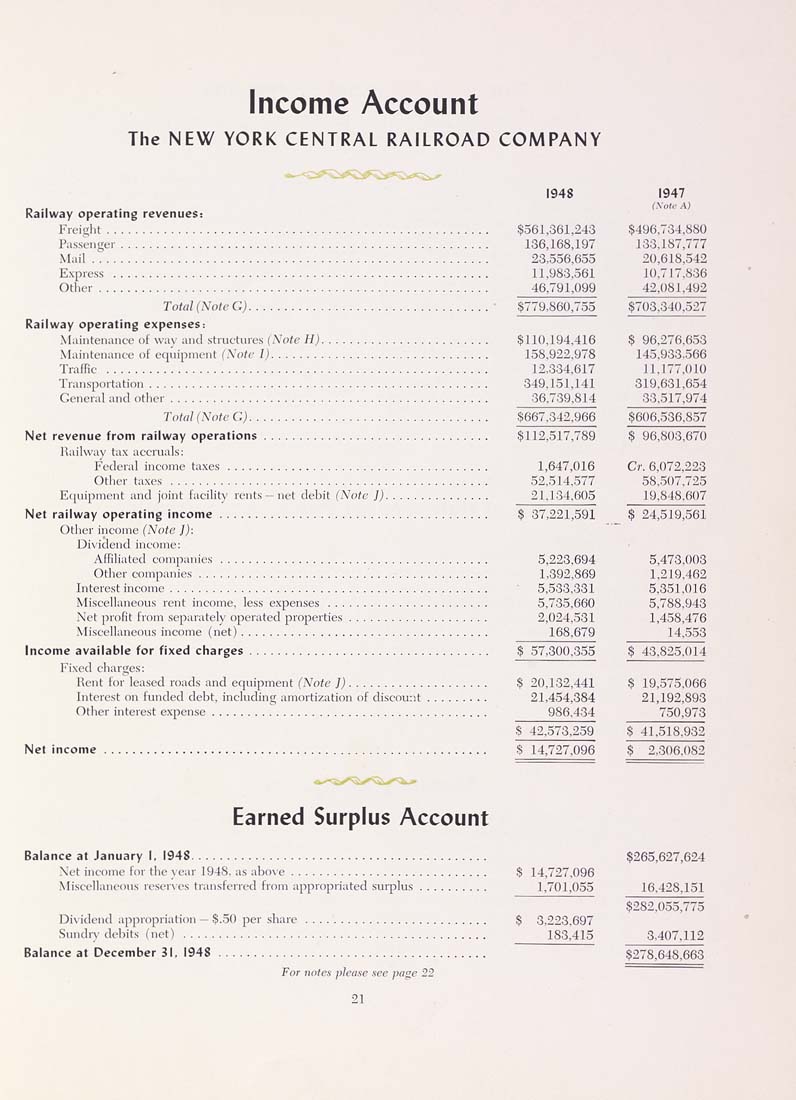

Income Account

The NEW YORK CENTRAL RAILROAD COMPANY

I94S

Earned Surplus Account

A)

Railway operating revenues;

Frci.,;hl...................................................... 5561,361,243 $496,734,880

Tasseiigcr.................................................... 136,168,197 133,187,777

Mail........................................................ 23,536,655 20,618,542

Express ..................................................... 11,983,561 10.717,836

Other....................................................... 46,791,099 42,081,492

Total (Note G).................................. $779,860,755 $703,340,527

Railway operating expenses:

Maintenance of way and structures (AWe HJ........................ $110,194,416 $ 96,276.653

Maintenance of equipment (Note I)............................... 158.922.978 145.933.566

TraHic ...................................................... 12.334.617 11.177,010

Transportation................................................ 349.151,141 319,631,654

General and other............................................. .36.7.39,814 33.517,974

Tolal (Xole C).................................. $667.342,966 $606,536,857

Net revenue from railway operations................................ $112,517,789 $ 96,803,670

Hallway tax accruals:

Federal income taxes ..................................... 1,647,016 Cr. 6,072,223

Other taxes ............................................. 52.514.577 58.507,725

Et|uipmeut and joint facility rents - net debit (Note J)............... 21.1.34.605 19,848,607

Net railway operating income...................................... $ 37,221,591 _ $ 24,519,561

Oilier iiicomo (Nolo J):

Dividend income:

AlBlialed companies ...................................... 5,223,694 5,473,003

Other companies......................................... 1,392,869 1,219,462

Intere.st income............................................. 5,533,331 5,351,016

Miscellaneous rent income, less expenses ....................... 5,735,660 5,788,943

Net profit from separately operated properties.................... 2,024,531 1,458,476

Miscellaneons income (net)................................... 168,679 14,553

Income available for fixed charges.................................. $ 57,300.355 $ 43,825.014

Fixed charges:

Rent for lea.sed roads :md equipment (Note I).................... 5 20,132,441 $ 19,575,066

Interest on funded debt, including amortization of disei)u:il......... 21,454,384 21,192,893

Other interest expense........^.............................. 986.434 750,973

S 42.373.239" $ 41,518,932"

Net income...................................................... $ 14,727,096 $ 2,306,082

Balance at January 1, 1948.......................................... $263,627,624

\et income h)r the \c:u- 1948, as :d)0\e............................ $ 14,727.096

Miseelhmeous rescr\es Inmsfeired IVom :ipproprialcd surplus.......... 1,701,055 16.428,151

$282,055,775

Di\ idend ;i]ipn)prialion - $..50 per share .......................... $ 3,223.697

Sundiv dehils (net) ........................................... 183,415 3.407,112

Balance at December 31, 1948 ...................................... $278,648,663

For notes pteti.se see page 22

21

|