The Record and guide (v.39no.981(Jan. 1 1887)-no.1006(June 25 1887))

(New York, N.Y. : C.W. Sweet, -1887.)

|

||

|

|

|

|

| v. 39, no. 984: Page 97 |

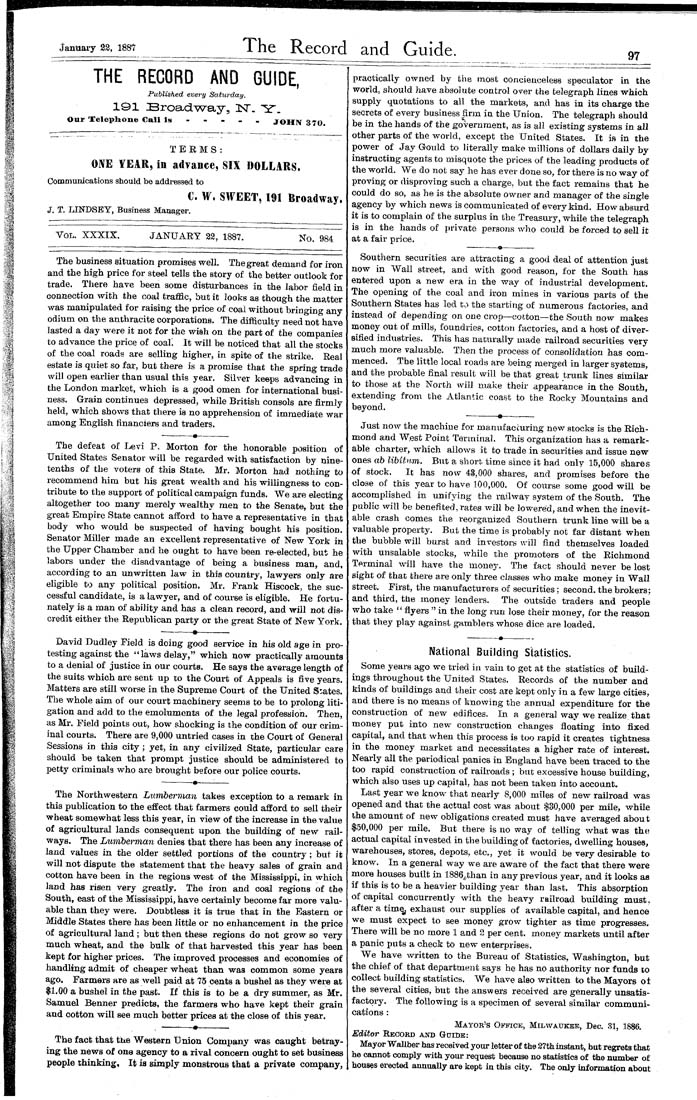

January 23, IBS'? The Record and Guide. 97 THE RECORD AND GUIDE, Published every Saturday. 191 Broadway, HST. 1^. JOHN 370. Our Telephone Call Is TERMS: ONE YEAR, in adyance, SIX DOLLARS. Communications should be addressed to C. W. SWEET, 191 Broadway. J. T. LINDSEY, Business Manager. Vol. XXXIX. JANUARY 23, 1887. No. 984 The business situation promises well. The great demand for iron and the high price for steel tells the story of the better outlook for trade. There have been some disturbances in the labor field in connection with the coal traffic, but it looks as though the matter was manipulated for raising the price of coal without bringing any odium on the anthracite corporations. The difficulty need not have lasted a day were it not for the wish on the part of the companies to advance the price of coal. It will be noticed that all the stocks of the coal roads are selling higher, in spite of the strike. Real estate is quiet so far, but there is a promise that the spring trade will open earlier than usual this year. Silver keeps advancing in the London market, which is a good omen for international busi¬ ness. Grain continues depressed, while British consols are firmly held, which shows that there is no apprehension of immediate war among English financiers and traders. The defeat of Levi P, Morton for the honorable position of United States Senator will be regarded with satisfaction by nine- tenths of the voters of this State. Mr. Morton had nothing to recommend him but his great wealth and his willingness to con¬ tribute to the support of political campaign funds. We are electing altogether too many merely wealthy men to the Senate, but the great Empire State cannot afford to have a representative in that body who would be suspected of having bought his position. Senator Miller made an excellent representative of New York in the Upper Chamber and he ought to have been re-elected, but he labors under the disadvantage of being a business man, and, according to an unwritten law in this country, lawyers only are eligible to any political position. Mr. Frank Hiscock, the suc¬ cessful candidate, is a lawyer, and of course is eligible. He fortu¬ nately is a man of ability and has a clean record, and will not dis¬ credit either the Republican party or the great State of New York, David Dudley Field is doing good service in his old age in pro¬ testing against the "laws delay," which now practically amounts to a denial of justice in our courts. He says the average length of the suits which are sent up to the Court of Appeals is five years. Matters are still worse in the Supreme Court of the United S'.ates. The whole aim of our court machinery seems to be to prolong liti¬ gation and add to the emoluments of the legal profession. Then, as Mr. Field points out, how shocking is the condition of our crim¬ inal courts. There are 9,000 untried cases in the Court of General Sessions in this city ; yet, in any civilized State, particular care should be taken that prompt justice should be administered to petty criminals who are brought before our police courts. The Northwestern Lumberman takes exception to a remark in this publication to the effect that farmers could afford to sell their wheat somewhat less this year, in view of the increase in the value of agricultural lands consequent upon the building of new rail¬ ways. The Lumberman denies that there has been any increase of land values in the older settled portions of the country; but it will not dispute the statement that the heavy sales of grain and cotton have been iu the regions west of the Mississippi, in which land has risen very greatly. The iron and coal regions of the South, east of the Mississippi, have certainly become far more valu¬ able than they were. Doubtless it is true that in the Eastern or Middle States there has been little or no enliancement in the price of agricultural land ; but then these regions do not grow so very much wheat, and the bulk of that harvested this year has been kept for higher prices. The improved processes and economies of handling admit of cheaper wheat than was common some years ago. Farmers are as well paid at 75 cents a bushel as they were at $1.00 a bushel in the past. If this is to be a dry summer, as Mr. Samuel Benner predicts, the farmers who have kept their grain and cotton will see much better prices at the close of this year. The fact that the Western Union Company was caught betray¬ ing the news of one agency to a rival concern ought to set business people thinking. It is simply monstrous that a private company. practically owned by the most concienceless speculator in the world, should have absolute control over the telegraph lines which supply quotations to all the markets, and has in its charge the secrets of every business firm in the Union. The telegraph should be in the hands of the government, as is all existing systems in all other parts of the world, except the United States. It is in the power of Jay Gould to literally make millions of dollars daily by instructing agents to misquote the prices of the leading products of the world. We do not say he has ever done so, for there is no way of proving or disproving such a charge, but the fact remains that he could do so, as he is the absolute owner and manager of the single agency by which news is communicated of every kind. How absurd it is to complain of the surplus in the Treasury, while the telegraph is in the hands of private persons who could be forced to sell it at a fair price, ——-----------o------■-------------- Southern securities are attracting a good deal of attention just now in Wall street, and with good reason, for the South has entered upon a new era in the way of industrial development. The opening of the coal and iron mines in various parts of the Southern States has led to the starting of numerous factories, and instead of depending on one crop—cotton—the South now makes naoney out of mills, foundries, cotton factories, and a host of diver¬ sified industries. This has natiu-aliy made railroad securities very much more valuable. Then the process of consolidation has com¬ menced. Tbe little local roads are being merged in larger systems, and the probable final result will be that great trunk lines similar to those at the North will make their appearance in the South, extending from the Atlantic coast to the Rocky Mountains and beyond. ----------a—'------- Just now the machine for manuf ac curing new stocks is the Rich¬ mond and West Point Terminal. This organization has a remark¬ able charter, which allows it to trade in securities and issue new ones ab libitum. But a short time since it had only 15,000 shares of stock. It has now 4§,000 shares, and promises before the close of this year to have 100,000. Of course some good will be accomplished in unifying the railway system of the South. The public will be benefited, rates will be lowered, and when the inevit¬ able crash comes the reorganized Southern trunk line will be a valuable property. But the time is probably not far distant when the bubble will burst and investors will find themselves loaded with unsalable stocks, while the promoters of the Richmond Terminal will have the money. The fact should never be lost sight of that there are only three classes who make money in Wall street. First, the manufacturers of securities; second, the brokers; and third, the money lenders. The outside traders and people who take " flyers " in the long run lose their money, for the reason that they play against gamblers whose dice are loaded. National Building Statistics. Some years ago we tried in vain to get at the statistics of build¬ ings throughout the United States. Records of the number and kinds of buildings and their cost are kept only in a few large cities, and there is no means of knowing the annual expenditure for the construction of new edifices. In a general way we realize that money put into new construction changes floating into fixed capital, and that when this process is too rapid it creates tightness in the money market and necessitates a higher raie of interest. Nearly all the periodical panics in England have been traced to the too rapid construction of railroads ; but excessive house building, which also uses up capital, has not been taken into account. Last year we know that nearly 8,000 miles of new railroad was opened and that the actual cost was about $30,000 per mile, while the amount of new obligations created must have averaged about $50,000 per mile. But there is no way of telling what was the actual capital invested in the building of factories, dweUing houses, warehouses, stores, depots, etc., yet it would be very desirable to know. In a general way we are aware of the fact that there were more houses built in 1886^than in any previous year, and it looks as if this is to be a heavier building year than last. This absorption of capital concurrently with the heavy railroad building must, after a tim^ exhaust our supplies of available capital, and hence we must expect to see money grow tighter as time progresses. There will be no more 1 and 2 per cent, money markets until after a panic puts a check to new enterprises. We have written to the Bureau of Statistics, Washington, but the chief of that department says he has no authority nor funds to collect building statistics. We have also written to the Mayors of the several cities, but the answers received are generally unsatis¬ factory. The following is a specimen of several similar communi¬ cations : Mayor's Office, Milwaukbb, Dec, 31, 1886. Editor Record and Guide: Mayor WaUber has received your letter of the 27th instant, but regrets that he cannot comply with your request because no statistics of the number of houses erected annually are kept in this city. The only information about |

| v. 39, no. 984: Page 97 |