The Greater New York Charter as enacted in 1897

(Albany : Weed-Parsons, c1897.)

|

||

|

|

|

|

| Page [421] |

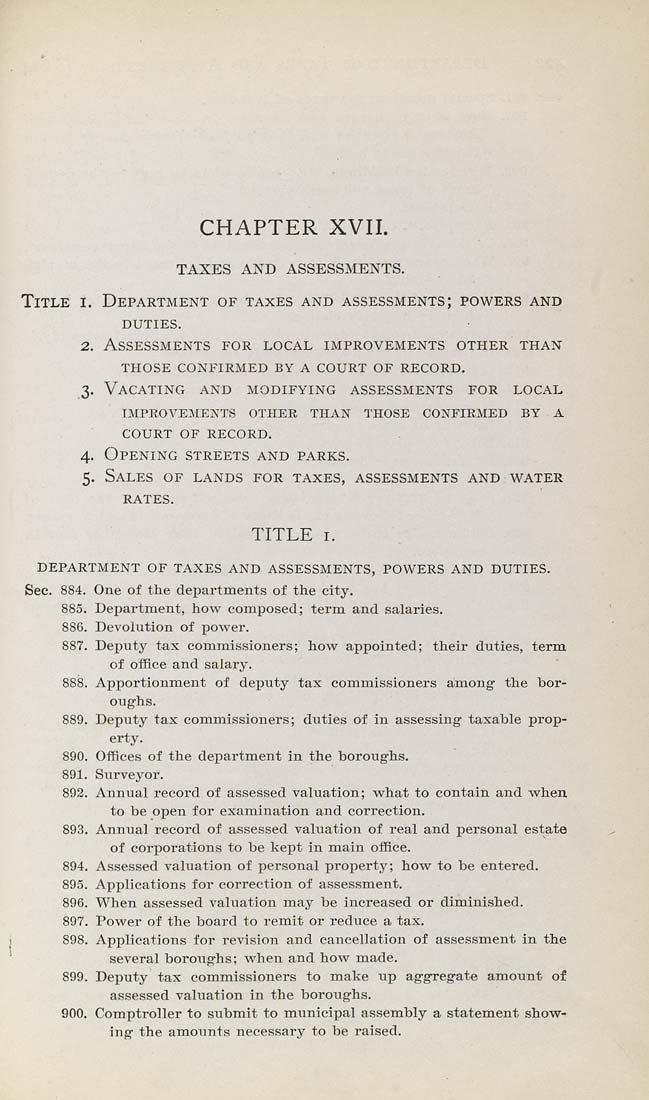

CHAPTER XVIL taxes and assessments. Title i. Department of taxes and assessments; powers and DUTIES. 2. Assessments for local improvements other than those confirmed by a court of record. 3. Vacating and modifying assessments for local improvements other than those cosfiemed by a court of record. 4. Opening streets and parks. 5. Sales of lands for taxes, assessments and water rates. TITLE I. department of taxes and assessments, powers and duties. Sec. 884. One of the departments of the city. 885. Dej)artment, how composed; term and salaries. 886. Devolution of power. 887. Deputy t-ax commissioners; how appointed; their duties, term of office and salary. 888. Apportionment of deputy tax commissioners among the bor¬ oughs. 889. Deputy tax commissioners; duties of in assessing taxable prop¬ erty. 890. Offices of the department in the boroughs. 891. Surveyor. 892. Anniial record.of assessed valuation; what to contain and when to be open for examination and correction. 893. Annual record of assessed valuation of real and personal estate of corporations to be kept in main office. 894. Assessed valuation of personal property; how to be entered. 895. Applications for correction of assessment. 896. When assessed valuation may be increased or diminished. 897. Power of the board to remit or reduce a tax. 898. Applications for revision and cancellation of assessment in the several boroughs; when and how made. 899. Deputy tax commissioners to make up aggregate amount of assessed valuation in the boroughs. 900. Comptroller to submit to municipal assembly a statement show- iiig the amounts necessary to be raised. |

| Page [421] |