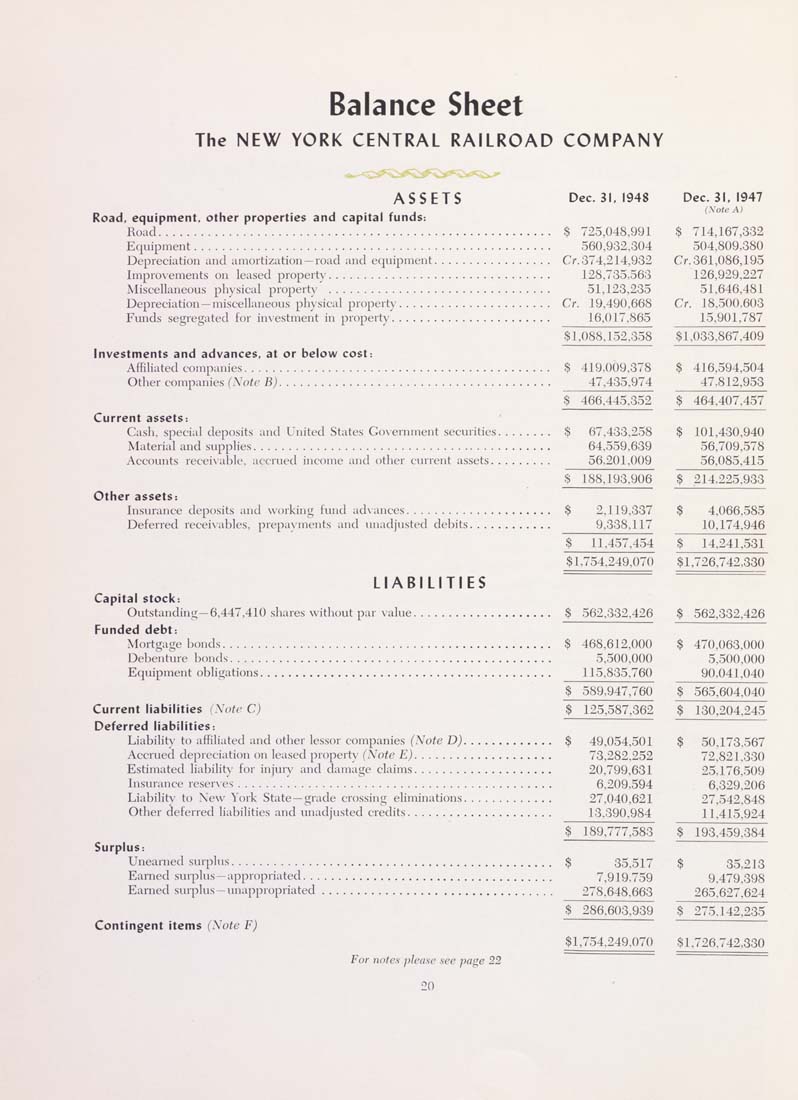

Balance Sheet

The NEW YORK CENTRAL RAILROAD COMPANY

ASSETS Dec. 31.1948 Dec. 31, 1947

Road, equipment, other properties and capital funds:

Riiud........................................................ 5 723,048,891 $ 714,167,332

Eiiuipmcnt................................................... 36(1,932,304 304,809,380

Depreciation and amortization-road and e<inipmeiil................. Cr.374,214,932 Cr. 361,086,195

Improvements on leased property................................ Iii8,733,563 126,929,227

Miscellaneous physical property ................................ 51,123,235 31,646,481

Depreciation —miscellaneous physical property...................... Cr. 19,490,668 Cr. 18,300,603

Funds segregated fen- investment in property....................... 16,017,865 15,901,787

$1.088,132.358 $1,033,867,409

Investments and advances, at or below cost:

Alfilialed companies............................................ $ 419,009,378 $ 416,594,504

Otlicr companies (Note B)....................................... _ 47,435,974 47,812,953

$" 466,445,352 $ 464.407.457

Current assets;

Cash, special deposits and I iiitcd Slates Govcrnincnl securities........ $ 67,433,258 $ 101,430,940

Material and .supplies........................................... 64,559.639 56,709,578

Aeeounls receivable, accrued income anil oilier einrent assets......... 56,201,009 56,085,415

.S 188.193.906 $ 214.225.933

Other assets:

Insurance deposits and working fund advances..................... $ 2.1 19.337 $ 4.066.585

Deferred receivables, prepayments and unadjusted clcljils............ 9,338.117 10,174.946

$ 11.437.454 $ 14,241,531

$ 1,734.249.070 $1,726,742,330

LIABUITIES "

Capital stock:

Outstanding-6,447.41() .shares witluiut p;u- \alue.................... $ 562,332,426 $ 562,332,426

Funded debt:

Mortgage bonds............................................... $ 468,612,000 $ 470,063,000

Debenture honils.............................................. 5,500,000 5,500,000

Equipment obhsiations.......................................... 115,835.760 90,041,040

$ 589,947,760 $ 565,604,040

Current liabilities i\otc C) $ 125,587.362 $ 130,204,245

Deferred liabilities:

Liabihty to affiliated and other lessor companies (Note D)............. $ 49,054.501 $ 50,173,567

Accrued depreciation on leased property (Note E).................... 73,282.252 72,821,330

Estimated liability for injury and damage claims.................... 20.799.631 25,176,509

Insurance reserves............................................. 6.209,594 6,329,206

Liability to New York State —grade crossing eliminations............. 27,040,621 27,542,848

Other deferred liabilities and unadjusted credits..................... 13,390,984 11,415,924

$ 189.777,583 $ 193.459,381

Surplus:

Unearned surplus.............................................. $ 35.517 $ 35,213

Earned surplus - appropnated.................................... 7.919-759 9,479.398

Earned .surplus-unappropriated................................. 278.648,663 265,627,624

$ 286.603,939 $ 275.142.235^

Contingent items {Note F)

$1,754.249.070 $1,726.742,330

For notes pJeasc see page 22

20

|