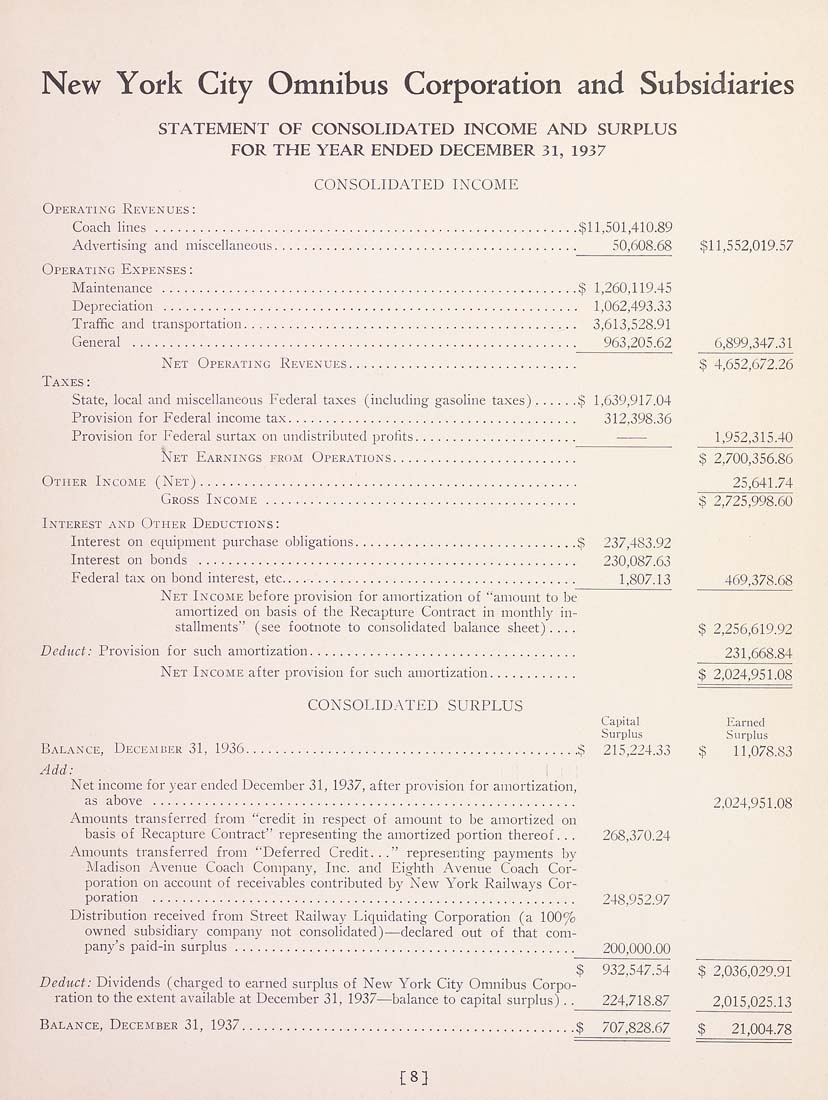

New York City Omnibus Corporation and Subsidiaries

STATEMENT OF CONSOLIDATED INCOME AND SURPLUS

FOR THE YEAR ENDED DECEMBER 31, 1937

CONSOLIDATED INCOME

Operating Revenues:

Coach lines .........................................................$11,501,410.89

Advertising and miscellaneous......................................... 50,608.68 $11,552,019.57

Operating Expenses :

Maintenance ........................................................$ 1,260,119.45

Depreciation ........................................................ 1,062,493.33

Traffic and transportation............................................. 3,613,528.91

General ........................................................... 963,205.62 6,899,347.31

Net Operatjng Revenui'S............................... $ 4,652,672.26

Taxes :

State, local and miscellaneous Federal taxes (including gasoline taxes)......$ 1,639,917.04

Provision for Federal income tax....................................... 312,398.36

Provision for Federal surtax on undistributed profits...................... ------ 1,952,315.40

Net Earnings from Operations......................... $ 2,700,356.86

Other Income (Net)................................................... 25,641.74

Gross Income .......................................... $ 2,725,998.60

Interest and Other Deductions:

Interest on equipment purchase obligations..............................$ 237,483.92

Interest on bonds ................................................... 230,087.63

Federal tax on bond interest, etc........................................ 1,807.13 469,378.68

Net Income before provision for amortization of "amount to be

amortized on basis of the Recapture Contract in monthly in¬

stallments" (see footnote to consohdated balance sheet).... $ 2,256,619.92

Deduct: Provision for such amortization.................................... 231,668.84

Net Income after provision for such amortization............ $ 2,024,951.08

CONSOLIDATED SURPLUS

Capital Earned

Surplus Surplus

Balance, Dkcemcer 31, 1936.............................................$ 215,224.33 $ 11,078.83

Add:

Net income for j'car ended December 31, 1937, after provision for amortization,

as above ......................................................... 2,024,951.08

Amounts transferred from "credit in respect of amount to be amortized on

basis of Recapture Contract" representing the amortized portion thereof... 268,370.24

Amounts transferred from "Deferred Credit..." representing payments by

Madison Avenue Coach Company, Inc. and Eighth Avenue Coach Cor¬

poration on account of receivables contributed by New York Railways Cor¬

poration ......................................................... 248,952.97

Distribution received from Street Railway Liquidating Corporation (a 100%

owned subsidiary company not consolidated)—declared out of tliat com¬

pany's paid-in surplus.............................................. 200,000.00

$ 932,547.54 $ 2,036,029.91

Deduct: Dividends (charged to earned surplus of New York City Omnibus Corpo¬

ration to the extent available at December 31, 1937—balance to capital surplus).. 224,718.87 2,015,025.13

Balance, December 31, 1937.............................................$ 707,828.67 $ 21,004.78

[8}

|