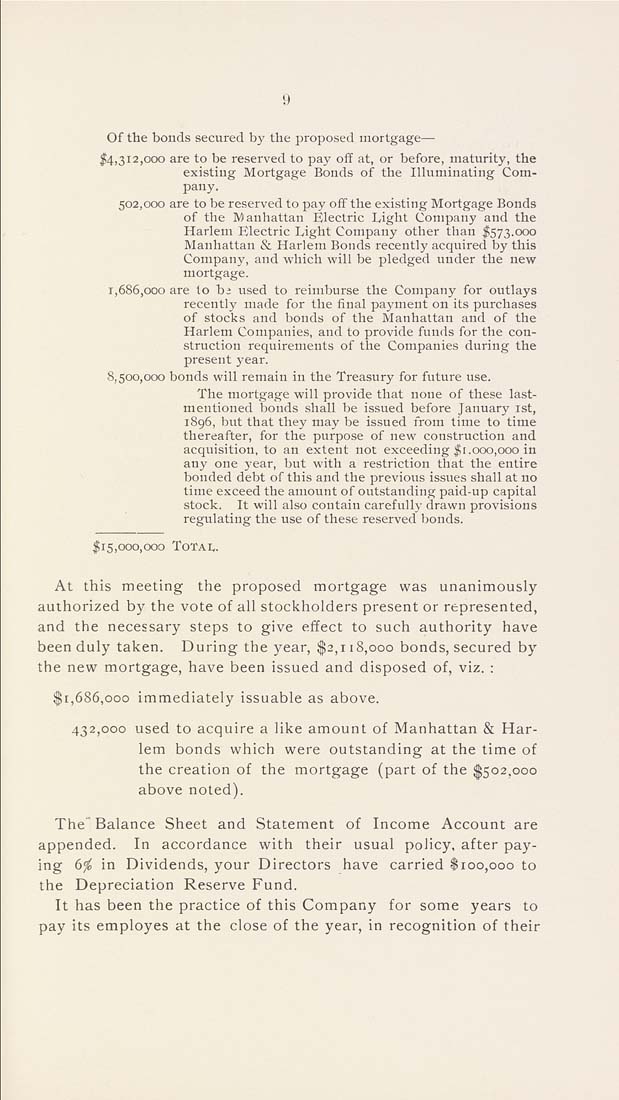

Of the bonds secured by the proposed mortgage—

14,312,000 are to be reserved to pay off at, or before, maturity, the

existing Mortgage Bonds of the Illuminating Com¬

pany.

502,000 are to be reserved to pay off the existing Mortgage Bonds

of the Manhattan Electric Light Conipauy and the

Harlem Electric Light Company other than $573,000

Manhattan & Harlem Bonds recently acqiiired by this

Company, and which will be pledged under the new

mortgage.

1,686,000 are lo b? used to reimburse the Company for outlays

recently made for the final payment on its purchases

of stocks and bonds of the Manhattan and of the

Harlem Companies, and to provide funds for the con¬

struction requirements of the Companies during the

present year.

8,500,000 bonds will remain in the Treasury for future use.

The mortgage will provide that none of these last-

mentioned bonds shall be issued before January ist,

1896, but that they may be issued from time to time

thereafter, for the purpose of new construction and

acquisition, to an extent not exceeding $1,000,000 in

any one j^ear, but with a restriction that the entire

bonded debt of this and the previous issues shall at no

time exceed the amount of outstanding paid-up capital

stock. It will also contain carefully drawn provisions

regulating the use of these reserved bonds.

$15,000,000 Total.

At this meeting the proposed mortgage was unanimously

authorized by the vote of all stockholders present or represented,

and the necessary steps to give effect to such authority have

been duly taken. During the year, $2,118,000 bonds, secured by

the new mortgage, have been issued and disposed of, viz. :

$1,686,000 immediately issuable as above.

432,000 used to acquire a like amount of Manhattan & Har¬

lem bonds which were outstanding at the time of

the creation of the mortgage {part of the $502,000

above noted).

The' Balance Sheet and Statement of Income Account are

appended. In accordance with their usual policy, after pay¬

ing 6^ in Dividends, your Directors have carried $100,000 to

the Depreciation Reserve Fund.

It has been the practice of this Company for some years to

pay its employes at the close of the year, in recognition of their

|