Project Objective

Project Objective

Through the Columbia Business School and Vagelos College of Physicians and Surgeons masterclass, Healthcare Management, Design and Strategy, our team was able to work closely with Quest Diagnostics to address one of their fundamental business problems: How should Quest respond to physician consolidation?

The primary objective of the

project was to conduct research on physician consolidation trends, quantify its

impact on Quest’s traditional core market, and develop a go-forward strategy

which identified alternative opportunities for growth.

Solution Approach -- Choice structuring, Options

By working closely with Quest’s

Corporate Strategy Team and select internal and external stakeholders, our team

recognized the need for Quest to focus its strategy to meet the needs of

non-independent physician practices and through qualitative and quantitative

competitive gap analysis, identified five opportunities for growth:

1. Change Quest’s Testing Mix: focus on advanced, esoteric testing

capabilities.

2. Accelerate Information Technology (IT)

Solutions: expand and extend

analytics and health system offerings.

3. Partnerships and Acquisitions: drive growth through partnerships and

acquisitions of labs/providers.

4. Increase Point of Care (POC) Services: increase offerings such as at-home test

kits; POC screens.

5. Drive Consultative Sales Approach: utilize testing expertise to drive value

for customers.

Given our timeline,

our group worked with Quest’s team to narrow the project’s scope and focus on testing

mix, specifically within oncology, which represents a Quest focus area and

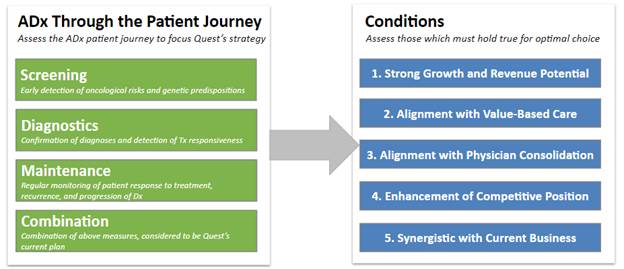

significant business opportunity. Using the patient journey as our roadmap, our

team then identified three distinct types of tests and therefore, four choices,

which Quest could focus its strategy to meet the needs of consolidated oncology

practices:

1. Screening: early detection of oncological risks and

genetic predispositions.

2. Diagnostic: confirmation and diagnosis of disease;

therapy selection.

3. Maintenance: regular monitoring of patient response

to treatment.

4. Combination: combination of above measures,

considered to be Quest’s current plan.

Utilizing the

“Choice-Structuring” approach taught in class, our group developed five

conditions on which we assessed each of the four choices above to identify the

optimal go-forward strategy. The five conditions, phrased as questions below,

included:

1. Does this strategy have strong growth and

revenue potential?

2. Does this strategy align with value-based

care trends?

3. Does this strategy address physician consolidation?

4. Does this strategy enhance Quest’s competitive

position?

5. Is this strategy synergistic with Quest’s

current offerings?

Comprehensive

research led to the following conclusions:

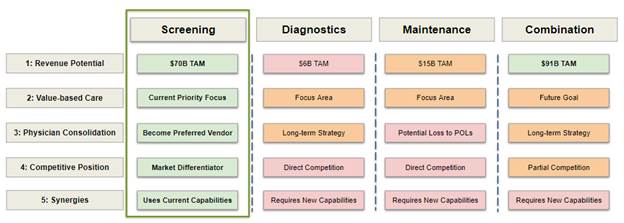

1. Cancer diagnostics are projected to grow

significantly in the coming years with cancer screening being the largest

segment in the market.

a. The oncology diagnostics market is fragmented with

independent providers capturing 10x more test volume than Quest.

b. Market for basic diagnostics projected to

grow 2.7% annually through 2026 vs. 7% for cancer diagnostics.

c. Early cancer screening is assessed

to have a market value of $70B while diagnostic and maintenance

testing are projected to have market values of $6B and $15B

respectively.

2. A push toward value-based care will

increase focus on early-detection screening, decreasing the need for

late-stage, expensive treatments.

a. Cost of cancer care is increasing 15%

annually, partially due to delay in diagnosis and treatments.

3. Independent oncology practices have the

highest rates of vertical consolidation across clinical specialties.

a. Oncology practices are consolidating

rapidly (’08 – ’20 statistics):

i.

722

oncology practices acquired by hospitals.

ii.

203

oncology practices merged or acquired by corporates.

iii.

348

oncology practices experiencing financial distress.

iv.

7%

annual increase in acquisition rate of oncology practices.

b. Consolidated oncology groups currently

outsource labs to multiple vendors.

4. Key competitors are focusing on oncology diagnostics

and therapy selection, leaving the screening market open for Quest.

a. There exists an opportunity for Quest to

acquire and partner with screening practices.

5. Quest’s stance as a leading provider of

lab infrastructural excellence and existing partnerships mean that it is well

suited to adopt oncology screening as a major strategic focus.

a. Quest already has major partnerships with

market leaders in screening which stand to be excellent launch pads as

testing modalities receive FDA approval.

Recommendation

Our analysis suggests Quest

should focus on enhancing its advanced testing capabilities by specifically

focusing on cancer screening. This recommendation is based on the belief

that screening best meets all of our prescribed

conditions and should therefore be chosen as Quest’s go-forward focused

strategy. As demonstrated below, a focus on screening provides Quest:

·

Strong

growth and revenue potential

·

Alignment

with value-based care

·

Alignment

with physician consolidation

·

Enhancement

of its competitive position

·

Synergies

with current business

Ultimately,

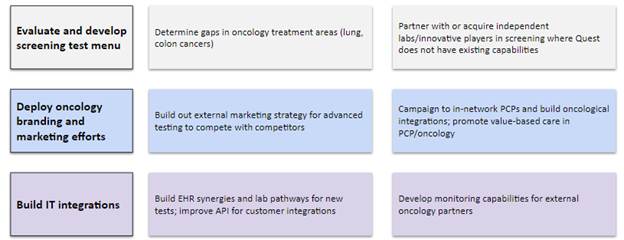

we believe Quest should focus on developing expanded screening capabilities to

become the primary laboratory for health systems and consolidating customers. To

do so, we recommend that Quest:

·

Evaluate

and develop a screening test menu

·

Deploy

oncology branding and marketing efforts

·

Built

IT integrations

Final Thoughts

Working with Quest Diagnostics has been an absolute pleasure. Special thanks to our sponsors Kirk Wilson, Jennifer Tsao, and Patrick Doolittle, who have made this semester extremely educational and rewarding.

As this was the first time Healthcare Management, Design and Strategy was offered, our team was unsure what to expect at the beginning of the semester. Working with the professors and our counterparts at Quest Diagnostics exceeded all expectations. As a group with diverse backgrounds and career aspirations, we learned how to work together effectively, understand a complex business problem, and through a disciplined analysis, deliver value to our client.

Contributors: