Annual report to shareholders

(Jersey City, N.J. : Manhattan Bond Fund, Inc. )

|

||

|

|

|

|

| Jan 31, 1943: Page 2 |

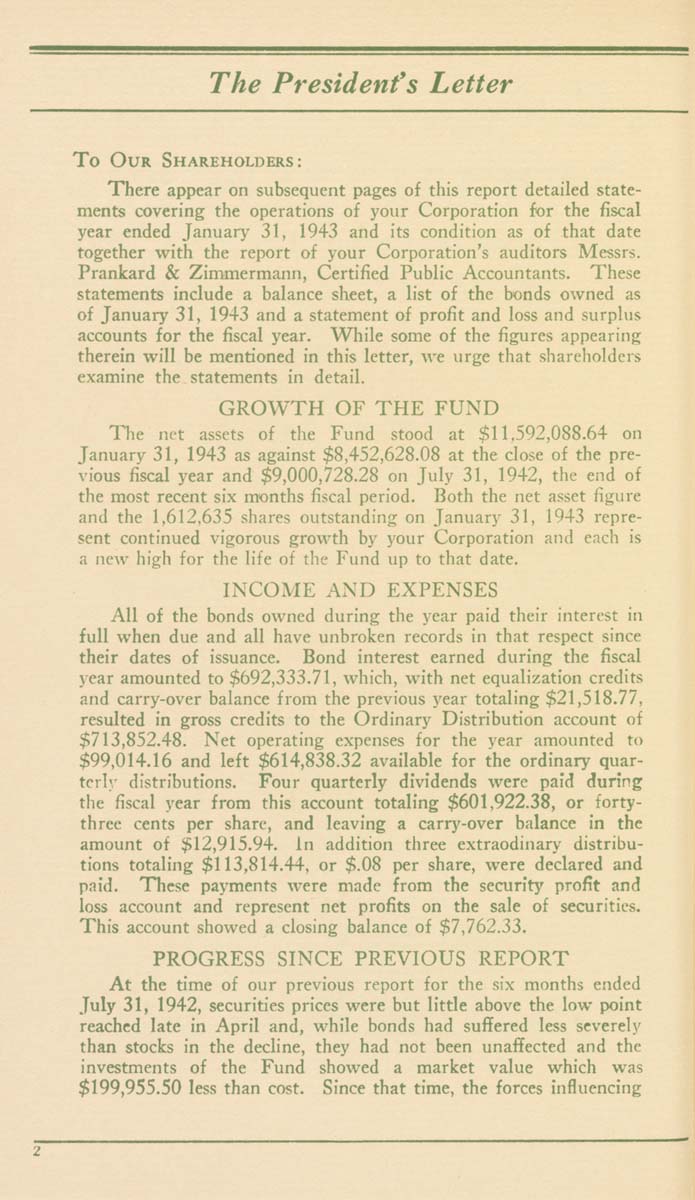

The President's Letter To Our Shareholders: There appear on subsequent pages of this report detailed state¬ ments covering the operations of your Corporation for the fiscal year ended January 31, 1943 and its condition as of that date together with the report of your Corporation's auditors Messrs. Prankard & Zimmermann, Certified Public Accountants. These statements include a balance sheet, a list of the bonds owned as of January 31, 1943 and a statement of profit and loss and surplus accounts for the fiscal year. While some of the figures appearing therein will be mentioned in this letter, we urge that shareholders examine the statements in detail. GROWTH OF THE FUND The net assets of the Fund stood at $11,592,088.64 on January 31, 1943 as against $8,452,628.08 at the close of the pre- "vious fiscal year and $9,000,728.28 on July 31, 1942, the end of the most recent six months fiscal period. Both the net asset figure and the 1,612,635 shares outstanding on January 31, 1943 repre¬ sent continued vigorous growth by your Corporation and c.ich is a new high for the life of the Fund up to that date. INCOME AND EXPENSES All of the bonds owned during the year paid their interest in full when due and all have unbrolcen records in that respect since their dates of issuance. Bond interest earned during the fiscal year amounted to $692,333.71, which, with net equalization credits and carry-over balance from the previous year totaling $21,518.77, resulted in gross credits to the Ordinary Distribution account of $713,852.48. Net operating expenses for the year amounted to $99,014.16 and left $614,838.32 available for the ordinary quar¬ terly distributions. Four quarterly dividends were paid during the fiscal year from this account totaling $601,922.38, or forty- three cents per share, and leaving a carrj'-over balance in the amount of $12,915.94. In addition three extraodinary distribu¬ tions totaling $113,814.44, or $.08 per share, were declared and paid. These payments were made from the security profit and loss account and represent net profits on the sale of securities. This account showed a closing balance of $7,762.33. PROGRESS SINCE PREVIOUS REPORT At the time of our previous report for the six months ended July 31, 1942, securities prices were but little above the low point reached late in April and, while bonds had suffered less severely than stocks in the decline, they had not been unaffected and the investments of the Fund showed a market value which was $199,955.50 less than cost. Since that time, the forces influencing |

| Jan 31, 1943: Page 2 |