71

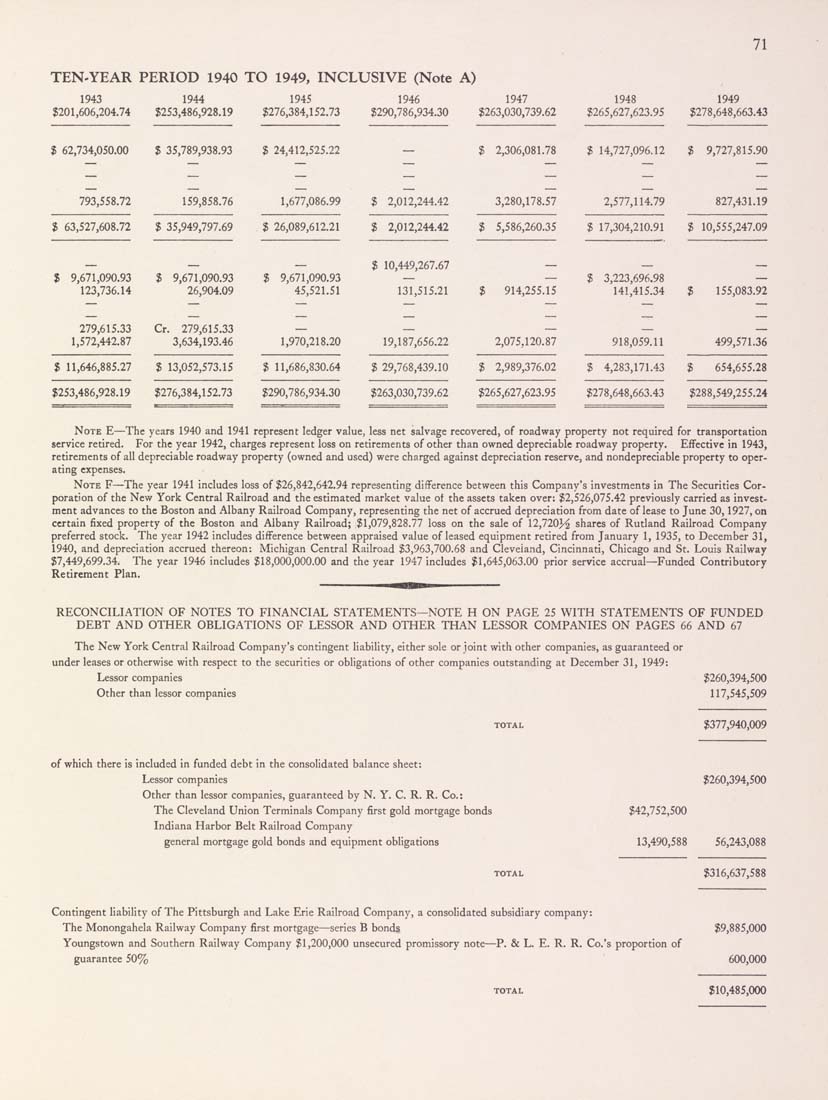

TEN-YEAR PERIOD 1940 TO 1949, INCLUSIVE (Note A)

1943 1944 1945 1946 1947 1948 1949

3201,606,204.74 3253,486,928.19 3276,384,152,73 3290,786,934.30 3263,030,739.62 3265,627,623.95 3278,648,663.43

3 62,734,050.00 3 35,789,938.93 3 24,412,525.22 — 3 2,306,081.78 3 14,727,096.12 3 9,727,815.90

793,558.72 159,858.76 1,677,086.99 3 2,012,244.42 3,280,178.57 2,577,114.79 827,431.19

3 63,527,608.72 3 35,949,797.69 3 26,089,612.21 3 2,012,244.42 3 5,586,260.35 3 17,304,210.91 3 10,555,247.09

— — — 3 10,449,267.67 — — —

$ 9,671,090.93 3 9,671,090.93 3 9,671,090.93 — — 3 3,223,696.98 —

123,736.14 26,904.09 45,521.51 131,515.21 3 914,255.15 141,415.34 3 155,083.92

279,615.33 Cr. 279,615.33 — — _ _ _

1,572,442.87 3,634,193.46 1,970,218.20 19,187,656.22 2,075,120.87 918,059.11 499,571.36

3 11,646,885.27 3 13,052,573.15 3 11,686,830.64 3 29,768,439.10 3 2,989,376.02 3 4,283,171.43 3 654,655.28

3253,486,928.19 3276,384,152.73 3290,786,934.30 3263,030,739.62 3265,627,623.95 3278,648,663.43 3288,549,255.24

Note E—The years 1940 and 1941 represent ledger value, less net salvage recovered, of roadway property not required for transportation

service retired. For the year 1942, charges represent loss on retirements of other than owned depreciable roadway property. Effective in 1943,

retirements of all depreciable roadway property (owned and used) were charged against depreciation reserve, and nondepreciable property to oper¬

ating expenses.

Note F—The year 1941 includes loss of 326,842,642.94 representing difference between this Company's investments in The Securities Cor¬

poration of the New York Central Railroad and the estimated market value oi the assets taken over: 32,526,075.42 previously carried as invest¬

ment advances to the Boston and Albany Railroad Company, representing the net of accrued depreciation from date of lease to June 30,1927, on

certain fixed property of the Boston and Albany Railroad; 31,079,828.77 loss on the sale of 11,110)4, shares of Rutland Railroad Company

preferred stock. The year 1942 Includes difference between appraised value of leased equipment retired from January 1, 1935, to December 31,

1940, and depreciation accrued thereon: Michigan Central Railroad 33,963,700.68 and Cleveland, Cincinnati, Chicago and St. Louis Railway

37,449,699.34. The year 1946 includes 318,000,000.00 and the year 1947 includes 31,645,063.00 prior service accrual—Funded Contributory

Retirement Plan.

RECONCILIATION OF NOTES TO FINANCIAL STATEMENTS—NOTE H ON PAGE 25 WITH STATEMENTS OF FUNDED

DEBT AND OTHER OBLIGATIONS OF LESSOR AND OTHER THAN LESSOR COMPANIES ON PAGES 66 AND 67

The New York Central Railroad Company's contingent liability, either sole or joint with other companies, as guaranteed or

under leases or otherwise with respect to the securities or obligations of other companies outstanding at December 31, 1949:

Lessor companies 3260,394,500

Other than lessor companies 117,545,509

3377,940,009

of which there is included in funded debt In the consolidated balance sheet:

Lessor companies 3260,394,500

Other than lessor companies, guaranteed by N. Y. C. R. R. Co.:

The Cleveland Union Terminals Company first gold mortgage bonds 342,752,500

Indiana Harbor Belt Railroad Company

general mortgage gold bonds and equipment obHgations 13,490,588 56,243,088

3316,637,588

Contingent liability of The Pittsburgh and Lake Erie Railroad Company, a consolidated subsidiary company:

The Monongahela Railway Company first mortgage—series B bonds 39,885,000

Youngstown and Southern Railway Company 31,200,000 unsecured promissory note—P. & L. E. R. R. Co.'s proportion of

guarantee 50% ' 600,000

TOTAL 310,485,000

|