Financial Overview

Advancing Columbia’s academic mission depends on strategic and financial planning that provides sufficient resources for both current and future needs, ensuring that the University can support today’s students and scholars as well as those of future generations. Our institution must remain nimble to seize new opportunities, as well as to adapt to broader economic conditions and operational challenges, such as those faced by the University in the pandemic.

This page offers an overview of University resources, provides answers to a range of questions about topics including the endowment, and links to information including University financial reports.

What's in the Financial Statements

Columbia’s operating revenue for the last fiscal year (2023) was $6.2 billion.

The University’s mission is reflected in its three largest revenue streams: patient care revenue (clinical care delivered in our doctors’ offices as well as services provided at affiliated inpatient facilities), tuition net of financial aid provided to students, and government grants and contracts (typically supporting our research activities).

Our revenue picture also conveys the critical support we receive from philanthropy through private gifts and the annual distribution from our endowment. This support enables the University to sustain programmatic excellence, maintain its physical campus and technical infrastructure, and invest in the future. The University depends on the support of our generous donors to balance our budget annually.

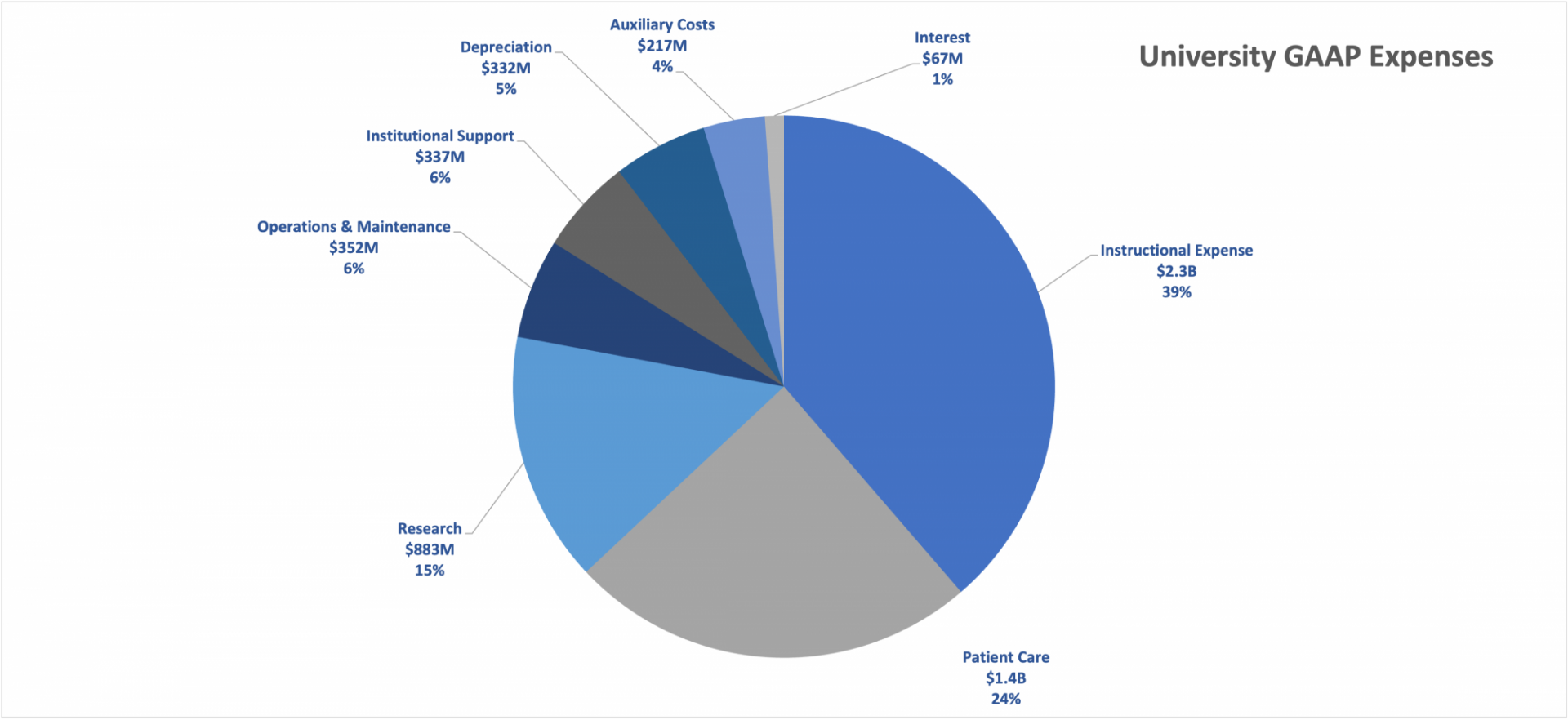

Total operating expenses for fiscal year 2023 were $5.9 billion.

The largest category of expenditures is instruction and educational administration—the costs of delivering the courses and programs that comprise Columbia’s educational enterprise, as well as services provided to students such as career advising. Additional expenditures flow from our key activities such as patient care and research, as well as the costs to support infrastructure for the entire enterprise.

Expenditures for salaries, wages, and benefits are included and cut across the categories of functional expense reported on our financial statements. These salary and benefits expenses are roughly two thirds of total University expenses.

Like most of its peers, Columbia has individual units that may generate an operating surplus in a given year. This operating surplus aggregates to a total surplus for the University, referred to in our financial statements as the “Change in net assets from operating activities.”

Given the decentralized financial model at Columbia, a substantial portion of the operating surplus is restricted to school- or department-specific uses. Some portion of the operating surplus is held by the central administration. Much of the centrally held surplus provides funding for capital construction projects to maintain and improve our campuses.

Our auxiliary operations (housing and dining) and residential real estate are just two examples of units with surpluses. They generate an operating surplus in order to fund significant capital projects for renovations and upkeep. The resources expended for these projects are not in our operating expenses, but rather are capitalized, reflected on our statement of cash flows and our balance sheet as we invest resources in projects to support “land buildings and equipment” and “institutional real estate.”

Another source of operating surplus can occur when Columbia receives gift funding in one period for activities that will stretch over multiple fiscal years. This creates a build-up of funds in one period and the spending down of funds in the subsequent year. Because our operating revenue on a GAAP basis reflects the commitments for gifts (pledges, as well as outright cash gifts), there can at times be substantial fluctuations in operating surplus due to the timing of the recognition of gifts versus the receipt of funds and the expenditures of gifts.

University Endowment

Endowment funds are an important part of Columbia operations, and they play an integral role in helping the University achieve its goals. They provide Columbia with a permanent source of funding to support financial aid, faculty and research, schools, departments, institutes, centers, capital projects, and more. Roughly 12% of the University budget is currently supported through an annual distribution from the endowment.

Columbia Investment Management Company (IMC) is charged with managing the bulk of University endowments. The IMC is a limited liability company of which Columbia University is the sole member. The IMC is staffed by a team of investment professionals and overseen by a board of Columbia Trustees and former Trustees, as well as a small number of non-Trustee investment experts.

Endowment funds are managed by Columbia’s investment team through one commingled pool but are tracked separately, similar to units in a mutual fund. The scale of the pooled assets allows the University to take advantage of a range of investment vehicles to provide a higher total return over time within an acceptable level of risk. The annual distribution is set by Columbia’s Board of Trustees in accordance with the Endowment Spending Rule, described below.

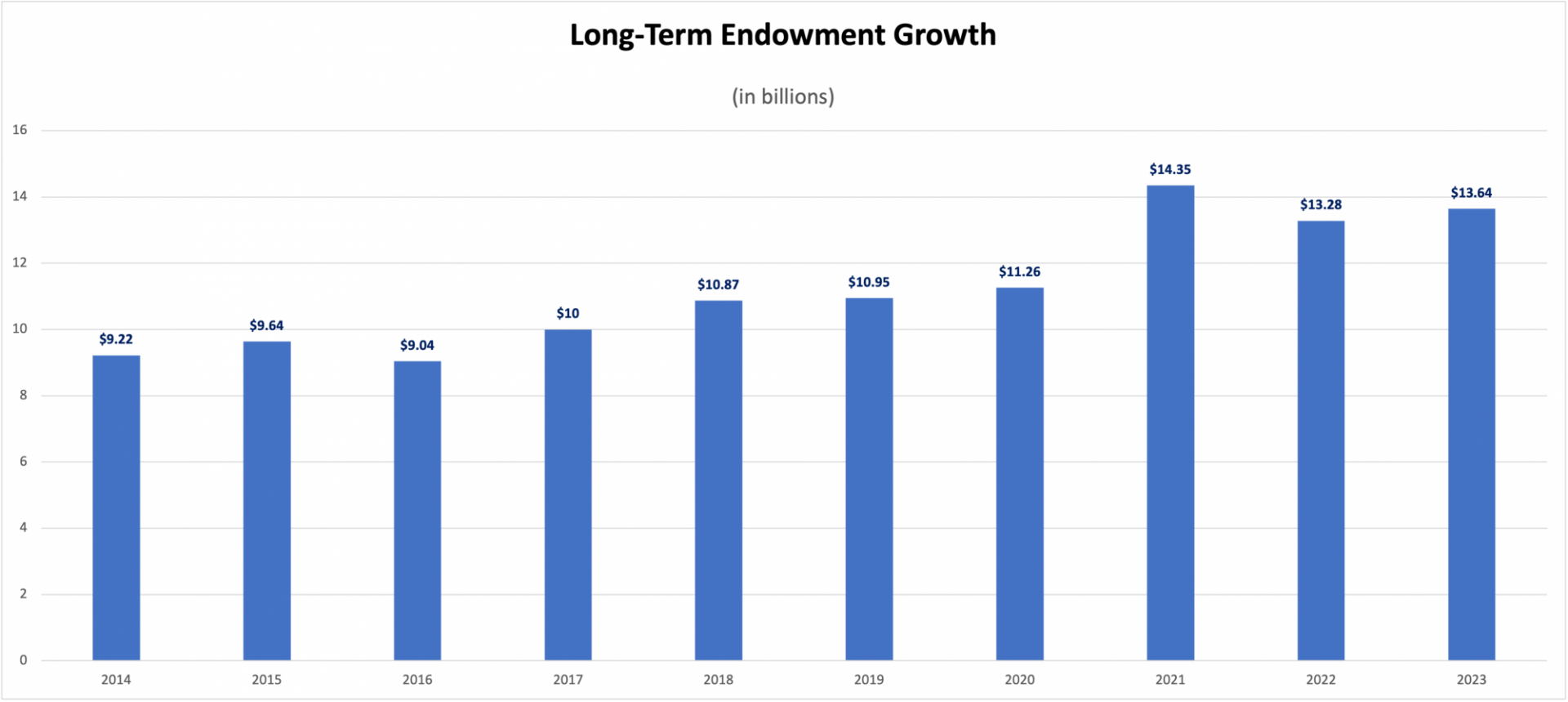

Columbia’s endowment closed at $13.64 billion for the period ending on June 30, 2023. The University’s trailing 10-year annualized net investment return was 8.0 percent (after outside manager fees).

We are often asked why Columbia can’t use some of its endowment principal to pay for urgent needs. First, the gifts that comprise a university’s endowment are typically restricted for specific purposes: to establish a scholarship, to provide faculty support in a particular field, to construct new facilities, or to support research on a designated topic. They cannot be repurposed for other uses, however urgent, that do not comply with the donor’s instructions.

Second, endowments represent a promise by the University to sustain a commitment of resources directed to a purpose over time. It may be tempting to draw down the endowment to provide more funds for today’s needs. But Columbia could not provide the level of excellence that it does today if past leaders had failed to sustain the purchasing power of the University’s endowments. Columbia similarly has an obligation to future students and faculty to continue to grow the endowment to maintain the caliber of the institution.

Approximately 12% of Columbia’s annual budget is funded with endowment distributions. The size of these distributions is governed by the Endowment Spending Rule. An aggressive spending policy that outpaces real returns over the long-term would erode the ability of the endowment to fund essential teaching, research, and student support in the future.

The spending rule is a formula used to determine the annual endowment distribution, or payout. As already noted, it is designed to be responsive to investment returns and inflation, enabling the endowment to protect the corpus (original gift) and retain its purchasing power. Any growth in excess of the annual distributions is retained in the endowment to buffer losses and enable growth over the long term.

The current endowment spending rule applies a target spending rate of 4.5 percent to a trailing market value of the endowment for a portion of our payout formula. It also factors in the prior year’s spending grown by an inflation factor. Given the mechanics of the spending rule, the gains or losses in endowment return in any given year are generally phased in over time.

In the 2023 fiscal year, the distributions from the endowment for ongoing operations, excluding internal management fees, were effectively 5.2% of the endowment’s market value at the beginning of July 2022, which is the start of Fiscal Year 2023.

A detailed explanation of the Endowment Spending Rule is provided in the notes to our financial statements.

The Advisory Committee on Socially Responsible Investing (ACSRI) was established in 2000 to advise University Trustees on ethical and social issues that arise in the management of the investments in the University endowment.

The committee’s twelve voting members are drawn in equal proportion from students, faculty, and alumni to ensure that it is broadly representative of the University community. The process for the appointment of its members provides for balanced representation, over time, of the University's divisions and schools. Two University officers sit as non-voting members in addition to the twelve voting members.

Any member of the Columbia community can submit a proposal to the ACSRI. The Committee’s proposal submission guidelines describe the process for bringing forward proposals, as well as the criteria used to evaluate proposals. The ACSRI may decide to evaluate a proposal and then may make a recommendation to the Board of Trustees regarding specific action. The ACSRI is advisory by definition, and any investment policy decisions require the approval of the Board.

The IMC operates within an investment policy framework to maximize return utilizing an acceptable level of risk for the University, as approved by the Trustees. However, there are instances in which the Trustees have set specific investment guidelines to ensure consistency with the values of the institution.

Specific resolutions guiding the University’s investment (or non-investment) in fossil fuels, tobacco, private prisons, and Sudan can be found on the Columbia Finance website.

Annual Financial Reports

Each fiscal year, the Trustees of Columbia University release the consolidated financial statements of the institution, which includes the opinion of independent auditors.

University Statements and News

October 17, 2023

The University has posted financial statements for fiscal year 2023.

October 17, 2023

The total value of Columbia’s endowment as of June 30, 2023 was $13.6 billion.

October 17, 2023

Additional enhancements to financial aid will support students attending Columbia College, Columbia Engineering, and Columbia School of General Studies.

April 26, 2022

Additional enhancements to financial aid will support students attending Columbia College, Columbia Engineering, and Columbia School of General Studies.

September 20, 2021

As Climate Week NYC begins, the university explores creating a fully electrified campus.

April 08, 2021

A new effort dedicated to raising $1.4 billion in financial assistance for students by June 2025.