nference: Adding Value in the Glioblastoma Clinical Journey

Project

Objective

Through the Columbia

Business School & the Vagelos College

of Physicians and Surgeons masterclass, Healthcare Management, Design

and Strategy, our team was able to work closely with nference to consider opportunities to add value in the

Glioblastoma (GBM) clinical journey.

This larger problem was broken down into two

phases: 1) defining the problem, and 2) identifying white space. Defining the

problem required expert interviews, meetings with the nference team,

and discussion with course professors. Then, identifying white space required a

market scan of the space. The market scan included analysis of companies focused

on the GBM clinical journey or adjacent areas (EHR data solutions, multiomics solutions, and AI-based radiology solutions).

This market scan was then layered on to the problem space to identify opportune

areas for impact.

Solution

Approach – Design thinking

Before we could define the problem and identify white space,

we had to understand the disease itself. It is a truly terrible disease. There

are roughly 13,000 GBM cases in the US each year and the five-year survival

rate is 7%. Although it is the most common primary brain tumor (15%), brain

tumors in general are rather rare (.01% of cancers).

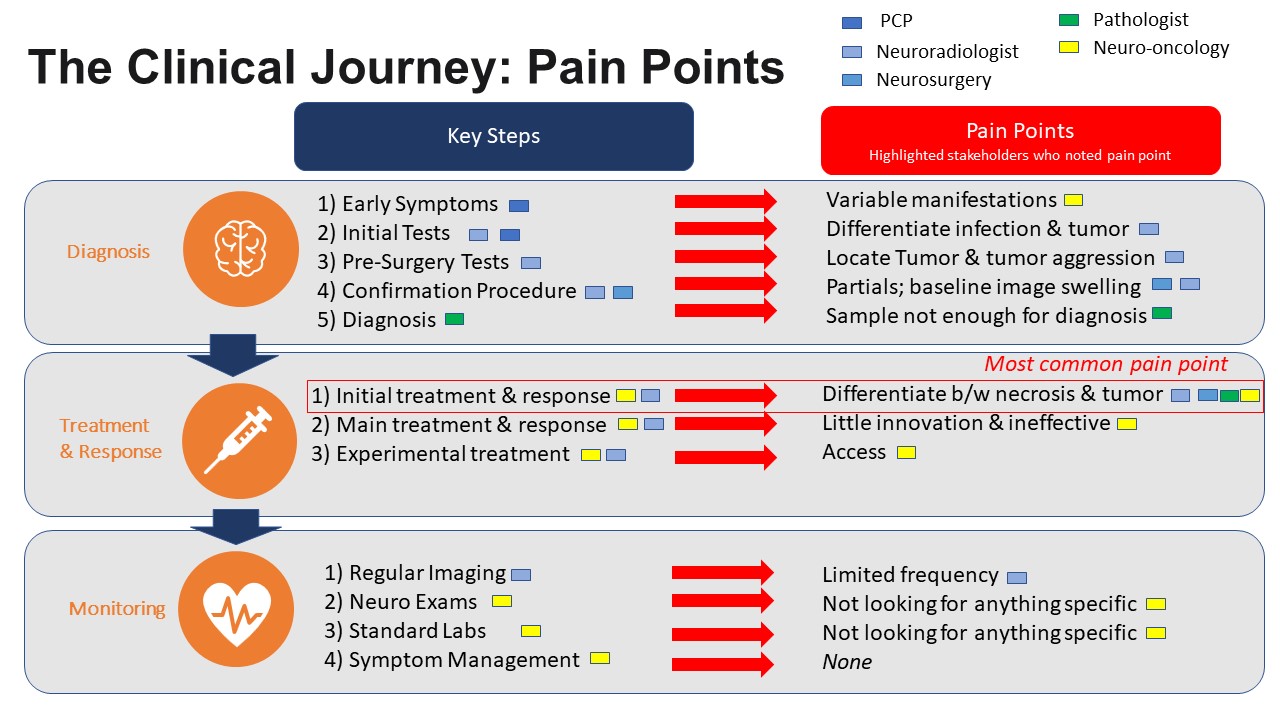

To define the problem, we interviewed experts in the field

(neurosurgeon, neuro-radiologist, neuro-oncologist, neuropathologist) and

synthesized the findings to identify the relevant pain points nference could address. Our research uncovered three major

stages of the journey: 1) diagnosis, 2) treatment & response and 3)

monitoring. We then dug deeper into each stage to identify both concrete

clinical steps and relevant pain points.

In diagnosis, patients first come to their PCP / Neurologist

with symptoms such as seizures, headaches, or focal neurological deficits.

However, there is no clear symptom for GBM and many are asymptomatic. Then the

PCP orders initial MRI imaging to look for any sort of mass. If any mass is

found, the patient is referred to a neuro-surgeon while the neuroradiologist

does further imaging. During imaging, it is often difficult to differentiate

between a mass and infection as they may look similar in images. The only

solution to confirm diagnosis is to go in surgically. This next step is the

pre-surgery testing, where the team is looking to locate the mass and plan

resection to minimize collateral damage. Then, the surgeon goes in to remove

the mass. If it is soft (infection), they simply bi opsy but if it is

hard (tumor) they resect as much as possible. Often,

they cannot remove all of the tumor due to its location near critical brain function.

Finally, the neuropathologist looks at the biopsy sample to determine whether

the tumor is GBM or another type of cancer. However, the samples are sometimes

small and other molecular studies are needed to determine if the tumor is GBM

and guide treatment decisions. Following diagnostic confirmation, patients are

referred to neuro-oncology.

In treatment & response, the evidence-based protocol has

not changed since 2005. In the initial course, the patient receives 6 weeks of

chemotherapy (Temodar) and radiation and occasionally

gene-specific drugs (e.g. dabrafenib-trametinib for BRAF V600E mutation).

Neuroradiology takes MRI images before and after to determine how the tumor has

changed. The difficulty here is that tumor necrosis (damage from radiation)

looks very similar to the tumor itself in images. This means that it is

sometimes difficult to tell if the treatment isn’t working (and thus should be

discontinued), or is doing its job. Then, after a 4-week break, the patient

receives cycled chemotherapy with Temodar until

progress slows. Unfortunately, this treatment cycle has nearly a 100%

recurrence rate, so patients are then referred to experimental treatments and

clinical trials.

As a patient is cycling through the chemo, they are

monitored regularly with imaging every 2-3 months and standard neurologic exams

/ labs. The side effects of the chemotherapy and tumor burden are difficult so

there is also symptom management with steroids and antiepileptic drugs.

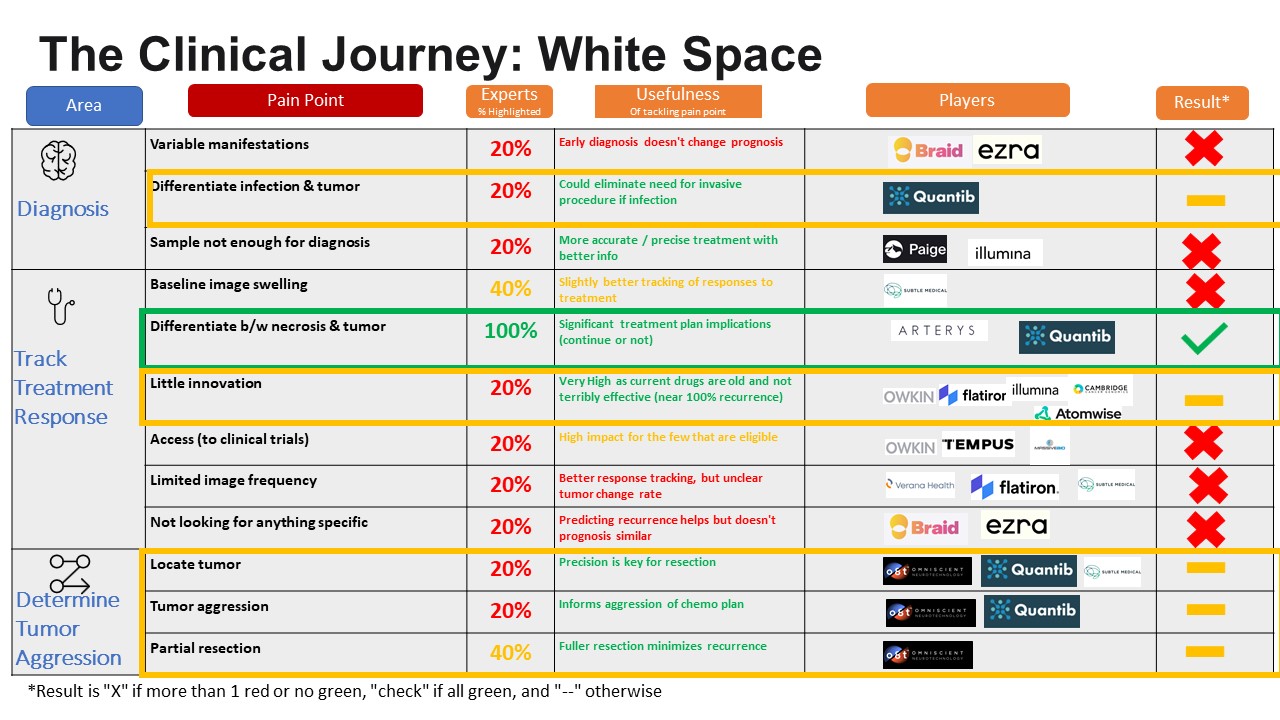

After defining the problem, we went about identifying white

space. We did this by taking the pain points and layered on 1) experts views on

pain point, 2) potential impact of an intervention for that pain point, 3) nference’s relevant capabilities for that pain point and 4)

robust market analysis of companies addressing pain point. See chart below for

details.

Recommendation

Our

analysis suggests that there is significant opportunity for nference

to enter the Glioblastoma clinical journey in either: 1) “differentiation

between necrosis & tumor” and 2) “little innovation.” For the pain point “differentiation

between necrosis & tumor”, every expert noted it as a key problem in the

GBM clinical journey. Further, it is an important problem to solve as that

distinction directly informs treatment planning (e.g. switching medication,

undergoing another round of radiation treatment). nference’s

imaging technology could solve this differentiation problem well. Finally, there

are not a lot of players in the space. For the pain point “little innovation”

(described above in above graphic), it is more about potential impact. Ideally

Vimana can help discover a new treatment regimen that improves the disease

prognosis and increases survivorship. The experts didn’t necessarily note it as

a problem and our research uncovered a lot of players attacking this particular

pain point. However, GBM has a 100% recurrence rate. That means the potential

impact is enormous if a new, better treatment could be developed. nference can use imaging data in combination with multiomics data to develop new targets to develop

therapeutics. Vimana can help determine biomarkers and protein targets that are

indications of GBM and can use this for drug discovery. Further, nference’s

ability to combine EMR, genomics and imaging could lead to a new breakthrough.

Contributors: Alice Daramola, Callie Estreicher, Will Graham, Drew Rubin, Elorm Yevudza