The exponential function

has the form:

F(x) = y = abx

where

a ¹ 0 and b is a constant called the

base of the exponential function. b > 0 and b ¹

1

x is

the independent variable. It is the exponent of the constant, b. Thus

exponential functions have a constant base raised to a variable exponent

In economics

exponential functions are important when looking at growth or decay.

Examples are the value of an investment that increases by a constant percentage

each period , sales of a company that increase at a constant percentage

each period, models of economic growth or models of the spread of an epidemic.

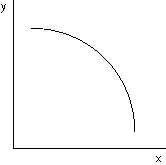

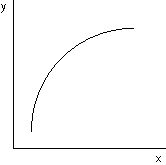

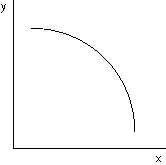

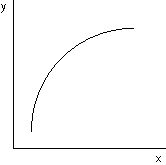

Notice

that as the value of x increases, the value of y increases or decreases more

and more rapidly.

Examples

of the exponential function

Applications

of exponential functions

An

exponential demand function

Demand

for a product in thousands of units can be expressed by the following exponential

demand function where p is the price in dollars:

Compound

interest - The time value of money

Financial

decision making, whether by the private sector, the government or by households

requires the evaluation of whether an expenditure is justified by the benefits

it is expected to confer. The investment decision involves acquiring

something in the expectation that it will be worth more in the future. In

financial terms this means purchasing an asset or assets which will provide

future income. Typically the expenditure and the benefits occur at different

points in time. Therefore sums of money occurring at different dates must

be compared.

Examples

of investment income include

The investment

decision is the acquisition of a productive asset.

If the

expected future inflow is greater than the present outflow then there is the

expectation of a positive return which favors making the investment decision.

Therefore the analysis of investment requires comparison of outflows with expected

inflows.

Although

the two procedures always yield the same decision, the discounting process

is more commonly used for financial decision making.

Notation

PV Present value

a value at time = 0

FV Future value

a value in some future period

the beginning amount plus accumulated compound interest

because the future has an infinite number of periods, these

periods are distinguished from each other by the use of subscripts.

FV1 = the value at the end of the first period

FV2 = the value at the end of the second period

FVn = the value at the end of the nth period

It is

important to note that in the future value notation, the future values are

understood to occur at the end rather than at the beginning of the relevant

future period. The standard financial tables, financial calculators,

and the spreadsheet Excel are all constructed with this understanding.

r the interest

rate per period

the discount rate

n the number of periods

in the analysis

Note

In finance discounting is the procedure for calculating present values.

However in retailing discounting is the procedure of reducing selling price

in order to increase sales.

Future

Values and compounding (single payments)

Compounding

is the process of converting values of the present to values of the future.

We begin

with present value.

What

do we have at the end of the first period, i.e. what is FV1?

At the

end of the first period we have our initial value, PV, plus the interest earned

on that initial value, rPV.

FV1 = PV + rPV

FV1 = PV (1+r)

What

do we have at the end of the second period, i.e. what is FV2?

We begin

the second period with FV1.

At the

end of the second period we have what we began with, FV1, plus

the interest earned on FV1.

FV2 = FV1 + r FV1

FV2 = FV1 (1+r)

FV2 = PV (1+r) (1+r)

FV2 = PV (1+r)2

If we

continued to calculate future values for all future periods we would note

the subscript for the relevant future period is the same numerical value as

the exponent for the expression (1+r).

It is

thus possible to find a general expression for any future value

FVn = PV (1+r)n

This is an exponential function of the form

y = a bn

where PV = a and

(1 + r) = b

In this expression the future value is determined by the value of r,

the interest rate, and n, the time period. Financial tables have been

constructed for many possible values of r and n. The expression, (1+r)n,

is known as the future value interest factor for a single payment, FVIFr,n

where r is the interest rate and n is the number of periods.

Examples

1.

Deposit 100 and leave it for twenty periods in an account which earns

4 percent per period. How much will be in the account at the end of

twenty periods?

FV20 = ?

FV20 = 100 (1.04)20

FV20 = 100 (2.1911)

FV20 = 219.11

2.

Invest 2,000 in stock whose expected annual rate of return is

8 percent. How much will you have at the end of ten years?

FV10 = ?

FV10 = 2,000 (1.08)10

FV10 = 2,000 (2.1589)

FV10 = 4,317.80

Present

Values and discounting (single payments)

Discounting is the process of converting expected future values

to present values.

We begin with a future value.

FVn = PV (1+r)n

PV = FV (PVIF n,r)

In this

expression the present value is determined by the value of r, the interest

rate, and n, the time period. Financial tables have been constructed

for many possible values of r and n. The expression, in square brackets,

is known as the present value interest factor for a single payment,

PVIF r,n where r is the interest rate and n is the number of periods.

Note that the present value interest factor for a single payment

is the inverse of the future value interest factor.

Examples

1.

A financial instrument is expected pay 5,000 in ten years. The

interest rate available today is 10 percent. What would be a fair price

for the claim to receive that 5,000 in ten years?

PV = ?

PV = 5,000 (.3855)

PV = 1927.50

2.

An investment today is expected to generate a series of cash flows in the

future such as the following:

0

-1,000

investment expenditure

1

200

2

400

receipts from the investment

3

700

An unsophisticated

analyst might consider this a good investment because the sum of the receipts,

1,300, is greater than the investment expenditure, 1,000. Such an analyst

might consider that the investment offers a gain of 300.

However

this is the wrong approach. Values of different periods can never

be aggregated before they are standardized. Failure to do so ignores

the fact that funds available in the present can be invested to grow to some

future value. The correct approach to analyzing this investment is to

discount each of the individual future values, then to aggregate them, and

finally to compare the result to the initial investment expenditure.

If the available interest rate is 14 percent then

-1,000 + 200 (.8772) + 400 (.7695) + 700 (.6750)

= -44.26

Accepting

this investment would actually create an immediate loss of 44 rather than

a gain of 300. This is an example of one of the basic methods of investment

analysis, the net present value method or NPV. It is called net present

value because it adds the receipts net of the expenditure.

Note

that the present value of a future value decreases as the discount rate increases

and decreases the further into the future the cash flow occurs.

[Index]